As we were being led to meet IGB Corp Bhd managing director Datuk Seri Robert Tan, we were told this was his first exclusive media interview in 2015. Tan, the man behind the international business conglomerate, keeps a rather low profile but granted The Edge an interview as IGB has once again been listed among the Top 10 developers in Malaysia at The Edge Malaysia Top Property Developers’ Awards.

“My greatest interest is in solving problems. I only do things that I am passionate about, which is why I hire someone else to take care of PR work,” he jokes.

With the current challenging market environment for the property sector in Malaysia, Tan says he has been busier than ever.

“IGB has good fundamentals and low gearing, as well as good and stable recurring income. I expected my retail and hotel businesses to experience a significant impact after the implementation of the Goods and Services Tax but the impact has been lighter than expected,” he says.

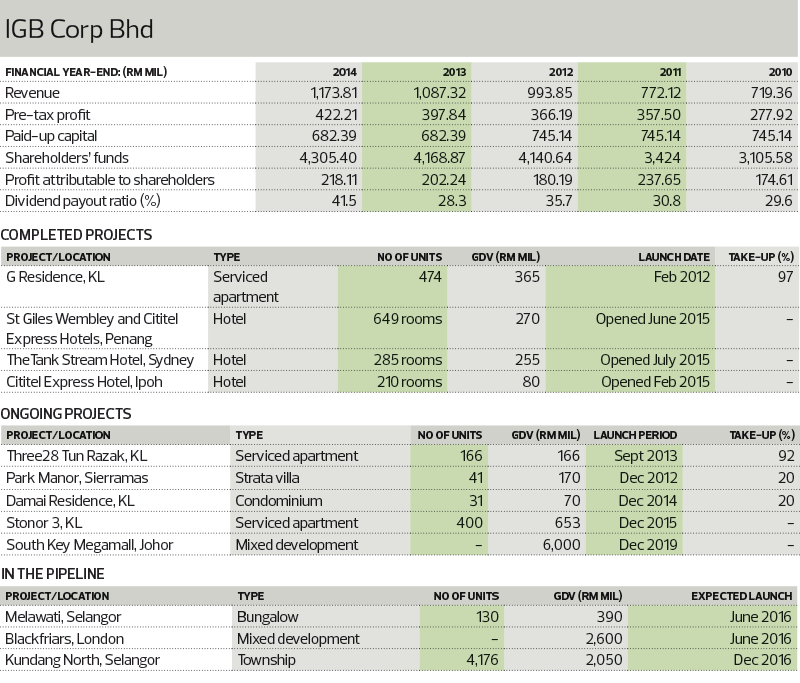

IGB is one of the biggest property players in Malaysia with residential, retail, commercial and hospitality projects here and overseas. Besides luxury condominiums in Kuala Lumpur city centre, IGB is best known for its iconic Mid Valley City in Kuala Lumpur, home to Mid Valley Megamall and The Gardens Shopping Mall. It is also known for the St Giles brand of hotels in Kuala Lumpur, Penang, Sydney, London, New York and the Philippines.

IGB recorded a 17% fall in net profit to RM55.35 million for the second quarter of its financial year ending Dec 31, 2015, from RM66.75 million a year ago. Its revenue for the same quarter also dropped 6.5% to RM271.92 million from RM290.84 million.

Tan says the weaker result was mainly due to lower contributions from the property and hotel divisions.

“The haze problem was beyond our control, we received more hotel cancellations due to the haze,” he says, adding that Malaysia is still a good tourist destination.

“As for the property development division, we had fewer launches this year compared with last year. However, all of our projects have been well-received. We are a niche developer mainly focused on conceptual high-end developments. We are not in a hurry to launch projects because we have other businesses that contribute to our income,” he adds.

According to him, the hotel and retail businesses contribute about half of the group’s revenue.

Moving forward, IGB will be focusing more on upgrading its existing malls and its venture into five-star hotels.

“We are aiming to have more assets that can give us recurring income. IGB has reached the stage where we do not need to sell [properties] that much. My strategy now is to keep good assets. We are trying to buy, build and keep, instead of purely buy, build and sell,” Tan says.

The hotel and retail businesses provide more excitement, says the man who loves challenges.

“However, IGB will not stop building. I have a team of excellent people taking care of the property development division and they are doing a great job. With the support of other businesses, the property development division has more time to plan for new launches, therefore quality and strong concepts are guaranteed,” he adds.

Tan shares his thoughts on IGB and the property industry in general.

The Edge: How is the current market situation impacting the group and what is your strategy in this environment?

Datuk Sri Robert Tan: If you analyse our results for the first half of 2015, you will see that our profit before tax and revenue has improved year on year, despite unfavourable consumer sentiments and other issues like the weakened ringgit and low commodity prices.

If asked to pinpoint an industry, property development has somewhat been affected by the generally cautious sentiment. It is not a huge concern for us as our property development activities focus on niche products and represents only about 15% of the group’s turnover and profits.

Our latest Stonor 3 project comprises 400 units of apartments in a 41-storey building with a gross development value (GDV) of about RM650 million. The project is strategically located and is a stone’s throw away from KLCC. Barring unforeseen circumstances, we are reasonably confident that this project will do well.

