KLCCP Stapled Group

(KLCC Property Holdings Bhd June 4, RM7.04)

(KLCC Real Estate Investment Trust June 4, RM7.04)

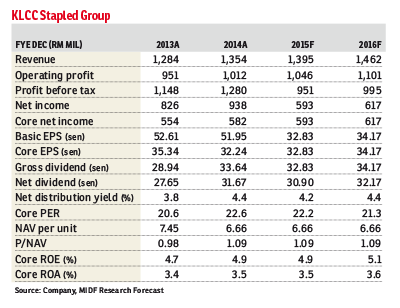

Maintain neutral with unchanged target price of RM6.88: We expect earnings of KLCC’s office division to remain steady. Three of its four office investment properties (Petronas Twin Towers, Menara 3 Petronas [office portion only] and Menara Dayabumi) have been leased out for the long term to its major shareholder, Petroliam Nasional Bhd. Menara ExxonMobil is under a five-year lease agreement expiring in January 2017. The tenancy agreement with ExxonMobil is likely to be renewed. This is in view of the good relationship established with ExxonMobil and the prime location of the property in the KLCC Development Area. In financial year 2014 ended December (FY14), the office segment was the major contributor to KLCCP Stapled Group, contributing 44% of its total revenue.

The Phase 3 refurbishment of Menara Dayabumi involves the redevelopment of the City Point podium into a 60-storey office and hotel tower with new retail outlets. From our recent meeting with management, we gather that KLCC has secured Shangri-La Hotel Group as tenant to occupy the top half of the tower and to operate it as a hotel. We are positive on this development but there will be no earnings impact until FY19 after the completion of the new tower.

We believe that the implementation of the goods and services tax (GST) from the second quarter of 2015 onwards will affect consumer spending in the short term. This should moderate the rental reversion growth to 5% in FY15 (from 12% in FY14) as tenants due for the lease renewal may negotiate for lower increase in rental rates than in the past.

For existing tenants, the rental rate and service charge should remain the same while the profit-sharing portion is expected to continue to contribute less than 1% of its retail division’s total revenue.

To recap, the retail segment contribution to KLCCP Stapled Group’s revenue is 33%. Recall that its hotel division’s revenue declined 36% year-on-year to RM31.5 million in the first quarter of 2015. This was caused by weaker market demand for luxury hotel rooms in Kuala Lumpur in line with the plunge in oil prices.

We gather that oil and gas accounts within the hotel division are economising on travel and event expenses for their businesses. In addition, renovation works have started on Mandarin Oriental Kuala Lumpur in 1QFY15 and we expect this to affect its occupancy rate.

Despite the challenging outlook for the hotel segment, its impact at the group level should be minimal as its revenue contribution to the group is minimal at 14%.

Post meeting with KLCC’s management, we maintain our earnings forecasts for both FY15 and FY16 due to limited rerating catalysts in the near term. Potential earnings growth is only expected in the longer term after the completion of its 60-storey tower next to Menara Dayabumi in FY19. Potential asset injection from Petronas (Lot 185 and Lot 91) into KLCC should only happen beyond FY18.

Our target price of RM6.88 is unchanged based on dividend discount model (required rate of return: 8%, perpetual growth rate: 3.1%). — MIDF Research

This article first appeared in The Edge Financial Daily, on June 5, 2015.

TOP PICKS BY EDGEPROP

Setiawangsa Business Suite

Taman Setiawangsa, Kuala Lumpur

Bungalow Lot at Jalan Gasing, Unparalleled Kuala Lumpur View For Sale

Petaling Jaya, Selangor

Pangsapuri Damai, Subang Bestari

Subang Bestari, Selangor

Laman Haris @ Eco Grandeur

Bandar Puncak Alam, Selangor

Iris @ Bandar Hillpark

Bandar Puncak Alam, Selangor