REAL estate developers have become more creative in luring prospective homebuyers into committing to a purchase, even as property price growth in the country moderates. It is a sign of the times.

Compared with the years immediately after the 2008/09 global financial crisis, the property market is now in a kind of lull. Data from the National Property Information Centre (Napic) shows property prices registering a compound annual growth rate of 8.44% from 2010 to 2014, based on its all-house price index. In the second quarter of 2015 (2Q2015), though, property price growth had slumped to 0.3% quarter on quarter.

At the same time, buying interest has waned, leaving an overhang in the market. Napic reveals that over 51,000 residential property units were launched in the fourth quarter of 2015 (4Q2015) in Malaysia. Out of this, 22%, with a collective value of RM5.9 billion, were left unsold. In addition, in the first nine months of 2015, the overall volume of housing contracted by 4.9%, and value by 12.7% year on year.

These numbers will hurt property firms. Property developers listed on Bursa Malaysia managed a respectable net profit growth of 6% in 2015 from a year earlier. However, most of the growth came in 1Q2015, when profit grew 31%, partly attributable to the buying frenzy before the implementation of the Goods and Services Tax. By 4Q2015, earnings growth had contracted by as much as 21% year on year.

Many property developers are still working through millions of ringgit worth of unbilled sales from better times and some have revalued properties to prop up their balance sheets. So, things could get worse. In that sense, offering innovative financing schemes to encourage people to buy homes and boost sales, is a neat trick in a country like Malaysia, where home ownership is a big priority.

The schemes offered by developers mostly target buyers who have been deliberately excluded, either fully or partially, from homebuying by financial institutions.

For instance, IOI Properties Group Bhd is offering a deferred payment scheme to those who cannot make a lump sum down payment, which is typically 10% of a property’s selling price. Buyers can make the down payment in instalments over 18 to 24 months upon signing a sales and purchase agreement (SPA). Buyers must issue post-dated cheques which are deposited every three months once they successfully obtain less than 90% financing from banks. The deferred payment scheme comes in addition to heavy discounts and price rebates already applied to the price of the property.

Sunway Bhd’s property division announced that it has introduced three schemes — guaranteed loan, deferred payment and voluntary exit plan — to give buyers a helping hand to home ownership. The guaranteed loan option is available for those who are unable to obtain loans from commercial banks. The deferred payment allows homebuyers to purchase a property with an initial down payment of as little as 3% and the voluntary exit plan gives buyers the option to terminate the SPA if they lose their employment.

Sunway tells The Edge that these are not sales “gimmicks”. Instead, the company says it understands that different individuals have different financial obligations and it is doing its part to offer flexible options to close financing gaps.

Sunway tells The Edge that these are not sales “gimmicks”. Instead, the company says it understands that different individuals have different financial obligations and it is doing its part to offer flexible options to close financing gaps.

These schemes may really be borne out of good intentions. But even the best of intentions can present difficulties, given the growing household debt in the country.

