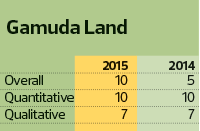

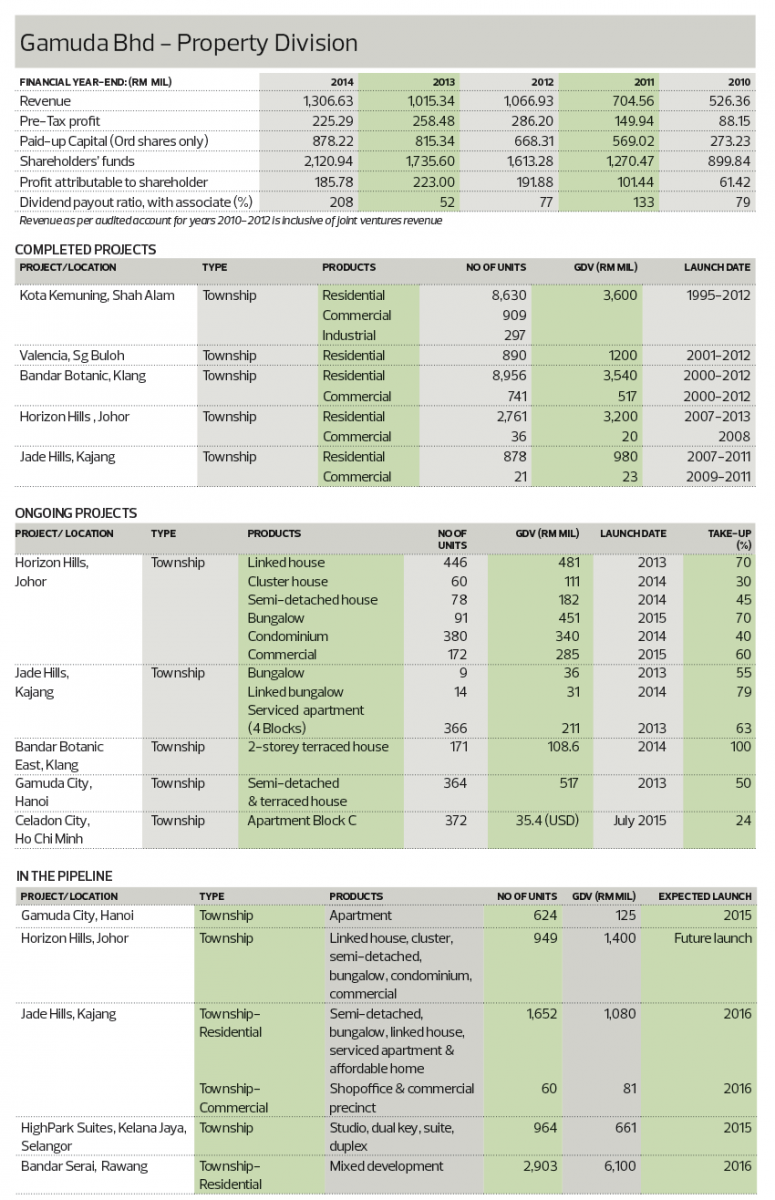

Gamuda Land, the property division of Gamuda Bhd, has made it to the Top 10 spot of The Edge Malaysia Top Property Developer Awards for four consecutive years. Despite the soft market, Gamuda Land registered an impressive RM1.2 billion in sales for financial year 2015, ended July, contributed mostly by the Gamuda City and Celadon City projects in Hanoi and Ho Chi Minh City in Vietnam.

Gamuda Land spent RM 1.6 billion on land acquisition and has set aside RM500 million in FY2016 to acquire more land. Currently, the group has 3,332 acres of undeveloped landbank locally and 571 acres overseas.

With projects worth an estimated total gross development value (GDV) of RM57 billion, Gamuda has set a sales target of RM1.33 billion for FY2016 and has a few big property launches up its sleeve, including a condominium in Singapore.

