An artist's impression of The Light Waterfront Phase 2

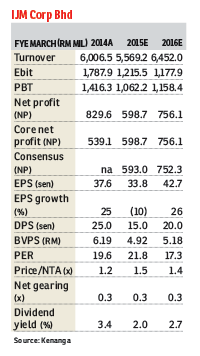

KUALA LUMPUR (April 23): Kenanga IB Research reported on April 22 that IJM Corp Bhd is in the midst of entering a new phase of growth as it is expanding most of its major earning drivers.

“A huge construction order book of RM7 billion will provide five-year earnings visibility and the completion of IJM Land Bhd’s privatisation exercise will boost its net profit by another 20% in the financial year ending March 31, 2016 (FY16),” the report said.

Two days ago, IJM Corp announced a related-party transaction, which involved acquisition of 50% stake in Aura Hebat Sdn Bhd (AHSB). AHSB is a joint-venture between The Light Waterfront Sdn Bhd and Perrenial Penang Pte Ltd.

The research house holds a positive view on the announcement as it signals that the company is getting ready to develop the Phase 2 of The Light, which comprises mostly commercial development. The gross development value (GDV) for phase 2 is RM3 billion.

However, the impact on the property's fully diluted real net asset value is minimal, the research house said.

“We have accounted for the development on the assumption of GDV per acre of RM63 million. However, this deal implies a GDV per acre of RM91 million, or 44% higher. If we were to impute this higher assumption and raise the GDV of The Light Phase 2 to RM8.6 billion, it would only increase IJM Land’s fully diluted revised net asset value (FD RNAV) by 2% to RM6.2 billion, which would not materially affect our valuation of IJM.” Kenanga IB Research’s report also appeared in The Edge Financial Daily today.

TOP PICKS BY EDGEPROP

Lucentia Residences @ BBCC

Kuala Lumpur, Kuala Lumpur

Pangsapuri Sri Ilham, Bandar Baru Seri Alam

Masai, Johor

Plenitube Harp @ Taman Desa Tebrau

Johor Bahru, Johor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor