BELIEVE it or not, the year 2015 can be considered one of the most vibrant in the history of the local property sector despite a general slowdown. There was no dearth of investors hunting for prized assets. After all, real estate is a good long-term investment.

There were deals that set new records and those that drew in foreign investors. And there were some that sprang a surprise or raised eyebrows.

A random survey among six real estate agents and property valuers reveals that most of the top 10 property transactions in 2015 were confined to Kuala Lumpur. Commonly mentioned were components of BlackRock Inc’s The Intermark — an integrated development at the intersection of Jalan Ampang and Jalan Tun Razak; land sales in 1Malaysia Development Bhd’s (1MDB) upcoming Tun Razak Exchange (TRX); and KL Sentral.

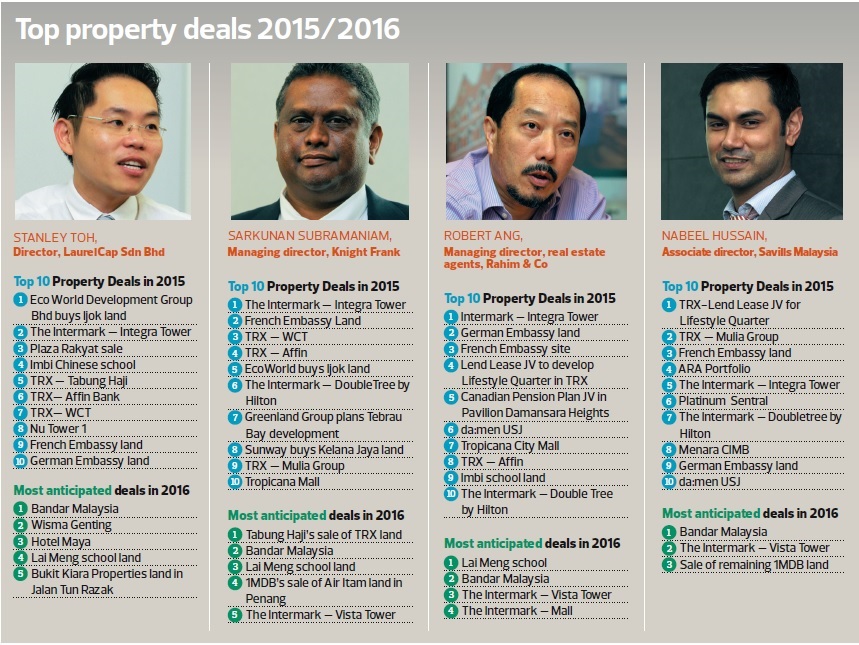

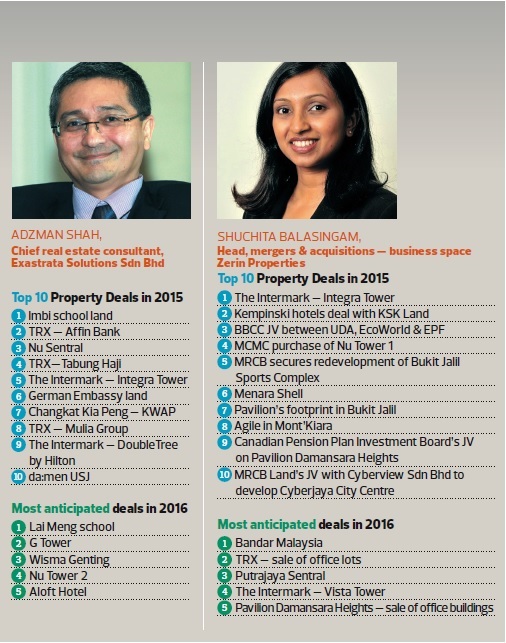

The six surveyed are Robert Ang, Rahim & Co’s managing director, real estate agents; Sarkunan Subramaniam, Knight Frank Malaysia’s managing director; Nabeel Hussain, Savills Malaysia’s associate director; Shuchita Balasingam, Zerin Properties’ head of mergers & acquisitions, business space; Stanley Toh, LaurelCap Sdn Bhd’s director; and Adzman Shah Mohd Ariffin, ExaStrata Solutions Sdn Bhd’s chief real estate consultant.

Their list reveals several common trends.

The Intermark makes a double mark on KL

The deal that made it to everyone’s top 10 list is the sale of the 39-storey, Grade A Integra Tower in The Intermark. In April, Kumpulan Wang Persaraan (KWAP) purchased the 760,715 sq ft office building with 850 parking bays from BlackRock Inc for RM1.065 billion. Located at the intersection of Jalan Ampang and Jalan Tun Razak, this is touted to be KWAP’s first domestic property investment.

“It was a record sum for a single office building,” says Ang, adding that the deal raised the bar for office buildings in KL.

Sarkunan similarly picked Integra Tower because it established a benchmark for values and yields for prime office buildings.

Nabeel, meanwhile, describes the asset as “one of the top quality office buildings in KL”. He says the purchase marks the beginning of KWAP’s domestic real estate investment drive after years of only investing overseas.

“In terms of size, Integra Tower was probably the biggest purchase of an office building in 2015,” comments Shuchita. “And the purchase is reflective of continued strong interest in the office sector.”

The sale of DoubleTree by Hilton, another component of The Intermark, was also ranked one of the top 10 transactions in 2015. Toh says the purchase of the 540-room hotel by Royal Group for RM388 million or RM718,000 per room was in line with the demand and supply at the time. He reckons that the price is reasonable, especially when benchmarked against the record RM1 million per room for the Westin Hotel Kuala Lumpur.

But to Nabeel, there has not been such a deal in many years. “It is the first arm’s length sale of an upscale hotel in KL in the last few years,” he says, adding that the deal suggests that investors are focusing not only on current income but also growth potential.

Interesting property exchanges at TRX

For the six property experts, what really stood out were the deals announced by 1MDB at TRX because they were unique. Lembaga Tabung Haji (LTH), for example, paid for a parcel in full while WCT Holdings Bhd is getting a piece of TRX land for RM223 million or RM3,100 psf in lieu of a contract sum payable to it by 1MDB for jobs done.

TRX is a 72-acre international financial district with an estimated gross development value (GDV) of RM40 billion. Launched in 2010 as the Kuala Lumpur International Financial District, 1MDB made progress and also created a stir this year, particularly with the LTH deal. TRX land was sold to Affin Bank Bhd and Indonesia’s Mulia Group as well.

“The TRX land sales to LTH and Affin were plagued by controversy and the price paid for the residential plot [by LTH] is probably one of the highest in the city centre in 2015,” says Toh.

In May, news leaked out that LTH had paid RM188.5 million for 67,792 sq ft, which worked out to RM2,780 psf. At first, the pilgrim fund claimed that it was already reviewing bids to sell the land but more recently, it decided to keep the prime parcel. It revealed that its property arm, TH Property Sdn Bhd, will develop the site.

Three months after LTH bought the land, Affin Holdings Bhd’s banking arm Affin Bank announced the purchase of 1.25 acres in TRX for RM255 million or RM4,699 psf to build its new headquarters.

This deal made it to Ang’s top 10 list. He termed it “a controversial sale at a record price (RM4,699 psf) to one of the smaller banking groups”.

Sarkunan found the TRX-Affin pact significant because “the high price point and the rationale behind it make it notable”. The banking group announced that the purchase price was fair as it was at a discount to an independent valuation of RM261 million.

Yet another TRX deal involved Mulia Group reportedly paying RM655 million for Signature Tower, which will be built on a 148,205 sq ft plot. According to Adzman, Mulia’s entry may lead to other big players from neighbouring countries coming in as development partners.

Work on the site has commenced and Signature Tower is slated for completion in 2020. “With a GFA (gross floor area) of 2.5 million sq ft, this tower will be larger than either of the Petronas Twin Towers,” Nabeel says.

Though a TRX deal with Australia’s Lend Lease was announced last year, the 60:40 joint venture to develop Lifestyle Quarter was sealed only in March 2015, a reason why the real estate experts felt it was worth mentioning.

The deal covers 18 acres and a GFA of 5.5 million sq ft. “This is one of the most ambitious projects in KL in recent years, led by Lend Lease, a global developer. Its retail mall with a GFA of two million sq ft will be a competitor to Suria KLCC and the Pavilion while the luxury hotel is expected to set a new benchmark in KL when completed in 2019. Combined with the high-end condominiums, the JV has a total estimated GDV of RM8 billion,” Nabeel remarks.

Ang adds that Lend Lease’s reputation as an international real estate heavyweight will boost TRX, lending it some much-needed credibility. “We can be assured that Lend Lease, on its part, will deliver a high-quality product that will form the catalyst for the rest of TRX.”

European embassy parcels

The sale of the sites of the French and German embassies in Kuala Lumpur also caught the attention of the property experts. The former German ambassador’s 81,288 sq ft residence in Jalan Kia Peng was sold for RM259 million or RM3,188 psf to MRCB. Ang places this land high on his list. “It is the most attractive development site in terms of location, being right at the doorstep of KLCC,” he comments.

And because the sale was concluded well above the reserve price of RM2,500 psf, Nabeel points out that it is evidence that demand for smaller sites around KLCC remains strong.

The French Embassy land was sold to Putrajaya Ventures Sdn Bhd. “This eight-acre site in the heart of the city was acquired for around RM900 million and it set a new benchmark for land prices east of Jalan Tun Razak. It also marked the first foray of Putrajaya Holdings Sdn Bhd into the city centre as it moved outside its traditional stronghold of Putrajaya.”

At RM900 million, the price works out to RM2,589 psf.

This deal also made it to Ang’s list because it is the largest redevelopment site in the city to come on the market while Sarkunan highlights that the deal shows there is demand for development land in the KL fringe and the price developers are willing to pay to secure such a parcel.

Highest priced deal outside TRX

An announcement that took everyone by surprise was the sale of the SRJK (C) Jalan Imbi land, which has set a new record for the highest land deal in terms of price per square foot outside TRX. A company called Elite Starhill Sdn Bhd had initially negotiated a deal to buy the school land and relocate the school to Cheras. Chinese company Debao Property Development Ltd has now bought Elite Starhill and will be buying the 90,008 sq ft parcel for RM388 million or RM4,310 psf.

“The Imbi Chinese school deal was something that sneaked under the noses of observers and the price is one of the highest transacted in the city centre,” says Toh who is a valuer. “The deal also validates the fact that Chinese developers are still very bullish about the Malaysian real estate market.”

Ang also mentions Debao because of the record RM4,310 psf price achieved for a non-TRX land in Jalan Imbi while Adzman suggests that Imbi land is now being benchmarked against TRX deals.

Desmond Lim makes the list

Tan Sri Desmond Lim Siew Choon has managed to grab the attention of the real estate industry with at least two deals this year. The first is the 51:49 joint venture entered into with the Canadian Pension Plan Investment Board to develop Pavilion Damansara Heights (GDV: RM7 billion), which sits on a 15.84-acre site in Pusat Bandar Damansara.

“This investment by a foreign institution in KL real estate amidst troubled economic times is significant because it underscores investor confidence in the long-term fundamentals of the market,” Ang says. In Shuchita’s view, since this is CPPIB’s first foray into Southeast Asia, it speaks volume of the interest and depth of Malaysian real estate and also Lim as a partner.

The second Lim-linked property deal is the purchase of da:men USJ mall by Pavilion Real Estate Investment Trust from Equine Park Country Resort Sdn Bhd and Revenue Concept Sdn Bhd for RM488 million.

“The move to inject da:men into the REIT before the mall’s opening poses a question on the yield expected based on the purchase price. There is no clear indication of the occupancy rate and projected revenue upon opening and for the next three years. The retail market is currently facing challenging times and rental rates may be suppressed,” Adzman points out.

“da:men is interesting because with this acquisition and a reported buy in the Golden Triangle, Pavilion REIT (or its affiliated companies) appears to be focusing on growth and relying on its retail expertise to turn around underperforming malls,” Nabeel states his reason for picking the deal.

KL Sentral

Several property deals took place within KL Sentral this year, including Menara CIMB, Menara Shell and Nu Sentral Tower 1. There was also the sale of the remaining 51% of Nu Sentral Mall Sdn Bhd to Pelaburan Hartanah Bhd for RM119.77 million by MRCB.

“Menara CIMB was sold to CIMB Group after several months of speculation. The 600,000 sq ft office building houses the CIMB Investment Bank and is one of the best-quality buildings in KL Sentral, along with Menara Shell and Platinum Sentral. At RM646 million, this is one of the top five largest office transactions in Malaysian history, ranked behind Integra Tower and Platinum Sentral,” Nabeel explains.

MRCB is selling Menara Shell for RM640 million to MRCB-Quill REIT. “There has been a lot of interest in the sale of Menara Shell for several months but the price was quite attractive and reflective of the current market, which is still active,” Shuchita says.

She highlights that the Malaysian Communications and Multimedia Commission’s (MCMC) purchase of a second building after it bought one of the towers in Shaftsbury Square in Cyberjaya is interesting. “They are a government agency, not a profit-making entity.” Together with the Menara Shell deal, these purchases will establish KL as a top office investment destination.

Joint ventures

There were several property-related joint ventures, which real estate developers thought were worth listing. These include UDA Holdings Bhd’s tie-up with EcoWorld Development Group Bhd and the Employees Provident Fund on a 40:40:20 basis to develop the Bukit Bintang City Centre (GDV: RM8.7 billion).

“Having EcoWorld as one of the partners puts a different swing on the kind of project BBCC will be. Plus having Mitsui as a retail partner makes it a part of the top 10, bringing an international flavour,” Shuchita says.

Yet another joint venture worthy of mention is MRCB’s partnership with Cyberview Sdn Bhd to develop Cyberjaya City Centre. “CCC is meant to be integrated with the Sungai Buloh-Putrajaya MRT line. This integration will make CCC the focal point of Cyberjaya once completed,” Shuchita adds.

EcoWorld’s purchase of land in Ijok, the sale of Tropicana Mall and Kempinski’s entry into Malaysia are among the other interesting property deals.

This article first appeared in The Edge Malaysia on Dec 21, 2015. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

Taman Connaught (Sri Cendekia)

Cheras, Kuala Lumpur

Parkfield Residences, Tropicana Heights

Kajang, Selangor

Ridgewood Canary Garden @ Bandar Bestari

Klang, Selangor

Anjung Sari

Setia Alam/Alam Nusantara, Selangor

Ridgewood Canary Garden @ Bandar Bestari

Klang, Selangor