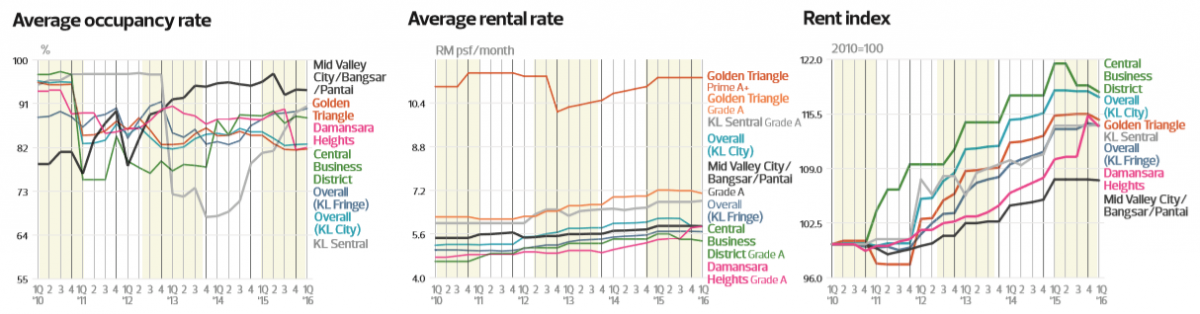

THE office market in Kuala Lumpur and beyond KL (Selangor) remained mostly static and unglued in the first quarter of the year, in the light of the slowing local economy, and the situation looks set to continue for the rest of the year.

THE office market in Kuala Lumpur and beyond KL (Selangor) remained mostly static and unglued in the first quarter of the year, in the light of the slowing local economy, and the situation looks set to continue for the rest of the year.

“The office market in KL and beyond KL was subdued in 1Q2016,” remarks Knight Frank Malaysia managing director Sarkunan Subramaniam. “Generally, there were fewer office space leasing enquiries and less activity. In most of the locations surveyed, there was a marginal contraction in the achieved rents for the quarter.”

