Hua Yang Bhd (May 25, RM2.06)

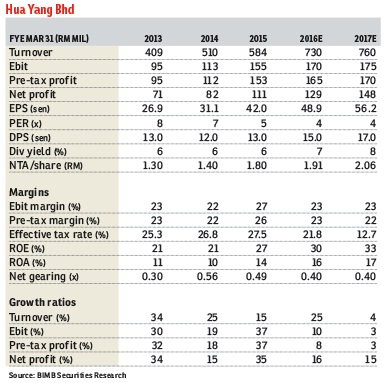

Maintain neutral with unchanged target price of RM2.12. Hua Yang’s fourth quarter ended March (4QFY15) net profit of RM30 million was flattish quarter-on-quarter (q-o-q), while it dipped by 21% year-on-year (y-o-y).

The meek performance was in tandem with current weakening property sentiment compounded by the attrition of securing loans for homebuyers.

New sales for the year declined by 37% from RM735 million to RM460 million. Despite the weaker sales, we reckon the steady bottom line was due to improved operating profit margin by four percentage points from 22% to 27%.

Unbilled sales for 4QFY15 amounted to RM702 million albeit easing 4% from 3Q due to slower recognition of new sales.

Management has guided targeted new sales of RM500 million for FY16 ending March 2016 on the back of planned launches of RM633 million high-rise and landed residential properties in the affordable segment.

A final single-tier dividend of eight sen was declared amounting to RM21 million payout for 4QFY15 or 13 sen per share.

While the total payout for FY15 summed up to 31% of net profit. This implies an attractive yield of 6%.

Hua Yang continues to be resilient as at least 80% of the group’s products were priced below RM1 million. We maintain our FY16 earnings estimate of RM129 million. — BIMB Research, May 25

This article first appeared in The Edge Financial Daily, on May 26, 2015.

TOP PICKS BY EDGEPROP

Avira Garden Terraces @ Medini

Iskandar Puteri (Nusajaya), Johor

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

Taman Cahaya Alam, Seksyen U12

Shah Alam, Selangor

Pangsapuri Orchid View Luxury Apartment

Johor Bahru, Johor

TriTower Residence @ Johor Bahru Sentral

Johor Bahru, Johor

Sky Trees @ Bukit Indah

Iskandar Puteri (Nusajaya), Johor