PETALING JAYA (March 9): The Goods and Services tax (GST) which was introduced in April last year has reduced demand for commercial properties in the market due to the additional 6% cost that buyers have to pay, said Real Estate and Housing Developers’ Association Malaysia (Rehda) deputy president Datuk Soam Heng Choon.

“Developers are cautious with launching their commercial property as the public is still taking some time to adjust to the post-GST situation,” he said at a media briefing organised by Rehda for their property industry survey 2H2015 and market outlook for 2016.

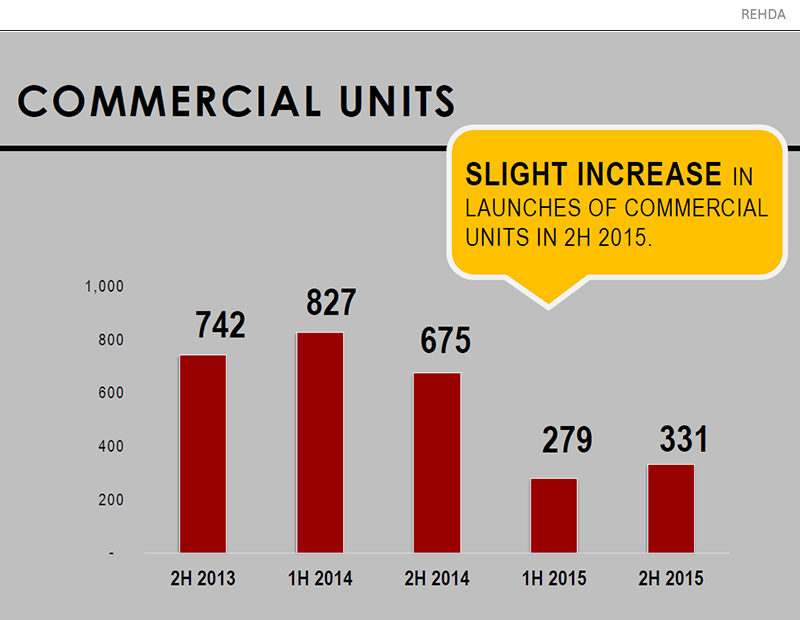

According to the survey report, 2H2015 saw a slight increase from 1H2015 with 331 units launched compared with 279 units.

Rehda president Datuk Seri Fateh Iskandar Mohamed Mansor noted the number of commercial units launched in 2013 and 2014 had dropped from 1,500-1,600 units to 600 units in 2015.

“We saw a slight increase in launches of commercial units in 2H2015 compared with 1H2015, and we expect 2016 to have better market sentiments for commercial properties compared with 2015 as it will already be a year this coming April since GST was imposed,” he added.

According to the survey, two thirds of respondents indicated that GST had caused property prices to rise due to the increased cost of doing business while three quarters of respondents blamed a slowdown in property sales to GST.

Meanwhile, 86% of the respondents said they had absorbed the increase in cost due to the GST, where 57% of them absorbed the increase partially while 29% absorbed the total increase, whereas 14% of them had passed on the increase to the house buyers.

The survey – which involved 159 developers and was held from July to December last year – was carried out by Rehda to assess the property market performance for 2H2015, the property market outlook for 1H2016 and the sentiment of developers about 2H2016.

TOP PICKS BY EDGEPROP

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

Seri Mutiara Apartments, Bandar Baru Seri Alam

Masai, Johor

SKS Habitat Apartment, Larkin

Johor Bahru, Johor

Taman Perindustrian Desa Cemerlang

Ulu Tiram, Johor

Sky Loft Premium Suites, Bukit Indah

Johor Bahru, Johor