KLCC Property Stapled Group (Jan 22, RM7)

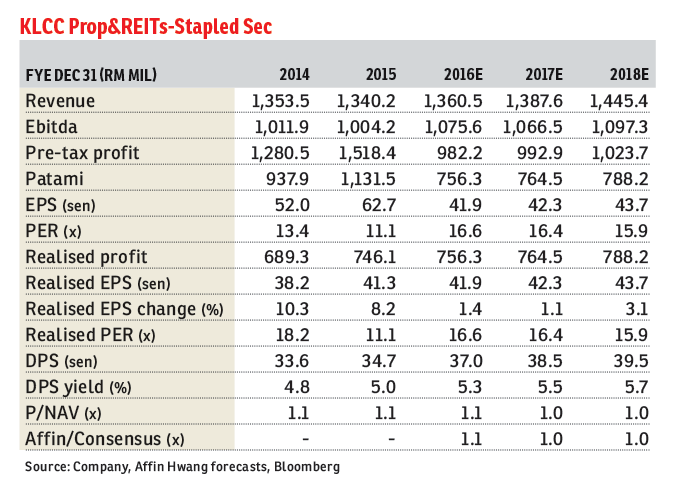

Maintain hold with a target price of RM7.50: KLCC Property Stapled Group (KLCCPSG) achieved a financial year ended Dec 31, 2015 (FY15) core net profit of RM746.1 million (+8.2% year-on-year [y-o-y]), with a stronger profit after tax and minority interest growth of 20.6% y-o-y (underpinned by a higher amount of revaluation surplus on its assets, while FY14 also saw a one-off debt-prepayment fee of RM26 million).

KLCCPSG’s FY15 results were in line with our core net profit forecast of RM744 million, but were above the consensus. The fourth quarter of FY15 (4QFY15) saw a higher dividend per share of 9.82 sen (4QFY14: 8.75 sen), hence bringing its total FY15 payout to 34.65 sen.

For FY15, KLCCPSG’s revenue was flat y-o-y, affected by moderation in hotel revenues (affected by renovation works on meeting rooms and recreational facilities in the first half of FY15) as well as flat office rental income due to the ongoing asset enhancement initiative (AEI) in Kompleks Dayabumi (closure of City Point).

As a result, operating profit remained flat in FY15. Its office and retail divisions remained key business drivers, contributing close to 92% of operating profit.

KLCCPSG’s medium- to long-term (more than three years) AEI and asset-injection plans are driven by: growth in its in-built pipeline (redevelopment of the City Point podium in Kompleks Dayabumi into a 200,000-sq ft retail area, 600,000-sq ft office and 500-room hotel (from 2015 to 2019); development of Lot D1 into an office tower (1.3 milllion sq ft of gross floor area); and acquisitions.

KLCCCP’s longer-term potential is being underpinned by an asset-injection pipeline of approximately RM5.8 billion (backed by its strong parent company) and its attractive feature as a syariah-compliant stock. — Affin Hwang Capital, Jan 22

This article first appeared in The Edge Financial Daily, on Jan 26, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Nilai Square Commercial Center

Nilai, Negeri Sembilan

Duduk Se.Ruang @ Eco Sanctuary

Kuala Langat, Selangor

Taman Bukit Rahman Putra

Sungai Buloh, Selangor

Jalan Bukit Rahman Putra

Bukit Rahman Putra, Selangor

Bandar Baru Sungai Buloh

Sungai Buloh, Selangor

Bandar Baru Sungai Buloh

Sungai Buloh, Selangor