Eco World Development Group Bhd (March 25, RM1.46)

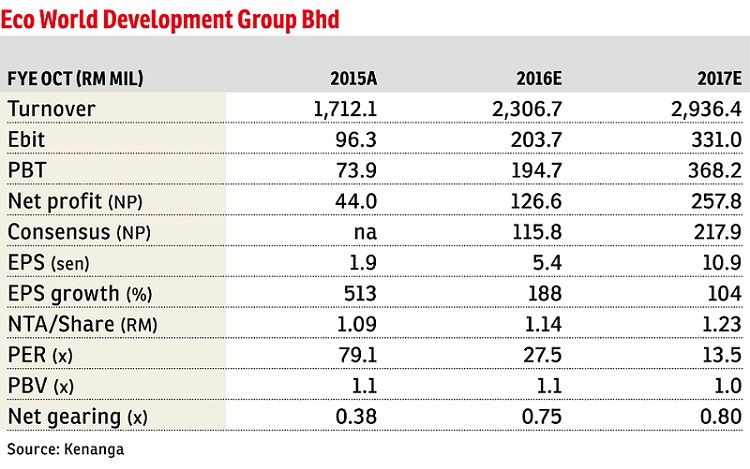

Maintain outperform with a lower target price (TP) of RM1.74: Eco World Development Group Bhd’s first quarter ended Jan 31, 2016 (1QFY16) earnings of RM20.7 million came broadly within expectations, making up 18% of street’s FY16 earnings estimate and 16% of ours. Due to maiden contributions from projects launched last year, we expect strong billing cycles in the second half as we gathered that some projects will be handed over earlier. Its four-month FY16 sales of RM608 million accounted for 15% of management’s and our FY16 sales target of RM4 billion. We deem this as broadly within expectations as our estimate includes sales from its potential associate stake in Eco World International Bhd (EWI), which will only occur in the third quarter of calendar year 2016.

No dividends were declared, as expected.

Quarter-on-quarter, EcoWorld’s earnings were up by 5% albeit a 32% decline in revenue, due to slower billings during the festive months. We note that its earnings before interest and tax margin improved by 2.1 percentage points to 7.8% as the group’s selling/marketing and administrative expenses were reduced by 41%, which is in line with management’s earlier guidance that most of the heavy branding activities were done last year and now that the EcoWorld brand is established, more social media marketing is being implemented. Year-on-year, the group’s bottom line swelled by 576% largely due to its normalisation of billings from new sales garnered when EcoWorld was established.

On its outlook, EcoWorld targets an initial public offering of EWI by June 2016. To recap, EcoWorld has formally expressed an interest to take up a 30% stake in EWI. Note that we have built in EWI associate stake into our estimates. We also hope to see more concrete details on the acquisition of the Kuala Selangor land, which will entail forming partnerships for funding.

There is no change to our earnings forecast. EcoWorld’s unbilled sales of RM4.4 billion provides two years of visibility.

We maintain our “outperform” rating on EcoWorld, with a lower TP of RM1.74 (previously RM1.90) based on a 51% property revised net asset value (RNAV) discount (from 45%) or 45% discount to sum-of-parts of RM3.17 (previously 40%) as we are downgrading the property sector to “underweight” from “neutral”.

However, our applied RNAV discount is still at a slight premium to our sector coverage’s average of 53% due to EcoWorld’s aggressive expansion plans and expectations that its share price will benefit from news such as EWI’s upcoming listing and more concrete details on the funding of avenue partnerships for land banks like Kuala Selangor.

The key risks to our call are: i) balance sheet risk; ii) weaker-than-expected property sales; iii) higher-than-expected sales and administrative cost; iv) negative real estate policies; v) tighter lending environment; and vi) delays in EWI’s listing. — Kenanga Investment Bank Bhd, March 25

This article first appeared in The Edge Financial Daily, on March 28, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Shamelin Heights Business Park

Cheras, Kuala Lumpur

Wisma Pantai ( Wisma Goshen )

Bangsar, Kuala Lumpur

Jalan Taman U Thant 1

Taman U-Thant, Kuala Lumpur

Jalan Taman U Thant 1

Taman U-Thant, Kuala Lumpur