“We come with a background in the construction and engineering segment, so our viewpoint is different from the viewpoint of a pure developer. We look at things like roads and infrastructure before we start developing a project. Without all these basic necessities coming into place, and if the road system is not properly planned for instance, future developments will be choked up,” Gamuda Land’s managing director Chow Chee Wah tells The Edge.

Gamuda Land bagged three awards at The Edge Malaysia Property Excellence Awards 2015. Besides being ranked among the Top 10 of The Edge Top Property Developers’ Awards 2015, its Kota Kemuning township was a winner of The Edge-Malaysia Property Development Excellence Award 2015, while Phase 15 of Ambang Botanic in Bandar Botanic, Klang, won The Edge-Malaysia PEPS Value Creation Award 2015 in the residential category.

Chow was all smiles as he shares with us the developer’s activities in the past year and plans to stay ahead in the current challenging market environment.

The Edge: How have the past 12 months been for Gamuda Land?

Chow Chee Wah: For FY2015, we acquired more land. This is to ensure we can continue to grow our property division and achieve our target of doubling our sales turnover in five years’ time. We also successfully bid for a land parcel in Toa Payoh, Singapore, in September.

For our Melbourne 661 Chapel Street project that was launched recently, although it is four kilometres away from the central business district, it is still quite a premium location. For this project, we try to be different from the other developers who go into the mass market in the CBD. When we chose this location, we considered both the local Australian market and foreign investors. For foreigners, you can only buy off the plan. However, once you have a ready-built condominium, you can only sell to the locals. Hence, the locals must really like your product. It will help to preserve your investment value.

Meanwhile in Singapore, the parcel of land which we bid for in Toa Payoh is old mature land. In Singapore, there is not much land available for a private condominium development. If you are in Singapore and you want to buy a Housing and Development Board (HDB) flat, there are stringent conditions that you need to fulfil. If you happen to not meet the conditions and you wish to settle down in that area with your parents ... this is the chance for you to own your private condominium. You do not have to live very far from your parents. It is a good parcel of land. The bidding was very competitive. The price we bid was within 1% of the second bidder and there was only a 4% difference among the top five bidders. Our pricing was just right. It was not overpriced and was just within the market price. We are looking to launch the project this coming March.

We also bought over our local partner in Vietnam. It used to be a 60:40 partnership but we bought over their 40% share, which makes us the full owner now.

What’s the progress of some of your upcoming projects?

Our project at Bandar Serai, Rawang, is currently in the market planning and approval stage. We are targeting to launch our first phase of linked houses by next year. Currently, we are looking at enhancing our market plan, especially on the innovation and engineering side.

At Kota Kemuning, which was developed 20 years ago, we have incorporated amenities such as a cycling track and jogging track, and enhanced the walkability to nearby amenities. To us, security is the main concern. We want it to be a gated and guarded community. In Bandar Serai, what we want to do is to take it up one notch by being a GBI (Green Building Index) certified township. Nowadays, the younger generation is in favour of public transport. The plus point of Bandar Serai is, you have a choice. If you choose to drive, Bandar Serai is located near to the highway. If you choose not to use the car, the Kuang komuter station is just a stone’s throw away. The Kuang station is just a station away from the Sungai Buloh station. Sungai Buloh is the starting point of MRT Line 1 and Line 2. You can also cycle to the station. Alternatively, we are looking to provide a shuttle bus to the Kuang station. This is line with our efforts to promote a healthy lifestyle. At the same time, while developing this infrastructure, we want to do it without disturbing the natural terrain. The terrain of Bandar Serai is very interesting. It is not flat, and our challenge is to implement the design we want while preserving the terrain.

We are also working on our Tanjung Dua Belas project in Kuala Langat — a 1,530-acre site with a GDV of RM20 billion. The location is quite strategic with MRT Line 2 coming down to Putrajaya and Cyberjaya. I think we have always emphasised connectivity and this must be implemented from the onset to support the product you want to deliver. We are looking into developing a satellite city with a smart city concept.

