KUALA Lumpur city centre (KLCC) has been known as the country’s operational hub for oil and gas industry players since government-owned oil and gas company Petroliam Nasional Bhd (Petronas) established its headquarters at Petronas Twin Towers in 1998.

The area is also home to expatriates working in sectors such as oil and gas, banking and finance, retail and hospitality.

Since the oil price slump, affected companies have taken cost-cutting measures and carried out restructuring exercises. Oil prices have plunged nearly 70% over the past 20 months and have significantly impacted the global economy. In the US, oil companies have retrenched more than 86,000 employees — some of whom were stationed in Malaysia.

In Malaysia, Petronas cut as many as 1,000 jobs early this month. According to the Malaysian Employers Federation (MEF), more than 20,000 workers from various sectors had been laid off as at September last year.

As a result, KLCC high-rise residential property owners are also feeling the pinch as expat tenants cut short their stint in the country.

City Crest Realtors principal Darren Khor tells TheEdgeProperty.com that the high-rise residential units are taking longer to rent out — including the more popular condominiums. Some real estate agents, who had previously focused on the KLCC market, have also shifted their focus to other areas as business declines in KLCC.

“The more in-demand properties, such as 1-bedroom or studio units, normally take about two weeks to find a tenant. Last year, it took about one to two months and now, we need two to three months,” Khor says.

GMAC Realtors senior negotiator Lim Jin May says business has been slow over past two years. Buyers were struggling to sell, with some willing to reduce asking prices to close deals.

GMAC Realtors senior negotiator Lim Jin May says business has been slow over past two years. Buyers were struggling to sell, with some willing to reduce asking prices to close deals.

She notes the rising supply of high-rise homes for lease since early last year as many owners saw their expat tenants end their contracts early as their employers implement cost-cutting measures.

“This has caused a surge in supply of units for rent and it is putting pressure on rents,” Lim adds.

KGV International Property Consultants Sdn Bhd director Anthony Chua concurs that the oil price slump has affected the overall residential property market in KLCC.

“Transaction activity has been softening over the past three years, reflecting the weakening economy,” he says.