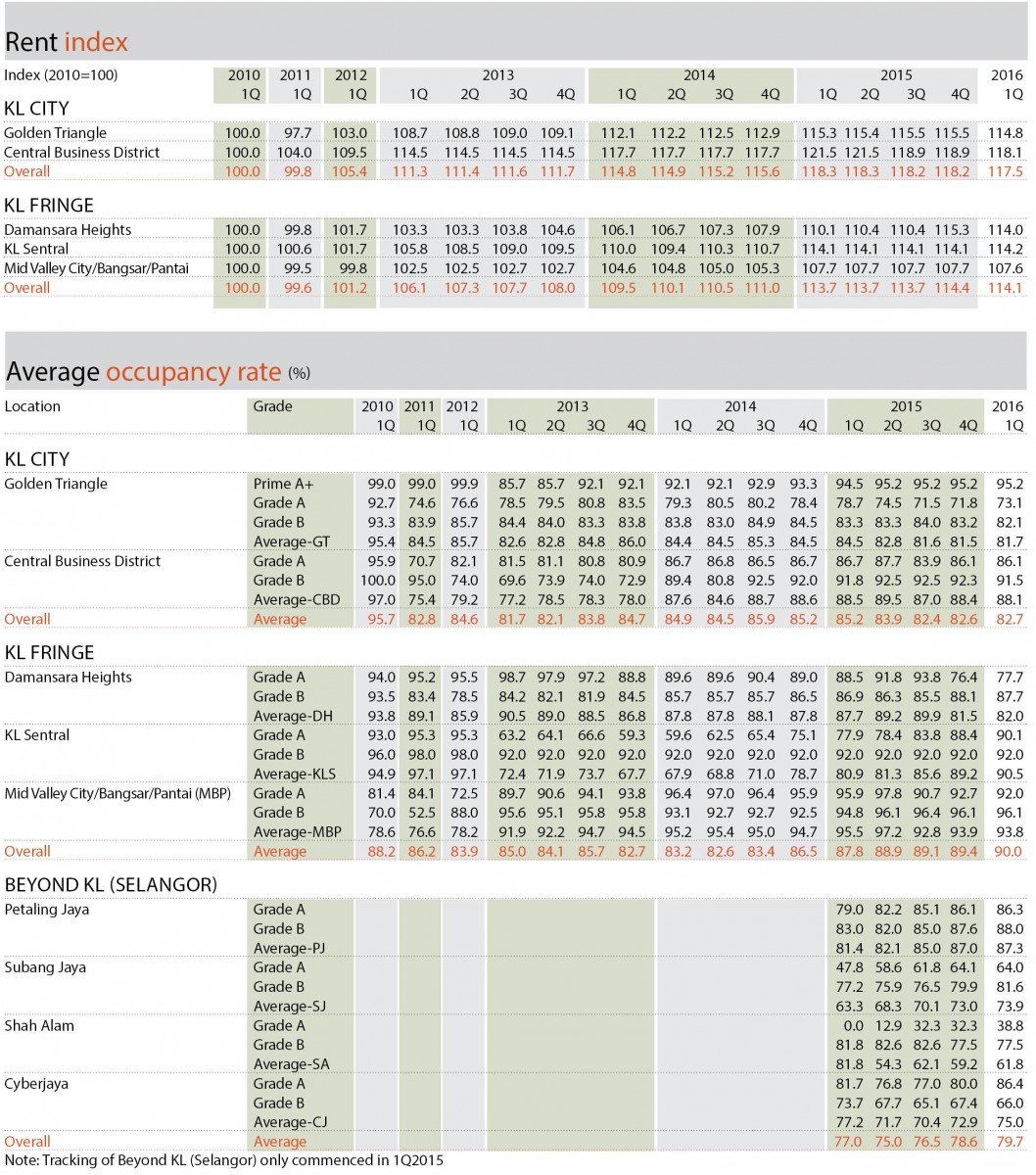

According to The Edge/Knight Frank Klang Valley Office Monitor 1Q2016, the cumulative supply of office space in KL City, KL Fringe and Beyond KL stayed unchanged at 92.53 million sq ft as there were no completions of office buildings during the period.

“But there is high impending supply [currently under construction] — about 860,000 sq ft in KL City, 3.4 million sq ft in KL Fringe and 1.7 million sq ft in Beyond KL are slated for completion by the end of the year,” says Sarkunan.

The supply of office space is expected to grow 15.1% between 2Q2016 and 2018 with the bulk of new completions in KL Fringe.

The cumulative total office space under construction in KL City, KL Fringe and Beyond KL in 1Q2016 stood at 13.99 million sq ft.

“Two office towers are expected to be completed in 2Q2016, namely Menara Hong Leong (Tower A of Damansara City) in Damansara Heights and Mercu Mustapha Kamal (Tower B) in Neo Damansara, Damansara Perdana. These towers are expected to add 686,000 sq ft to the existing stock,” Sarkunan points out.

Despite notable occupier movements in KL City and KL Fringe, overall occupancy in both regions remained flat during the quarter under review. “This is because much of the leasing activity was related to existing tenant movements, upgrading and rent advantage rather than expansionary purposes,” observes Sarkunan.

Beyond KL (Selangor), however, recorded a marginal improvement of 1.4% in overall occupancy. “The office market in this region is expected to be stable this year, supported mainly by the upcoming completion of transport links such as the LRT and MRT lines. But overall, occupancy rates are expected to trend downwards this year,” says Sarkunan.