Globally, everyone is talking about smart cities, so, this will be a testing ground for us to bring it to life. We will have to work with consultants and service providers and it is important that we invest in the data centres and fibre optics so that we can support the broadband speed.

We are also looking into bus shuttle services, including informing you of the arrival times with an app in your phone. With the app, you can plan your time more efficiently. We need to use information technology to facilitate our lifestyle.

We are also planning to have international schools, medical hubs, e-schools and amenities such as jogging tracks, parks and cycling tracks as well as a seamless link to the wetlands.

On the commercial side, we are looking into investing in a data centre such as a cloud computing system. Most businesses invest a lot in their servers and business solution software to ensure they get the best productivity at work. However, with a secured data centre like a cloud computing system, you can save a lot on your software products. Not only does it reduce the cost of your business, you are on par with the technology level of global business demands.

We are also launching our Bukit Bantayan apartments in Kota Kinabalu this December. We have five apartment blocks comprising about 1,500 units. It is situated about 11km from Kota Kinabalu and 3km from Inaman town. We are targeting buyers aged 25 to 44 who have just started to work and are looking for affordable homes and a contemporary lifestyle. It also caters for newlyweds in search of their first home and home upgraders. We are pricing the units in the range of RM450,000 to RM500,000, which is a reasonable price. It is also easier for loan approvals as well.

In view of the current economic situation, what are some of your priorities moving forward?

We ventured into the property market in 1995 with Kota Kemuning. It has been 20 years since. We have gone through two cycles of major economic downturn and three smaller ones. Despite the soft economy, we believe there is still demand for high-quality products. We at Gamuda Land are known to deliver high quality products. To us, it is vital for us to create value for an investor even in the soft market. We will launch our products even though the take-up may be slow. We can always sell after we build. When the cycle comes up and when it is the right time to own, investors want to own ready products.

Just take our Horizon Hills project in Johor, for example. In the 2007 and 2008 economic downturn, there was a lot of unsold stock. But within six months of the market coming back, all the stock was sold. For the price that we sold, we covered our holding cost at an even higher rate. When people bought at that time, the capital appreciation for their units was even faster because by then, it was a mature township.

To reach an occupancy rate of 85% is quite fast, especially if it is a gated and guarded community. That is because everyone can move in at the same time when the project has been completed. There is a sense of security because you don’t have contractors and residents moving in and out.

Although sales aren’t doing as well currently, we still have sales every month for Horizon Hills. Fortunately, we have been able to increase our local market share of purchases as well. We have had buyers moving over from Tebrau. As you know it is really hard to get people to move to the west from the east. For the remaining 50% of the township, the product mix varies. We have linked houses, semidees and bungalows in store.

The net profit for the property division has dipped for FY2015. What steps are you taking to perform better in FY16?

At some point, the profit margin will come down because land prices are going up. Prices are getting more competitive and it is a challenge to maintain high profit margins all the time. We have to make our properties affordable. The pricing of the houses must give value for money. We are always educating our buyers to look into the common amenities that the developer is providing, things that you cannot build or renovate on your own. You can purchase a cheap property but if you do not have the connectivity, the amenities and the maintenance ... you will not enjoy strong capital appreciation. For us to win the Value Creation award from The Edge four times is an honour to us.

We have also come up with many ways to help buyers who are interested to own our units. For our High Park in Kelana Jaya and Robertson in Kuala Lumpur, we are offering an easy payment scheme. When you sign your sale and purchase agreement, you only pay the first 5%. Subsequently, you pay 1% every two months until you finish paying up the whole 20%. That translates to 15% every alternate month, which means you are paying over 2½ years. This really eases your cash flow.

