THE high-rise residential segment in the thriving township of Puchong, Selangor, has been growing steadily over the last few years. Puchong’s first few high-rise residential developments consisted of low and medium-cost apartments. Even today, the area offers more affordable high-rise residential properties than neighbouring Subang Jaya and Petaling Jaya.

However, since the middle of the last decade, Puchong has been seeing more high-end high rises being developed such as S P Setia Bhd’s Solace at Setia Walk and IOI Properties Group Bhd’s Aseana Puteri. Nevertheless, it largely remains focused on the mid-market segment.

IOI Properties’ township developments were the catalysts to Puchong’s growth as a property investment hot spot. In 1996, IOI Properties developed IOI Mall at the Puchong Jaya town centre and it has since become one of the main landmarks of Puchong. The developer still has about 100 acres of land here left to be developed.

Puchong has grown over the years into a self-contained township with ample amenities including SK Puchong Jaya, SJK (C) Han Ming, Rafflesia International School, Taylor’s International School, 32-court Michael’s Badminton Academy, Tesco, Columbia Asia Hospital and KPMC Puchong Medical Centre. Puchong is also easily accessible via the Lebuhraya Damansara-Puchong, New Pantai Expressway, Puchong-Sungai Besi Highway and Shah Alam Expressway.

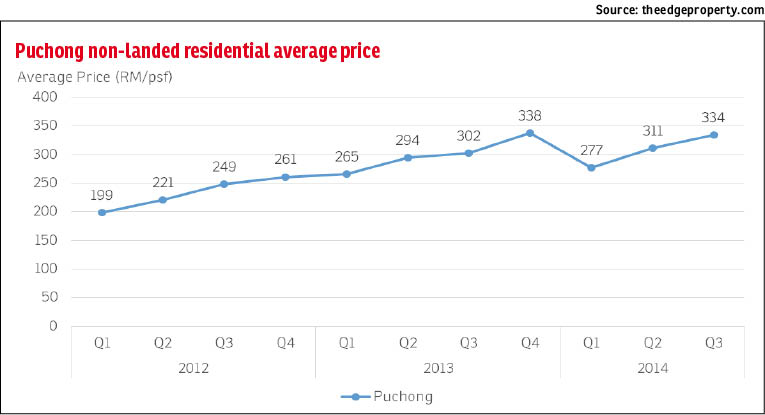

According to theedgeproperty.com’s analysis of transactions, the average price for high-rise residential properties in Puchong had surged 10.6% from RM302 psf in the third quarter of 2013 (3Q2013) to RM334 psf in 3Q2014. This had followed a substantial 21.4% growth in the preceding year till 3Q2013.

The analysis by theedgeproperty.com covered areas from Bandar Puchong Jaya up to the Klang River in the north, Taman Tasik Puchong and Taman Putra Prima in the south. Bandar Kinrara, Bandar Bukit Puchong and beyond were not included.

According to managing director of Landserve Sdn Bhd, Chen King Hoaw, prices of condominiums and apartments in selected developments in Puchong have increased between 35.6% and 79.2% over the last five years (from 2011 till 2015).

The market softened slightly in 2014, with capital growth and transaction volumes moderating but the market remains upbeat.

“The recorded transaction prices for both condominiums and apartments in Puchong had risen at a rapid pace and we see no sign of prices decreasing or slowing down as at June 2015,” says manager of Oregeon Property Consultancy Sdn Bhd, Kok Chin Yee.

“The recorded transaction prices for both condominiums and apartments in Puchong had risen at a rapid pace and we see no sign of prices decreasing or slowing down as at June 2015,” says manager of Oregeon Property Consultancy Sdn Bhd, Kok Chin Yee.

Although Puchong is a mature neighbourhood, high-rise residences in Puchong are more affordable than those in Subang Jaya and Petaling Jaya. Data analysed by theedgeproperty.com showed that average prices for high-rise residential property in Subang Jaya are much higher than those in Puchong at RM581 psf, in 3Q14.

Older than those in Subang

“Subang Jaya and Petaling Jaya have ample job opportunities for the middle to high-income group, hence translating into higher property prices. The market segment is different [from Puchong],” says Chen.

Chen also believes that the management of these strata developments plays a crucial role in their popularity among buyers  and investors. “Stratified residential developments in Subang Jaya and USJ are better managed overall. This is one of the crucial factors that determines whether the price or investment value of a strata property can be sustained and enhanced in the long-term,” Chen offers.

and investors. “Stratified residential developments in Subang Jaya and USJ are better managed overall. This is one of the crucial factors that determines whether the price or investment value of a strata property can be sustained and enhanced in the long-term,” Chen offers.

Kok adds that the high-rise residences in Bukit Puchong, Puchong Perdana, Bandar Puteri Puchong and other parts of Puchong are older than those in Subang. Furthermore, Subang possesses an integrated rail and bus system with the KTM Komuter, which also contributes to the price difference.

Kok says as at June 2015, the average transacted prices of older non-landed residences are still below RM400 psf, while newer serviced apartments are seeing an average transacted price of RM536 psf.

Despite the rising number of new high-rise residential projects in Puchong, this property segment in the area remains fairly affordable, with those tagged between RM300,001 and RM400,000 accounting for the largest market share of transactions in the 12 months to 3Q2014 (27.9%). This was followed by the RM200,001 to RM300,000 range (20%) and the RM100,001 to RM200,000 range (16.1%), according to data recorded by theedgeproperty.com.

In the same period, the data showed that the most expensive project in Puchong by average transacted unit price was Solace Serviced Apartment at RM654,000. It is also the most expensive by average price psf at RM563psf.

Kok says the development of the residences at Setia Walk has set a price benchmark for high-rise residential properties within Puchong.

“Other than setting a benchmark, it acts as a catalyst and a trendsetter for modern lifestyle concept residential property in Puchong,” he adds.

Meanwhile, Permai Villa commanded the highest average price growth, with an average price increase of 46% y-o-y to RM229 psf in 2014.

theedgeproperty.com research noted that this [healthy price growth] may likely be due to its proximity to two upcoming LRT stations in Taman Puchong Perdana. There are very few residential high-rises located close to the LRT stations in Puchong as the stations are constructed mostly along the busy Lebuhraya Damansara Puchong (LDP) highway and within landed residential or commercial precincts in Taman Industri Puchong, Taman Puchong Perdana and Taman Puchong Prima.

Outlook

One of the price growth catalysts for Puchong in the near future is the completion of the LRT line extension, which is due in 2016. With eight new stations joining the Sri Petaling line to the Kelana Jaya lines, Puchong is expected to see significant improvement in its connectivity and ease its infamous traffic situation.

While values have increased substantially, rental yields based on asking rents as at June 2015 were fairly average, ranging between 3.7% and 5.7% annually.

Puchong’s incoming supply and new pricing benchmarks of non-landed residences will come from new township projects in the pipeline such as D’Island Residence by LBS Bina Group Sdn Bhd.

D’Island Residence is a 175-acre mixed residential development, which was launched in September 2011.

Located in Taman Tasik Puchong, the development has a gross development value of RM3.6 billion and comprises 1,035 residential units (237 units of luxury superlink, 298 units of semi-detached homes, 148 bungalows and 352 units of super condominiums). D’Island will be developed within five to seven years.

As prices of landed homes in Puchong continue to escalate, Landserve’s Chen expects future demand for affordable high-rise residential properties in Puchong to be strong.

Property prices across the board are expected to trend upwards, he adds. However, he says sound management of strata developments is highly critical to the sustainable growth and viability of a project.

“The ceiling prices for properties, especially high-rises, depend on their quality of maintenance and management,” adds Chen.

Kok also believes that high-rise residences will be the mainstream property in the near future due to the scarcity of land for landed home developments.

“We believe that the supply for high-rise residences will be significantly higher than low-rise residences in future,” he says.

“Looking at the current price trend, I foresee prices to keep on rising. However, economic conditions and political stability shall have the last say on the market and price trends,” he offers.

This article first appeared in property+, a section of the digitaledge DAILY, on Sept 4, 2015. Download property+ for free here.

For a quick and brief analysis of the property market in Puchong:

PROPERTY SNAPSHOT 1: Puchong’s story continues

PROPERTY SNAPSHOT 2: What’s affordable in Puchong?

PROPERTY SNAPSHOT 3: What are developments priced in Puchong?

PROPERTY SNAPSHOT 4: What’s hot in Puchong?

TOP PICKS BY EDGEPROP

Duduk Huni @ Eco Ardence

Setia Alam/Alam Nusantara, Selangor

Taman Sengkang @ Pasir Panjang

Port Dickson, Negeri Sembilan

Apartment Putra 1 (Pangsapuri Putra 1)

Kajang, Selangor

Astana Alam Apartment

Bandar Puncak Alam, Selangor