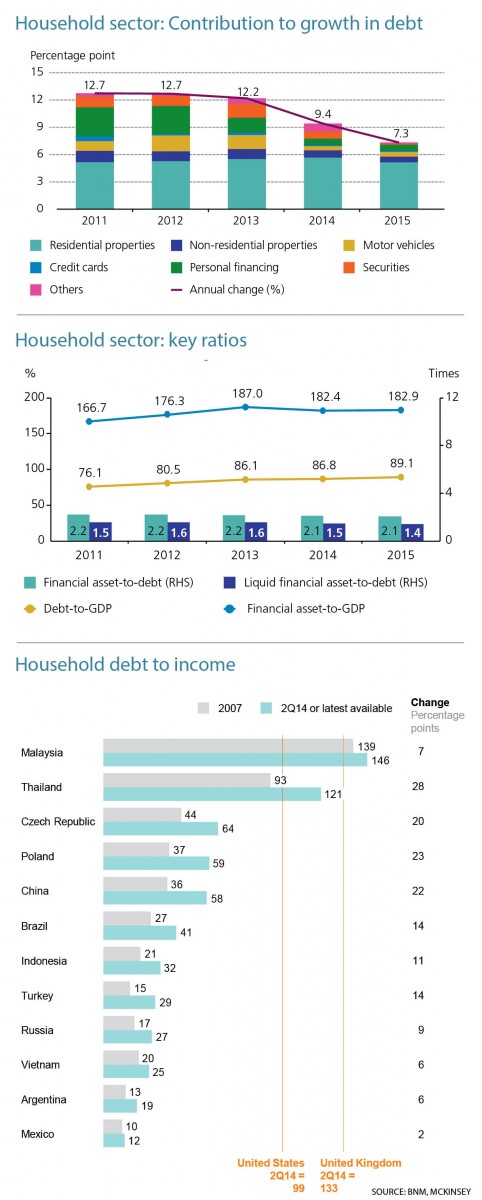

Bank Negara’s 2015 Financial Stability and Payment Systems Report says that the household debt-to-gross domestic product (GDP) ratio is “elevated” at 89.1%, a 2.3 percentage point increase from 2014. It adds that household borrowings from banks and non-banks expanded by 7.3% as at end-2015, but is extending the slower pace of growth since 2010.

An MIDF economist says growth of household debt of about 8% is “good” and an indication of a growing economy.

One of the reasons household debt in Malaysia has grown steadily over the last five years is the rapid rise in real estate and land prices during the property boom. Bank Negara says that from 2009 to 2014, average house prices in Malaysia rose at a CAGR of 7.9%, faster than growth in average household income of 7.3% during the same period. In cities like Kuala Lumpur and Penang, house prices have risen so fast that they are now considered to be severely unaffordable.

With that, households took on bigger mortgages and banks were more willing to lend against collateral with an increasing value. But, it is worth noting that the central bank found that a median household in Kuala Lumpur and Penang has insufficient capacity to service a mortgage based on the median house prices in these areas. In key urban employment centres, that capacity is even less.

A February 2015 report by McKinsey Global Institute identifies Malaysia as one of the seven countries with household debt that “may be unsustainable”.

“In most developing economies, household debt relative to income has grown rapidly, particularly where urbanisation is raising property values and access to credit is expanding. Debt relative to household income has risen by 13 percentage points on average since 2007 in developing economies. But the debt level in developing economies is still very low, at 42% of income, compared with an average of 110% in advanced economies.

“Notable exceptions among developing economies are Malaysia, whose household debt ratio is 146% of income, and Thailand at 121%. These debt ratios are similar to those in the US and the UK. Given the lower income levels in those countries, this raises questions about sustainability of household debt,” the report says.

Bank Negara is at pains to stress that Malaysia’s exposure to household debt, while growing, is mitigated by the fact that a significant proportion (61.4%) of household debt in Malaysia is secured by property and securities. Also important to note is that sound underwriting standards and risk management practices by financial institutions and the macro prudential measures the central bank has taken since 2010 mean that debt is usually distributed across households with the ability to repay borrowings.

In 2015, the share of borrowings by highly leveraged lower-income households that earned RM3,000 or less a month declined to account for 23.6% of the total banking system financing to the household sector. The aggregate leverage (measured as a ratio of outstanding debt to annual income) for households in this group has been hovering at about seven times since the introduction of macro prudential measures in 2010. This is unlikely to change in the near term as loans are sticky and take years to repay. In the higher income groups, aggregate leverage levels have remained stable, averaging about three times.

So, could creative financing options threaten the sustainability of the country’s household debt?

Economic growth is expected to slow and the employment rate is ticking up again. If the country’s economic environment worsens unexpectedly, the sustainability of its household debt will inevitably come into question. When household debt becomes unsustainable, households will start to deleverage. A bigger portion of household income will go towards repaying debt. This can strangle already weak consumer sentiment and consumer spending, the largest growth drivers.

This is why it is imperative for policymakers to start getting creative fast in providing more homes that prospective home owners can really afford based on their income rather than helping them buy what they cannot afford.

This article first appeared in The Edge Malaysia on April 4, 2016. Subscribe here for your personal copy.