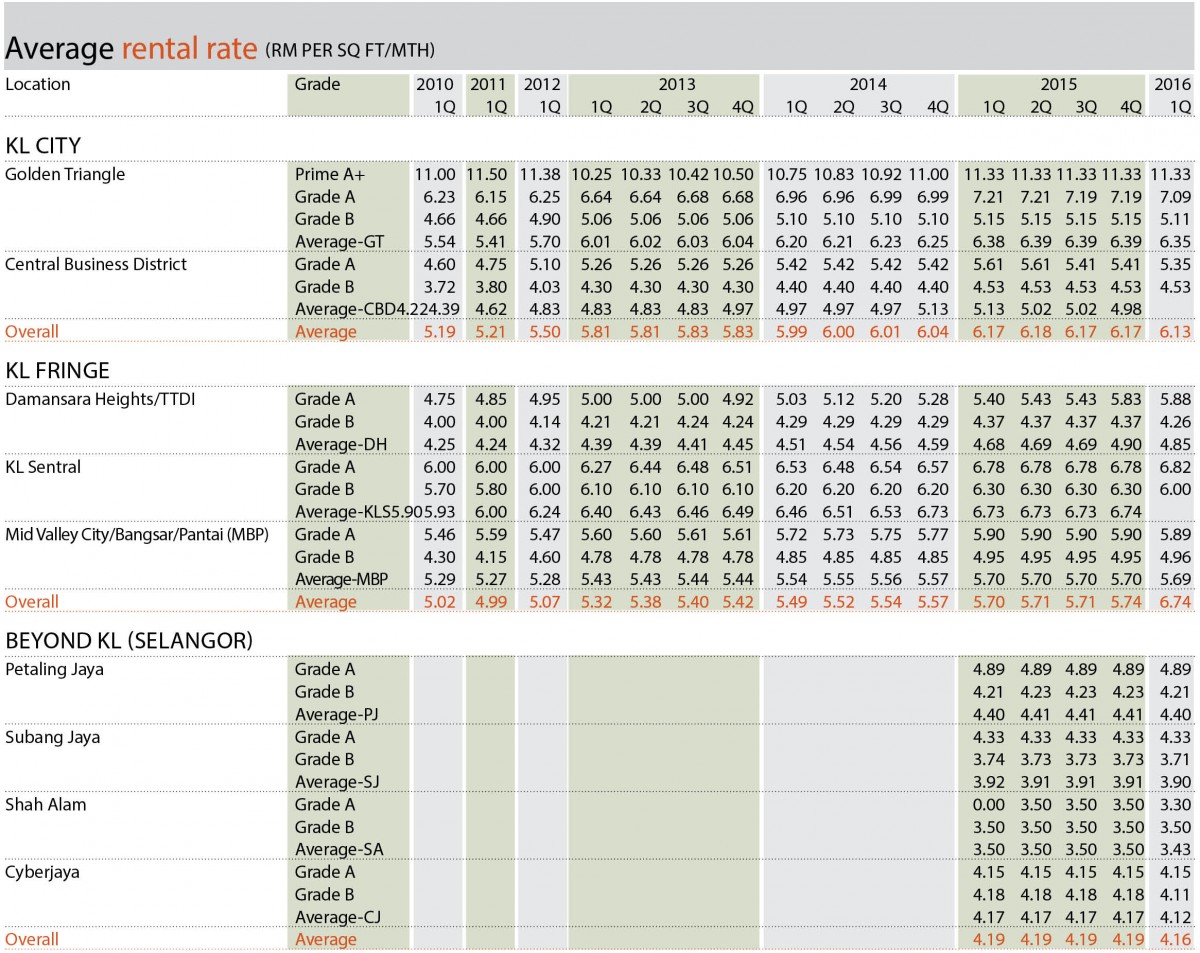

Average rents in KL City and KL Fringe fell 0.6% and 0.3% respectively, mainly due to comparatively cheaper achieved rents while average rents in Beyond KL (Selangor) shrank 0.8% in 1Q2016. “Average rents in KL and Beyond KL are likely to dip in the coming quarters as new supply enters the market, resulting in a mismatch with demand,” says Sarkunan.

“Nevertheless, more owners and landlords of newly completed buildings [particularly those not pre-let earlier or have yet to achieve significant occupancy post-completion] are stepping up their marketing/leasing efforts by offering lower rents and attractive incentives, such as a rent-free period and so on, to attract tenants.”

Key trends in 2016

“The KL office market is under growing pressure. Rents are expected to decline marginally due to heightened competition and a high supply pipeline [existing and incoming],” says Sarkunan.

Office vacancies are also expected to increase. There has been lesser demand and lower absorption (take-up) as firms cut workforce, freeze hiring and consolidate business operations.

Based on the monitor, new office space take-up continues to fall as occupiers, particularly from the oil and gas sector, are operating in a challenging business environment. This is reflected in KL’s net absorption, which was significantly lower at about 102,482 sq ft in 1Q2016, a sharp contraction of 63.01% q-o-q and 38.56% y-o-y.

