Eco World Development Group Bhd (April 15, RM1.80)

Initiate coverage at outperform, with a target price (TP) of RM2.05: The key management team behind Eco World is well-experienced in quality township planning. They comprise well-experienced industry professionals, most of whom have more than 10 years of experience in S P Setia. Recently, Tan Sri Liew Kee Sin became chairman of Eco World. We expect this to translate into a strong demand for Eco World’s properties as property buyers these days are savvy and cognisant of Eco World’s background, which will translate into a bigger market share.

Eco World’s remaining gross development value (GDV) as at Feb 15 was RM51.2 billion, of which 83.5% of the remaining GDV consists of mixed developments/townships, while 16.5% is made up of industrial business parks. Township developments include projects such as Eco Majestic, Eco Botanic, Eco Spring, Eco Tropics and Eco Sanctuary. We favour township developers as: (i) this segment enjoys resilient demand from genuine buyers like first-time home buyers and upgraders; and (ii) townships offer more value creation opportunities in the long term, so value enhancement will be strong over the lifespan of the township, versus niche or one-off developments. Note that the injection of landbank was done at decent prices (effective land cost is 12.8% of total GDV).

Strong news flow as the group intends to embark on landbanking aggressively, including embarking on joint-venture (JV) projects (e.g. BBCC) and into international frontiers (e.g. EWI SPAC). There are also numerous articles over the last one year as Eco World is undertaking simultaneous launches and hosting events as part of its aggressive marketing strategy. We expect the group to continue building its war chest of projects either on: (i) a JV front to alleviate the balance sheet weight; (ii) outright purchase of land, which may require higher net gearing or fresh cash calls in the next two years.

The group has recently completed its rights issuance and we note that its share price is easing up from its highs, which will present cheaper entry points for investors. Now the group is pursuing the last part of the corporate exercise, which will raise another RM634.4 million. This will help improve its shareholding spread and bring in institutional investors.

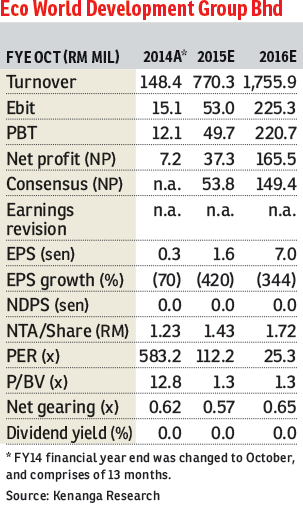

The normalisation of price-earnings ratios may take up to financial year 2017 (FY17) as property contributions are still at an early stage, while FY15E to FY16E net gearing is expected to remain relatively high at 0.57x to 0.65x even post- placement. The group secured strong sales of RM3.2 billion in FY14 and expects RM3 billion to RM4 billion in FY15 and FY16, versus our sales estimates of RM3 billion to RM3.6 billion, respectively. Unbilled sales of RM3.1 billion provide 2 to 2½ years’ visibility.

Initiating coverage on Eco World with an “outperform” and ex-all fair value of RM2.05 based on the revised net asset value/discount cash flow @ 10% weighted average cost of capital and after accounting for the entire major corporate exercise, full conversion of warrants, potential GDV from the EWI SPAC and the BBCC JV. — Kenanga Research, April 15

This article first appeared in The Edge Financial Daily, on April 16, 2015.

TOP PICKS BY EDGEPROP

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor

Cheria Residences, Tropicana Aman

Telok Panglima Garang, Selangor