IOI Properties Group Bhd (Oct 21, RM2.18)

Maintain buy with a higher target price of RM2.38 from RM2.20: IOI Properties Group announced that it had signed conditional share sale agreements with Tan Sri Lee Shin Cheng, Puan Sri Hoong May Kuan and Datuk Lee Yeow Chor, to buy their respective 100% stakes in Mayang Development Sdn Bhd (MDSB) and Nusa Properties Sdn Bhd (Nusa) for RM1.3 billion and RM319.8 million respectively.

Maintain buy with a higher target price of RM2.38 from RM2.20: IOI Properties Group announced that it had signed conditional share sale agreements with Tan Sri Lee Shin Cheng, Puan Sri Hoong May Kuan and Datuk Lee Yeow Chor, to buy their respective 100% stakes in Mayang Development Sdn Bhd (MDSB) and Nusa Properties Sdn Bhd (Nusa) for RM1.3 billion and RM319.8 million respectively.

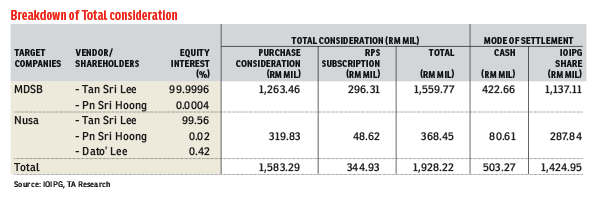

After also taking into account the redemption of redeemable non-cumulative preference shares in MDSB and Nusa held by Shin Cheng, the actual consideration for the proposed acquisitions will work out to RM1.6 billion and RM368.5 million respectively.

The proposed acquisitions will be funded via a combination of cash and new IOI Property Group shares at an issue price of RM2.21 per share. Subject to approvals from its shareholders and other relevant parties, the acquisitions are expected to be completed by the third quarter of financial year 2016.

The landbank of MDSB and Nusa, totalling 399.7 acres (162ha), is located within IOI Resort City and is strategically fronting the entrance of Putrajaya, and next to the South Klang Valley Expressway.

Post completion of the acquisitions, IOI Property Group’s undeveloped land bank in IOI Resort City is expected to increase to 449.7 acres from its existing 50 acres.

According to announcement, the land bank is expected to generate an indicative gross development value (GDV) of about RM20 billion. Of this, RM2.7 billion worth of properties have been identified for launch.

For starters, IOI Property Group will launch three developments, namely Conezion, Clio II and The Jewel. Shop offices and serviced apartments within the Conezion development are now open for registration and preview, with booking sessions targeted for end October.

Note that Conezion is now 27% completed and will contribute to IOI Property Group’s revenue immediately once the project is launched. Meanwhile, both Clio II and The Jewel are scheduled for launch in 2016.

Given the land bank is adjacent to the current development of IOI Property Group, we believe the land acquisitions will provide synergistic benefits to IOI Property Group, allowing the group to further leverage on its investments to date with common infrastructure in IOI Resort City.

In addition, it will also create the critical mass in terms of higher shopper traffic and working population, to support its investment properties such as IOI City Mall and IOI City Towers.

Upon completion, IOI Resort City will span across 780 acres comprising hotels, a golf course, retail malls, and commercial and residential properties.

Given the bigger scale of development with common infrastructure in place, we believe the proposed acquisitions will enable IOI Property Group to enhance its existing and future products offered within IOI Resort City.

We believe these are timely acquisitions given that IOI Property Group’s undeveloped landbank within IOI Resort City has depleted to about 50 acres with the balance GDV of RM1 billion that could last the group for another three to four years.

Hence, the proposed acquisitions will extend the lifespan of IOI Resort City development. Also, the additional land bank justifies IOI Properties Group to embark on the second phase of IOI City Mall, to capitalise on the success of the mall which has achieved an occupancy rate of more than 92% as at Sept 30, less than a year after its initial opening.

We fine-tune our FY16 and FY17 net profit forecasts to decline by 0.7% and 0.5% respectively after incorporating the audited FY15 financial statements. However, we have not factored in the new lands to our earnings model, which are pending shareholders’ approval.

Nonetheless, if we assume Conezion will be launched in the first quarter of calendar year 2016 (1QCY16) whereas Clio II and The Jewel will be launched in 4QCY16, the gross margin will range from 20% to 40%, and our FY16, FY17 and FY18 profits are expected to increase by 0.6%, 2.3% and 4.9% respectively.

As far as earnings per share is concerned, FY16, FY17 and FY18 earnings are expected to be diluted by 14%, 13% and 10% post acquisition. — TA Securities Research, Oct 21

Interested in properties in Putrajaya after reading this article? Click here.

This article first appeared in The Edge Financial Daily, on Oct 22, 2015. Subscribe to The Edge Financial Daily here.