“Some O&G companies are looking at sub-letting their office space or trying to convince their landlords to reduce their occupying space. Yet others are trying to renegotiate more reasonable rents with their landlords,” says Sarkunan, adding that more multinational corporations may also be enticed to relocate their regional offices from Singapore to KL to benefit from lower operational costs here.

According to him, persistently low oil prices have slashed the revenue of leading subsea companies such as McDermott, Technip and Saipem. They have thus shifted their operations from Singapore to KL to take advantage of the attractive ringgit, which translates into lower operational costs, and also to be closer to their clients, he says. “The proposed high-speed rail between KL and Singapore will also be a game changer when it is operational post-2020, which augurs well for the KL office market and commercial activities along the route and major stops.”

On future challenges, Sarkunan says, “The KL office market is expected to remain lacklustre with less activities generally. Pressure will mount on rents and occupancy as the supply-demand mismatch worsens. At the same time, existing and new tenants may take advantage of the subdued market to renegotiate rents. The scheduled completion of Phase 1 of the Sungai Buloh-Kajang MRT line may lead to higher demand for decentralised office space.

“All in all, well-located, good grade office buildings and those with MSC status are expected to continue to perform well.”

Occupancy and rental rates unchanged

Based on The Edge/Knight Frank Klang Valley Office Monitor 1Q2016, the overall occupancy rate in Beyond KL improved 1.4% to 79.7%. Occupancy in Beyond KL grew slightly, up 4.5% in Shah Alam, 2.8% in Cyberjaya, 1.2% in Subang Jaya and 0.4% in Petaling Jaya.

“Despite several tenants moving out of the SME Technopreneur Centre in Cyberjaya, FTMS Global College took up the entire Block 3420 (formerly occupied by Ericsson), while there were a few tenant movements in the Top Glove Tower in Shah Alam, leading to a 2.6% improvement in overall occupancy,” says Sarkunan.

The overall occupancy rate in KL Fringe increased 0.7% to 90% with improvements in most areas, including KL Sentral (up 1.5%) and Damansara Heights (up 0.6%). However, there was a slight decline in Mid Valley City/Bangsar/Pantai (down 0.2%).

In KL City, overall occupancy in 1Q2016 showed a marginal improvement of 0.1% to 82.7%. There was a slight growth in the Golden Triangle (up 0.2% to 81.7%) but a decline in the central business district, down 0.3% to 88.1%.

As for rents in 1Q2016, there were dips in all the regions. Beyond KL saw an overall reduction of 0.8% to RM4.16 psf — it was RM4.12 psf in Cyberjaya; RM3.43 psf in Shah Alam; RM4.40 psf in Petaling Jaya; and RM3.90 psf in Subang Jaya.

In Damansara Heights in KL Fringe, the overall rents of Grade A offices rose 0.9% to RM5.88 psf while in KL Sentral, they rose 0.7% to RM6.82 psf. In Mid Valley City/Bangsar/Pantai, Grade A offices saw their rents decline 0.1% to RM5.89 psf.

In KL City, overall rents in the Golden Triangle Prime A+ were unchanged quarter on quarter at RM11.33 psf. However, those for the Golden Triangle Grade A decreased 1.45% to RM7.09 psf and fell 1.1% to RM5.35 psf for CBD Grade A.

According to Sarkunan, several upcoming areas and developments present good opportunities for investors.

“The upcoming developments in Damansara Heights, such as the nearly completed Damansara City by Guocoland and the ongoing redevelopment of Pusat Bandar Damansara (PBD) by Pavilion Group and its JV partner (Canada Pension Plan Investment Board), coupled with two MRT stations nearby [in Semantan and PBD], augur well for the office market in the location,” he says.

“Another upcoming area is KL Eco City. The integrated development next to Mid Valley City is expected to become one of the major locations in KL Fringe after its scheduled completion in 2016/2017. Apart from seven office buildings [six purpose-built and one stratified], the project also features three high-rise residential blocks and one serviced apartment block.