We are offering the opportunity to our buyers to buy a property at today’s price for a future value. For the balance of 80%, the buyers can pay upon vacant possession. This is a modified scheme of build-and-sell, similar to that implemented in the UK, where there is a 10:90 scheme or 20:80 scheme. When the property is ready, only then do the buyers pay the remaining 80%. They can sell their existing home to upgrade four years from now. The market should have already bounced back by then. As a developer, we want to take care of our buyers’ concerns and needs.

What other challenges is the group facing? How are you planning to overcome them?

We are always challenging ourselves to create something different that distinguishes us from our competitors. The question is, can we do better than our previous township? What can we do next? What can we do better? We do not want to look at ourselves as just a building contractor. We find it pointless to acquire land, build it up and gain our construction profit. Instead, we want to create a product that our buyers can be associated with and they can be proud of investing in.

For example, at our five-acre HighPark project, we built a park podium on the seventh floor comprising a 1km jogging track, a 50m swimming pool, an aqua gym and herb and maze gardens, among other facilities.

We also provide free WiFi for residents and visitors. Instead of going outside to conduct your business meetings or meet your clients, you can do it at the park podium. We are also looking into installing vending machines for coffee, soft drinks and even food items for the convenience of our residents. This kind of facilities really attract the younger generation.

Kelana Jaya is a 35 to 40-year-old township. As the younger generation comes up, they want their own privacy and to be independent of their parents. Yet at the same time, they want to have a good quality lifestyle. We have built-ups ranging from 452 to 840 sq ft. Nowadays, we only see the younger generation coming out from their rooms during mealtimes. Other than that, they are mostly in their rooms. We feel that this size is practical for the younger generation, and it is good for privacy.

As time passes, service charges increase as well. Service charges are applied based on the built-up. For a 450 sq ft unit, if the service charge is 50 sen psf, the maintenance will only be just over RM200, and for 600 sq ft, that will translate to about RM300. It is still in the affordable range. There are some condominiums that have maintenance charges of over RM800 to RM1,000. Even the rental for a master bedroom costs more than RM1,000. The size of High Park units are just like hotel suites. At the same time, you do not have to sacrifice your lifestyle.

In the CBD area, we have our Robertson project. This caters for buyers who are looking to work and live in the same area, where connectivity is at your fingertips. The monorail, MRT and LRT are all within a 12-minute walk. We invested in two fully covered walkways — one will bring you to the Bukit Bintang MRT station and the other to Pudu Sentral where the city and regional buses are.

From Pudu Sentral, you are connected to the Plaza Rakyat LRT station where you can also get to the Warisan Merdeka MRT station and the Bukit Bintang monorail. We want to lay out the conveniences for them.

What is your outlook on the property market this coming year?

Our local market is still soft and there is no sign of Bank Negara Malaysia loosening the interest rates for now. For the local market, we were appointed the project delivery partner for the Penang Transport Master Plan. We may need to reclaim some land, so there is an opportunity for us to look into that. We are still in the midst of negotiations and no firm plans have been made yet. This will take place on Penang Island, which is a better location than the mainland.

For the overseas market, we are still looking into projects in Singapore. Land prices are realistic and competitive during a down cycle. Our purchasers have indicated to us that they are looking to diversify their investment portfolio. At the same time, they want to tag along with a developer whom they trust. We have investors whose children are studying in Australia or working in Singapore and they are looking at directing their investments that side. A big portion of sales for FY2016 will be for projects based in Vietnam’s Ho Chi Minh and Hanoi and Singapore’s Toa Payoh. TEPEA 2015

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on Dec 7, 2015. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

Taman Perindustrian Ehsan Jaya

Kepong, Kuala Lumpur

Peranakan Straits, Setia Eco Templer

Rawang, Selangor

Country Heights Damansara

Country Heights Damansara, Kuala Lumpur

East Residence @ KLGCC

Damansara, Kuala Lumpur

The Ritz-Carlton Residences

KLCC, Kuala Lumpur

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)