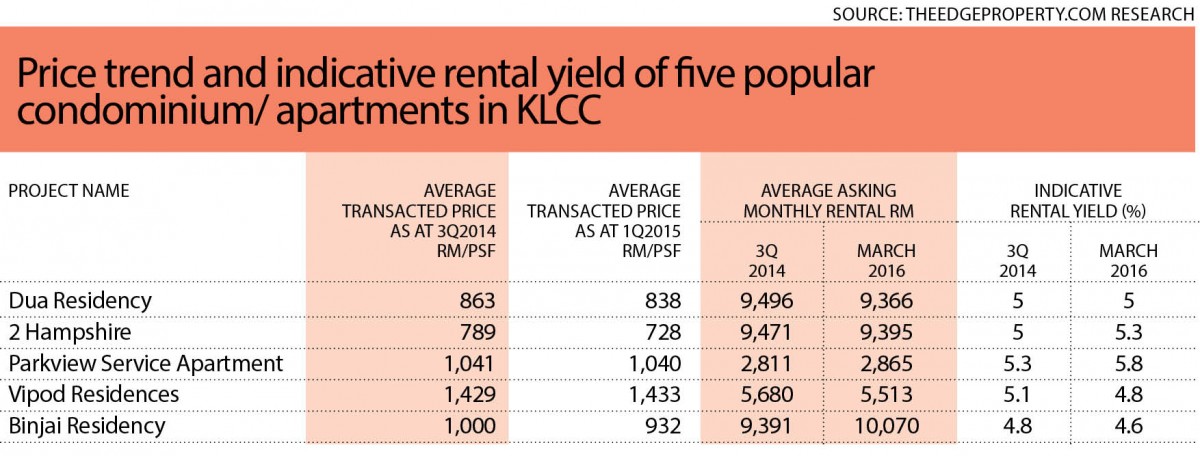

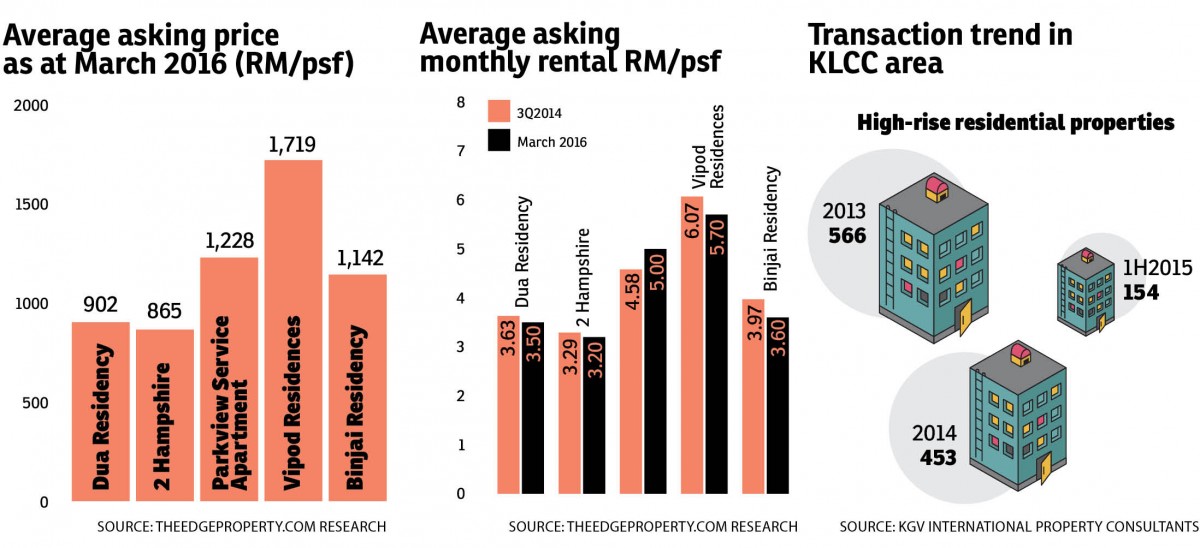

According to KGV International Property Consultants’ data, residential property transaction volumes in KLCC have been declining since 2013. There were 566 and 453 deals in 2013 and 2014 respectively. For the first half of 2015, there were only 153 deals — not even half of that in 2014.

As for the rental market, the impact is even more significant, considering that most owners of the residential units in KLCC are investors. Khor says investors who depend on rental income had previously targeted expats working in and around the KLCC area as well as high-income professionals who could afford the high rents and who enjoy the city lifestyle.

“More than 70% of owners in KLCC have rented out their units due to the attractive rents; they could get at least RM3,000 to RM4,000 a month. Less than 20% are owner-occupiers. KLCC is an expat-driven market. Local tenants make up less than 10%,” he adds.

Owners reducing rents

Khor also says impatient owners will lower their asking rents to attract tenants. Compared with last year, asking rents have dropped about 10%, even at some popular properties.

“For instance, Hampshire Place, which has been fetching monthly rents of RM6,500 to RM7,000, is now getting only RM6,000. Some owners are even willing to go below RM6,000,” he adds.

According to research by TheEdgeProperty.com, as at March 10, the average asking monthly rent for Hampshire Place was RM5,007 or RM4.60 psf, compared with RM5,116 or RM4.69 psf in June 2015. Indicative rental yield dropped slightly to 5.1% from 5.2%.

According to research by TheEdgeProperty.com, as at March 10, the average asking monthly rent for Hampshire Place was RM5,007 or RM4.60 psf, compared with RM5,116 or RM4.69 psf in June 2015. Indicative rental yield dropped slightly to 5.1% from 5.2%.

According to The Edge/Savills 4Q2015 Klang Valley housing monitor, the rents of 2,000 sq ft units at Stonor Park dropped to RM8,000 in 4Q2015 from RM8,800 in 4Q2014. Stonor Park, which was developed by Beneton Properties Sdn Bhd in 2006, is one of the most exclusive high-rise residential properties in KLCC. It comprises 71 units with build-ups of between 2,000 and 8,000 sq ft.

Stonor Park is not alone; Marc Service Residence and Parkview Service Residence have seen a decline of between 12% and 10% in monthly rents in 4Q2015 from a year ago.

The Edge/Savills housing monitor data shows that Marc Service Residence, Parkview Service Residence and Stonor Park have fetched rental yields ranging from 4.74% to 7.65% between 2010 and 2015.

GMAC Realtors’ Lim says owners used to enjoy a high yield of 6% to 7% during good times — when oil prices were above US$100 a barrel — but in the current economic situation, rental yields are only around 4% or less, if the owners bought the units when prices were at their peak.

KLCC still expensive

Despite the gloomy outlook, the KLCC area remains the most expensive address in the country. KSK Land Sdn Bhd launched YOO8 by Kempinski last November with a benchmark average price of RM3,200 psf. Its selling price has surpassed Four Seasons Place in KLCC, which is located 1.8km away from YOO8 — at an average price of RM2,900 psf in the end of 2013.

YOO8 is a part of the RM5.4 billion integrated 8 Conlay development. The newly launched Tower A branded residence has 564 units with built-ups of between 700 and 1,300 sq ft.

Meanwhile, Wing Tai Asia’s build-then-sell (BTS) project, Le Nouvel KLCC, has an indicative price of RM2,200 psf onwards. The luxury apartments have built-ups of 1,810 to 2,832 sq ft and are expected to be launched this year.

Meanwhile, Wing Tai Asia’s build-then-sell (BTS) project, Le Nouvel KLCC, has an indicative price of RM2,200 psf onwards. The luxury apartments have built-ups of 1,810 to 2,832 sq ft and are expected to be launched this year.

According to TheEdgeProperty.com’s analysis of transactions, the average selling price of non-landed homes in KLCC has been on the rise. The average transacted price for high-rise residences in 2014 was RM1,091, compared with RM1,053 in 2013. In 1Q2015, the average transaction price of 36 properties was RM1,167.

City Crest Realtors’ Khor says that although the rental market is facing challenging times, the KLCC property market is still stable in terms of value.

“KLCC is still a viable investment area in the long run due to land scarcity and expected demand from the overall growing working population in the future,” he says.

He adds that once the overall economy improves, oil prices recover, connectivity and walkability in the city centre are upgraded and inner city public transport becomes more efficient, demand for KLCC properties will rise again.

TOP PICKS BY EDGEPROP

Seksyen 5, Petaling Jaya

Petaling Jaya, Selangor

Seksyen 4, Petaling Jaya

Petaling Jaya, Selangor

Section 22, Petaling Jaya

Petaling Jaya, Selangor

Trillium, Perdana Lakeview East

Cyberjaya, Selangor