“UOA Business Park, formerly Kencana Square, is a mixed-use development comprising nine blocks of boutique offices and a row of retail shops that are expected to be fully completed in 1H2016. Having Federal Highway frontage and direct access to the Subang Jaya LRT and KTM stations, the project is expected to become another major office location like Bangsar South,” adds Sarkunan.

Notable movements and transactions

In 1Q2016, Tropicana Plaza Sdn Bhd (formerly Dijaya Plaza Sdn Bhd) proposed to sell a piece of freehold land with a 19-storey office building — known as Dijaya Plaza, which had two levels of 322 parking bays and all the equipment fittings — to Kenanga Investment Bank Bhd. Dijaya Plaza is located in Jalan Tun Razak and has a net lettable area of about 156,488 sq ft and is priced at RM140 million or RM895 psf. The sale is expected to be concluded by 2Q2016.

Elsewhere, Inflobox has opened its first Asian R&D facility in Uptown 1, Damansara Uptown, to help address global domain name system threats.

Milliman Inc, a leading global consulting and actuarial firm, has opened an office in KL (1 Sentral, KL Sentral). The 12th in Asia-Pacific, the KL office offers employee benefits, life, non-life and health insurance consulting services.

Meanwhile, CE+T Power Group, one of the leading manufacturers of modular power inverters for the European and US markets, has opened its central Asia-Pacific office in Plaza Sentral in KL.

Notable announcements

In KL City, TRX City Sdn Bhd (formerly 1MDB Real Estate Sdn Bhd) will build a 27-storey office tower with a gross development value of about RM500 million and lease the structure to Prudential Assurance Malaysia (PAMB) for 15 years.

PAMB will make the financial district of Tun Razak Exchange its operation base for Malaysia and is expected to occupy more than half the building that is located in the Park Quarter, which comprises low-rise residential and office buildings, a cultural centre and open spaces. PAMB will move in at the end of 2018.

In KL Fringe, Naza TTDI is collaborating with Keystone Impetus Sdn Bhd to develop two blocks of stratified office buildings on a 2.47-acre site in KL Metropolis. Completion is slated for 2021. The 75.5-acre, mixed-use development, KL Metropolis, is located off Jalan Duta and will house the country’s largest exhibition space, the Malaysian International Trade and Exhibition Centre.

Also in KL Fringe, UDA Legasi Sdn Bhd’s upcoming mixed-use project, Legasi Kampong Bharu, will feature a 29-storey office tower with 83 units. Located in Jalan Raja Muda Musa, adjacent to the Putra LRT Kg Bharu station, Menara Legasi is targeted for launch this month and completion by 2019.

In Beyond KL, Ascent Paradigm by WCT Holdings Bhd, which opened in 3Q2015, has seen half its NLA of 504,084 sq ft taken up. Located in Kelana Jaya, off the LDP, the 32-storey Grade A, MSC-status corporate tower is part of the RM1.8 billion Paradigm integrated commercial development. Besides housing WCT’s new headquarters, its other tenants are DKSH Malaysia Sdn Bhd, CHR Hansen Malaysia Sdn Bhd, Keyence (M) Sdn Bhd and US-based pharmaceutical company Eli Lily (M) Sdn Bhd.

Meanwhile, Mah Sing Group Bhd’s office building in Icon City is open for lease. Located at the intersection of the Federal Highway and LDP, MSC Tower (pending official approval) is a 9-storey office building that is LEED and Green Building Index-certified and has MSC Malaysia Cybercentre status (Stage 1).

With a gross floor area of 48,833 sq ft and NFA of 3,662 sq ft on each level, the office space has a typical ceiling height of 9ft and 2x2 acoustic ceiling boards for sound absorption.

Also in Beyond KL, TSR Capital has proposed to acquire a private company that owns a freehold parcel (5,000 sq m) with development approval for two blocks of office towers (19-storey and 11-storey) and a 4-storey car park. The project, which has a preliminary estimated GDV of RM230 million, is located adjacent to Menara TSR in Mutiara Damansara.

TSR intends to partially sell or lease the buildings to be developed on the land with 70% of the lettable space to be sold and the remaining kept for rental income and capital appreciation.

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on June 13, 2016. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

Livia @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Robin @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Chimes @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor