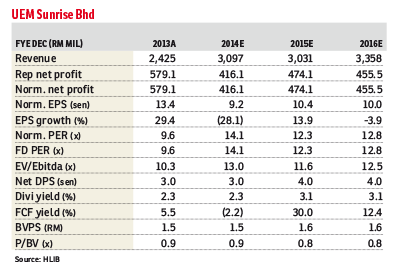

PETALING JAYA: Research house Hong Leong Investment Bhd (HLIB) maintained its conservative forecast of UEM Sunrise Bhd's profit for the financial year 2015 (FY2015), according to a report in The Edge Financial Daily today.

This is due to the challenging sector outlook for the year, said HLIB in the report.

At a recent briefing, UEM Sunrise said it expects flattish revenue year-on-year (y-o-y), with net profit of between RM500 million to RM550 million. The group's FY2015 profit target exceeded HLIB's forecast by 5% to 16%.

UEM Sunrise’s sales targets this year are between RM2 billion and RM2.4 billion, with half this figure expected to be derived from international sales, with the rest from domestic sales.

No sales figures for the first quarter of FY2015 (1Q2015) were given, but managing director and CEO Anwar Syahrin Abdul Ajib said first quarter sales had exceeded the group’s expectations despite having no launches during the period.

With the group’s gearing level is at 0.37 times, he said UEM Sunrise remains on the lookout for landbank acquisitions.

HLIB noted that RM1 billion will be allocated for this purpose in the northern region, Sabah and Sarawak or internationally.

It said the risks for UEM Sunrise are a slowdown in Nusajaya sales, failure to achieve the sales target and high beta stocks.

Positives are a highly liquid proxy for the property sector, a large war chest for landbank acquisitions and UEM Sunrise’s rich “news flow”.

Negatives are a share price that is highly news driven and vulnerable to an external slowdown, and the highest price-earnings ratio (PER) multiples in the sector, at more than twice the sector average.

HLIB maintains a “hold” on the stock, with an unchanged target price of RM1.58, based on unchanged 15.1 times FY2015 PER or a 50% discount to revalued net asset value.

For a related story on UEM Sunrise Bhd, click here.

TOP PICKS BY EDGEPROP

Desa ParkCity (The Breezeway Garden Condo)

Desa ParkCity, Kuala Lumpur

BANDAR AINSDALE FASA 3B (TENANG)

Seremban, Negeri Sembilan

Hijayu 1, Bandar Sri Sendayan

Siliau, Negeri Sembilan

Taman Senawang Perdana

Seremban, Negeri Sembilan

Taman Bukit Senawang Perdana

Seremban, Negeri Sembilan

Taman Bukit Senawang Perdana

Seremban, Negeri Sembilan

TAMAN BAYU INDERA, LUKUT

Port Dickson, Negeri Sembilan

Springfield Residences @ Setia EcoHill 2

Semenyih, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)