Sime Darby Bhd (Nov 28, RM8.16)

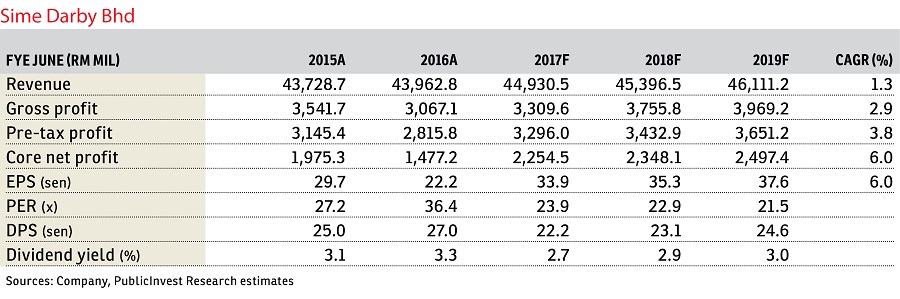

Upgrade to outperform with a target price (TP) of RM9.30: Sime Darby Bhd posted a core net profit of RM276 million in the first quarter ended Sept 30, 2016 (1QFY17), accounting for 12% of our and consensus estimates. Nevertheless, we think the results will improve substantially in the subsequent quarters, led by the plantation and motor segments and a gradual recovery in the industrial segment. No dividend was declared for the quarter. We upgrade our call from “neutral” to “outperform” with a higher TP of RM9.30 after pegging a higher price-earnings ratio valuation for the plantation arm as we see the likelihood of unlocking its potential value via a demerger exercise given the current bullish sentiment for crude palm oil (CPO) prices.

For 1QFY17, the group’s sales fell slightly by 0.7% year-on-year (y-o-y) to RM10.1 billion mainly attributed to the weaker sales contribution from industrials (-9.3%), property (-31.3%) and logistics (-1.4%), which were partly cushioned by an increase of 5% in both plantation and motor segments.

Average CPO selling price rose 24.1% y-o-y to RM2,592 per tonne while fresh fruit bunches (FFB) production contracted 24% y-o-y to 2.15 million tonnes. All regions except Malaysia contributed to the weaker equipment deliveries and product support sales. Property development dipped 32% as there was no contribution from the Pagoh Education Hub project and due to the deferment of launches in several townships in Selangor and Negeri Sembilan. Lower throughputs at Jining Ports as a result of tighter environmental controls and stiff competition from neigbouring ports dragged the port business sales by 4% though the sales from Weifang Water Management climbed 7%. The motor segment registered impressive sales in Southeast Asia (+19%) and China or Hong Kong (+4%) despite weaker sales in Malaysia (-4%) and Australia or New Zealand (-2%).

Stripping out exceptional items, the group would have registered an improved core net profit of RM266 million. Motor (+52.9%) and property (+68.6%) segments outperformed while plantation (-9.6%), industrial (-19%) and logistics (-29.4%) segments weakened. Cost of production rose from RM1,450 per tonne to RM1,600 per tonne, dragged by a sharp decline in FFB production. Sales of some of the CPO were held back as it intends to secure higher prices in 2QFY17. Though industrial’s earnings weakened, it saw a turnaround in Australia, led by higher contribution from the parts and services business and improved margins from the cost savings and manpower efficiency adopted since a few quarters ago. Motors registered stronger earnings contributions from all regions except Southeast Asia, which remained flattish.

The management has set a higher key performance indicator (KPI) of RM2.2 billion for FY17 based on an average CPO price of RM2,650 per tonne and a stagnant FFB production growth. It also expects to recognise an estimated profit of RM300 million from the Phase 1 Battersea project in 3QFY17.

— PublicInvest Reseach, Nov 28

This article first appeared in The Edge Financial Daily, on Nov 29, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Sutera Heights, Taman Juara Jaya

Cheras, Selangor

Bandar Botanic Kelang

Bandar Botanic/ Bandar Bukit Tinggi, Selangor

Cheria Residences, Tropicana Aman

Telok Panglima Garang, Selangor

Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor