KUALA LUMPUR (Jan 21): EcoFirst Consolidated Bhd saw its net profit jump over 78 times to RM11.74 million or 1.61 sen per share for its second financial quarter ended Nov 30, 2015 (2QFY16) from RM150,000 or 0.02 sen per share a year ago, mainly due to reversal of over provision of tax penalties and interests.

The property developer's revenue also quadrupled to RM23.63 million in 2QFY16 from RM5.35 million in 2QFY15.

The multi-fold net profit growth in 2QFY16 helped to boost its earnings for the cumulative six months ended Nov 30, 2015 (1HFY16) by more than 16 times to RM14.08 million or 1.93 sen per share from RM866,000 or 0.13 sen per share in 1HFY15.

Revenue for 1HFY16 also quadrupled to RM46.96 million from RM10.48 million in 1HFY15.

In a statement today, EcoFirst attributed its stellar performance to its Upper East @ Tiger Lane luxury condominium project in Ipoh, Perak, which contributed 75% of the group's revenue, as well as consistent recurring earnings from its two malls — South City Plaza in Sri Kembangan, Selangor, and 1Segamat Mall, Johor.

It said the 1HFY16 results also included reversals of RM10.4 million over provision of tax penalties and interests upon a scheduled payment settlement being agreed on with the Inland Revenue Board on outstanding taxes and related penalties and interests owed by subsidiaries of the group.

"As expected Upper East will be the major contributor for the financial year ending May 31, 2016 (FY16) and is currently the strength of EcoFirst, bringing in 75% of the group's revenue," EcoFirst group chief executive officer and managing director Datuk Tiong Kwing Hee said.

"We foresee further significant contributions from this project in the second half of 2016 as well," he added.

Tiong said the property development division will continue driving EcoFirst's growth, especially with two parcels of land in Ulu Kelang, Selangor, in the final stages of being acquired, which have been earmarked for residential and commercial developments.

"Property development will be our main focus this year. Our upcoming Ulu Kelang project will be the jewel in our crown and elemental to our long-term growth strategy.

"The plans that we have for our Ulu Kelang land will keep us busy and ensure steady income for EcoFirst for the next 10 years.

"We hold on to maintaining three principles in guiding our property development division: location, pricing and product; and so far we have managed to deliver all three in EcoFirst's products," Tiong added.

At 2.46pm, EcoFirst shares were traded up one sen or 4.26% at 24.5 sen, with 1.14 million shares done. In comparison, its latest reported book value per share is 30.09 sen. Its market capitalisation stood at RM171.59 million. -- theedgemarkets.com

TOP PICKS BY EDGEPROP

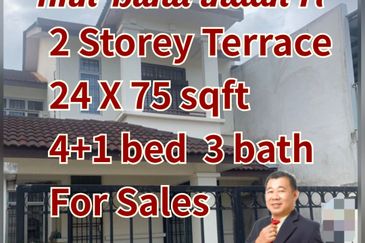

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

Halya @ Daunan Worldwide

Bandar Puncak Alam, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Idaman Residence

Iskandar Puteri (Nusajaya), Johor

De Tropicana Condominium

Kuchai Lama, Kuala Lumpur