IGB has moved away from being a traditional property developer to investing in properties in strategic and in-demand locations to enhance our recurring income stream. Such a move enhances the stability of the group’s revenue and profits.

Besides a stable revenue stream, being in the retail, commercial property, hotels and property development industries affords us a hedge whenever an industry undergoes challenging periods as we are able to continue growing our other core businesses to compensate for a slowdown in a particular industry. This speaks for the relative stability of our earnings to date, with no unpleasant surprises.

We are continually enhancing, improving and refreshing our assets to ensure their attractiveness and desirability to consumers and their return and loyalty. Mid Valley Megamall and The Gardens Mall are two examples of our constant refreshing of our assets, where the malls continue to attract crowds of shoppers on weekdays and weekends and perform well in spite of challenging consumer sentiment.

IGB recorded an outstanding financial performance in 1QFY2015. However, the hotel division recorded lower occupancy and average room rate. What can you do to improve its performance?

As at 1H2015, our hotel operations contributed 26% of the group’s overall revenue. There are no proportionate targets as any drop in contribution by the hotel division may result from an improvement in the group’s other divisions. It is more important for each division to at least meet its budgeted numbers. However, we are always on the lookout for opportunities to build or acquire hotels, particularly strategically located ones such as three to four-star hotels in a city.

What is your secret to keeping the group competitive?

You must have a genuine passion for the businesses you are in. With passion, you will spend more time finding ways and means to improve the business operations, efficiency and image, and ultimately the profitability of the group. No company thrives by sitting still or resting on its laurels.

You also must have a clear business strategy. Mid Valley and our current projects were conceived after painstaking work on planning, research and strategy.

Needless to say, a good, experienced and stable team who are convinced of the viability of a company’s strategy and direction, motivated by results and who trust one another would be able to bring a company to new heights and consistently better such heights.

What is your business focus in the near future and where will that be?

We are focused on our major mixed development projects in Southkey, Johor Baru, and Blackfriars in London. The Southkey and Blackfriars projects have GDVs of RM5 billion and £850 million respectively. If approved, the amended scheme for Blackfriars will yield a substantially improved GDV.

The two projects will enhance the asset base of the group as it is the intention of the group to retain all of Southkey and the bulk of the assets at Blackfriars.

We do not have any particular preferences with regards to future projects, although it is generally easier to expand the group’s hotels business. We have added four new city hotels in the past year — two in Penang, one in Ipoh and the other in Sydney, Australia, all of which have added more than 1,100 rooms, giving the group a total of about 6,500 rooms.

We are always on the lookout to expand our hotel business. Europe, particularly tourist destinations such as Barcelona, Berlin and Madrid, is attractive to us. As we have a hotel in the UK already, expanding to Europe should be easier than competitors who are based somewhere further than Europe.

However, we don’t believe in setting ourselves a timeframe to start a business in new market. We will continue to observe and do the right thing when opportunity approaches.

What is the overall business development plan?

Our major overseas development projects are in London and Bangkok. We are seeking an amendment to the planning permission for our Blackfriars project, which if successful, will materially increase the GDV for the project.

Meanwhile, our Bangkok project is at the design and planning stage. That is a mixed development project. The land fronts the Chao Phraya River.

Emerging markets offer potential while the developed regions offer ready infrastructure, local expertise and certainty in their financial, tax and legal regimes. But we have a relatively low-risk appetite and have a long record of balancing business opportunities with caution.

What are the challenges ahead? What is your strategy moving forward?

The main challenges come from external factors, primarily the prevailing cautious investor sentiment in the market. The IGB group is able to embark on niche developments as we have moved away from being a pure property developer and now have a strong recurring income stream.

As such, we have the opportunity to focus on development projects which deliver value for money properties at different price levels. We have been able to manage and control our costs by embarking on innovative designs and projects.

Our upcoming key launches include the Southkey project in Johor (GDV: RM6 billion), Blackfriars in London, the Kundang township (GDV: RM2 billion) and the Bangkok project.

What is your outlook on the Malaysian property industry?

To be honest, personally I do not see any bright spots in the next one or two years in the Malaysian property market. It is a buyers’ market now and this should continue in the next one to two years.

Although the market is moving slower at the moment, we do not see desperate sellers, which could possibly lead to a market crash, thanks to Bank Negara Malaysia, which has been managing the economy pretty well and the strict controls on property market speculation.

I believe property prices will be hovering around current levels in the next two years. We will not see a market crash but a downturn, or slow market movement.

I also do not see property price adjustments because building costs have gone up due to the implementation of the Goods and Services Tax and the volatility of building material prices.

There is a possibility that property developers may stop building due to high cost and the slow market. However, if developers hold back launches till the market recovers, there may be the chance of price surges due to shortfalls in supply. TEPEA 2015

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on Dec 7, 2015. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

Taman Senawang Perdana

Seremban, Negeri Sembilan

Taman Senawang Perdana

Seremban, Negeri Sembilan

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

Centra Residences @ Nasa City

Johor Bahru, Johor