Axis Real Estate Investment Trust (Sept 9, RM1.64)

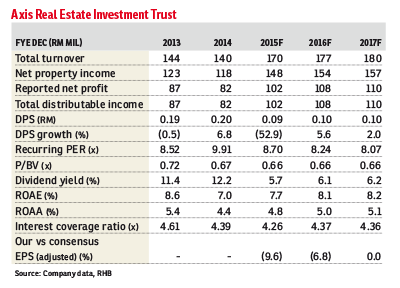

Upgrade to buy with a target price (TP) of RM1.84 (post-split): Management shared during our meeting on Tuesday that Axis Real Estate Investment Trust’s (REIT) tenancies were not significantly affected by the recent macro headwinds arising from the weakening ringgit and the softening of the property sector.

This is because the bulk of its portfolio tenancies consists of export-driven logistics companies that have seen minimal impact from the macro challenges. Additionally, as the REIT only owns four pure office assets, it is largely insulated from the oversupply in office space, given the offices’ prime location is in Petaling Jaya with high occupancies (more than 90%).

We believe that the REIT should focus on filling up its vacant spaces in Axis Business Park and Axis Eureka (which currently have occupancy rates of below 60%), as this could potentially boost distribution per unit contribution by about 3.9 sen.

Management has reiterated its commitment to fill up the vacant spaces and is actively seeking tenants. Given its track record, we believe that it would be able to secure long-term tenants for these assets.

The REIT has completed its 2-for-1 unit split as of Tuesday. The unit base now stands at 1.1 billion versus 547.8 million pre-split. We reiterate our view that this unit split will improve liquidity and enhance its attractiveness to retail investors, given the larger unit base now. We note that although its unitholders have also approved the mandate for the placement of new units, future placements would most likely be done in tandem with the new asset acquisitions.

We made no changes to our earnings forecasts. However, we upgrade our call to “buy” (from neutral) given the 14% upside from its current price. Our new dividend discount model-based TP post-split is now RM1.84 (RM3.67). While the REIT provides a defensive exposure in the current volatile equity market, the potential rerating catalyst should come from yield-accretive asset injections. — RHB Research Institute, Sept 9

This article first appeared in the digitaledge DAILY on Sept 10, 2015. Subscribe here.

TOP PICKS BY EDGEPROP

Livia @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Robin @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Chimes @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Kawasan Industri Desa Aman

Sungai Buloh, Selangor