UOA Development Bhd (Nov 24, RM2.40)

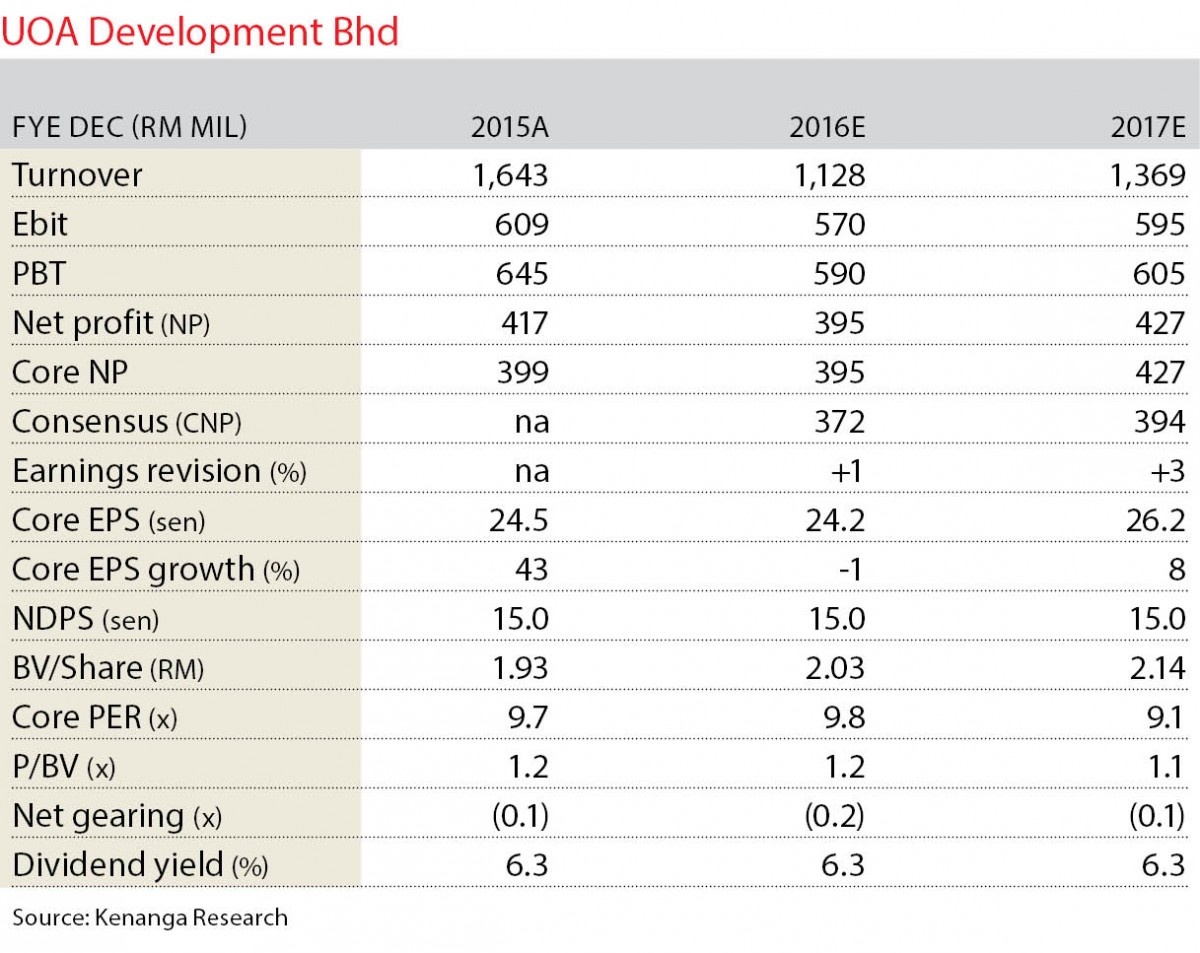

Upgrade to outperform call with a target price (TP) of RM2.54: For the cumulative nine months ended Sept 30 of financial year 2016 (9MFY16), core net profit (CNP) of RM278 million was within expectations, while sales surprised on the upside at RM1.15 billion.

Being the only developer to enjoy pure exposure in Kuala Lumpur while rolling out a pipeline of urban-based affordable priced products will provide it an edge to generating stronger sales. Furthermore, this net cash developer offers an attractive yield of 6.3%. We upgrade to “outperform” with an unchanged TP of RM2.54.

The sales beat expectations, while 9MFY16 CNP of RM278 million was within expectations at 75% of the street’s and 71% of our FY16 estimates (FY16E). 9MFY16 sales were at RM1.15 billion (+62% year-on-year [y-o-y]) which exceeded our expectations as it comes in at 96% of our FY16E target of RM1.2 billion, with the main drivers being United Point@Kepong, Sentul Point and Danau Kota.

However, no dividends were announced as expected.

UOA Development has lower billings compensated by superior margins. After stripping out its FV adjustments of RM55.5 million, third quarter of FY16 (3QFY16) CNP fell 54% quarter-on-quarter (q-o-q) as gross development margins normalised to 45.8% after 2QFY16’s high-base effect as the previous quarter saw project completion (Desa Green).

Administrative or general expenses were also up 27% q-o-q at RM47 million, arising from higher sales commissions. Y-o-y, 9MFY16 CNP was lower by 9% largely due to lower billings dragging down revenue by 36%, but it was partly compensated by higher earnings before interest and taxes margins of 52.6% (+13.1 percentage points) due to the reasons mentioned above. The company remained in a net cash position of 0.13 times.

On the bright side, Uda Development benefited from its pure positioning in Kuala Lumpur while churning out “affordable” priced products at RM400,000 to RM500,000 per unit. Furthermore, its United Point project is next to a KTM station.

However, the group does not have any major launches for 4Q16 as most were done in 9MFY16 and thus, it expects 4Q16 sales to be weaker than in previous quarters. Launches for FY17 include Desa Business Suites (RM300 million), The Sphere@Bangsar South (RM1.2 billion), and the affordable homes@Selayang (RM90 million).

We raise FY16-FY17E earnings by 1%-3% as we raise corresponding sales targets to RM1.38 billion to RM1.41 billion. The unbilled sales of RM1.51 billion provide between one and 1½ years of visibility.

We upgrade to “outperform” from “market perform” with an unchanged TP of RM2.54 based on a 36% discount (+1SD to its mean) to its fully diluted revalued net asset valuation of RM4. Given the recent drop in share price due to a market selldown, we reckon it is now a good accumulation opportunity for this defensive developer.

At our TP, its FY16E net yield is at 5.9% (current yield: 6.3%) which is slightly better compared to sizeable Malaysian real estate investment trusts’ average net yield of 5.3%. Against a weak sector backdrop, we believe UOA Development is one of the better bets, due to its pure Kuala Lumpur exposure with connectivity plays, high development margins and a strong net cash position.

Downside risks to our call include weaker-than-expected property sales, margin issues, negative real estate policies and tighter lending environments. — Kenanga Investment Research, Nov 24

This article first appeared in The Edge Financial Daily, on Nov 25, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Idaman Residence

Iskandar Puteri (Nusajaya), Johor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

Peranakan Straits, Setia Eco Templer

Rawang, Selangor

Bandar Botanic Kelang

Bandar Botanic/ Bandar Bukit Tinggi, Selangor

Cheria Residences, Tropicana Aman

Telok Panglima Garang, Selangor

Telok Panglima Garang Industrial Zone

Telok Panglima Garang, Selangor