UEM Sunrise Bhd (Dec 1, RM1.02)

Maintain underperform call with an unchanged target price (TP) of RM1: For the nine-month period ended Sept 30, 2016 (9MFY16), core net profit (CNP) of RM94 million made up 49% and 56% of consensus and our FY16 estimates (FY16E) respectively, being its fifth consecutive quarter of disappointments.

Earnings before interest and taxes (Ebit)-wise, 9MFY16 came in at 80% of our estimates but earnings were dragged down by higher-than-expected finance costs and tax rates, while share of associates or joint controlled entities (JCE) came in lower than anticipated.

The group’s 9MFY16 sales stood at RM707 million (fell 40% year-on-year [y-o-y]) met expectations at 71% and 78% of management’s and our target of RM1 billion and RM900 million respectively; drivers were Conservatory@Melbourne, Melia@Gerbang Nusajaya and Serene Heights@Bangi. As expected, there were no dividends.

Quarter-on-quarter third quarter of FY16 (3QFY16) CNP was down by 34% to RM36.3 million due to lower property billings which dragged revenue down by 22%, despite Aurora Melbourne Central and Conservatory’s contributions in Melbourne.

Even though Ebit margins improved by 2.4 percentage points (ppts) to 16.2%, this was negated by its higher effective tax rate of 32.5% (up 7ppts) due to some loss-making subsidiaries resulting in unrecognised deferred tax assets.

Y-o-y 9MFY16 CNP fell by 49% largely on Ebit margin compressions (fell 4.7ppts to 13.2%) on lower product margin recognition, rebates arising from clearing of inventory and liquidated ascertained damages.

Furthermore, associate or JCE contributions (Horizon Hills, Setia Haruman) declined (by 46%), while there was a significantly higher effective tax rate of 29.5% (14.1ppts higher).

Recall last quarter, UEM Sunrise slashed its sales target to RM1 billion from RM1.5 billion due to deferment of St Kilda@Melbourne launch. No major launches for 4QFY16, but we expect some en-bloc sales (Almas Residences, Aurora Offices) to drive sales.

We also expect more divestments to manage their net gearing levels (0.43 times in 3QFY16). There is also the issue of the tax penalty relating to old land deals amounting to RM73.8 million, which the group is appealing and believes it has a strong case. If the appeal fails, the group believes it has sufficient tax credits from unmaterialised land sales to offset the cash flow impact, that is negative impact on earnings but none on cash flow while impact is in FY17. No provisions have been made yet.

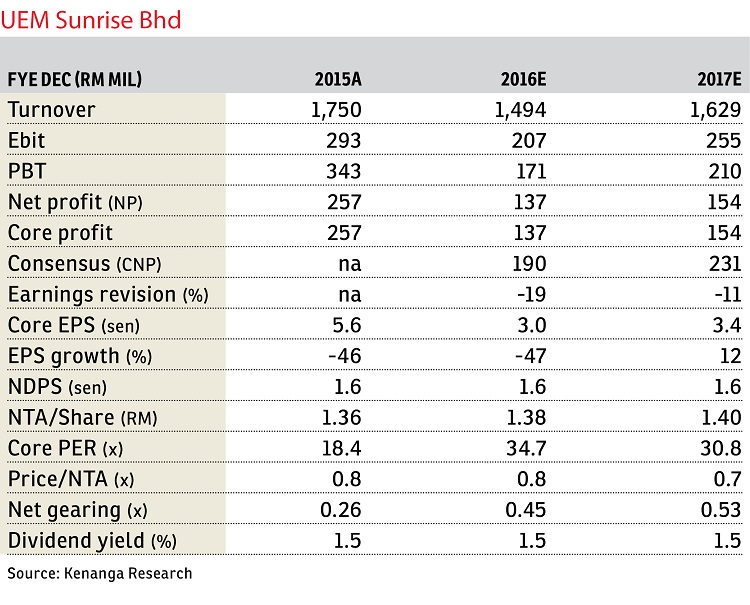

Lowering FY16E and FY17E CNP by 19% and 11% on higher effective tax rates and finance costs and lower share of JCE contributions, we conservatively maintain our FY16E and FY17E sales of RM900 million and RM1 billion.

We have yet to impute for the tax penalty as this could be a long drawn-out case; impact on FY17E earnings is about about 50%. Its unrecognised revenue of RM4.1 billion provides 2.5 years visibility.

We remain concerned about its sustainable local sales momentum and potential earnings risks. If they are unable to divest enough about assets, odds of some form of cash calls (particularly non-pure equity type cash calls) are high. — Kenanga Research, Dec 1

This article first appeared in The Edge Financial Daily, on Dec 2, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Seri Kasturi Apartments, Setia Alam

Setia Alam/Alam Nusantara, Selangor

Putra Indah Condominium

Seri Kembangan, Selangor

Country Heights Damansara

Country Heights Damansara, Kuala Lumpur

East Residence @ KLGCC

Damansara, Kuala Lumpur

The Ritz-Carlton Residences

KLCC, Kuala Lumpur

The Residence, Mont Kiara

Mont Kiara, Kuala Lumpur

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur