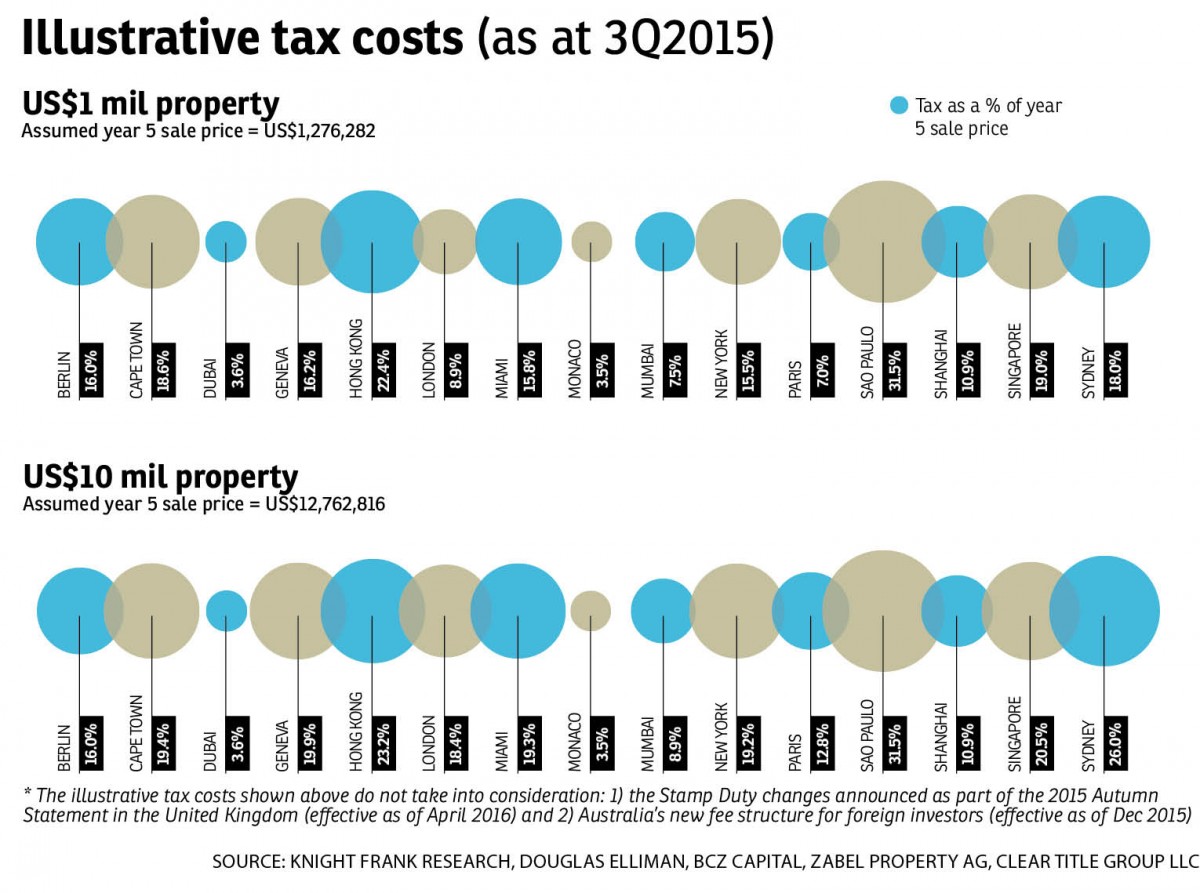

PROPERTY transaction costs and taxation are becoming increasingly important considerations for investors. Global consultancy Knight Frank in its recently launched Global Tax Report developed jointly with Ernst & Young revealed that indicative property tax costs can range from as low as 3.5% or 3.6% of the property price in Monaco and Dubai, respectively, to over 30% in Sao Paulo.

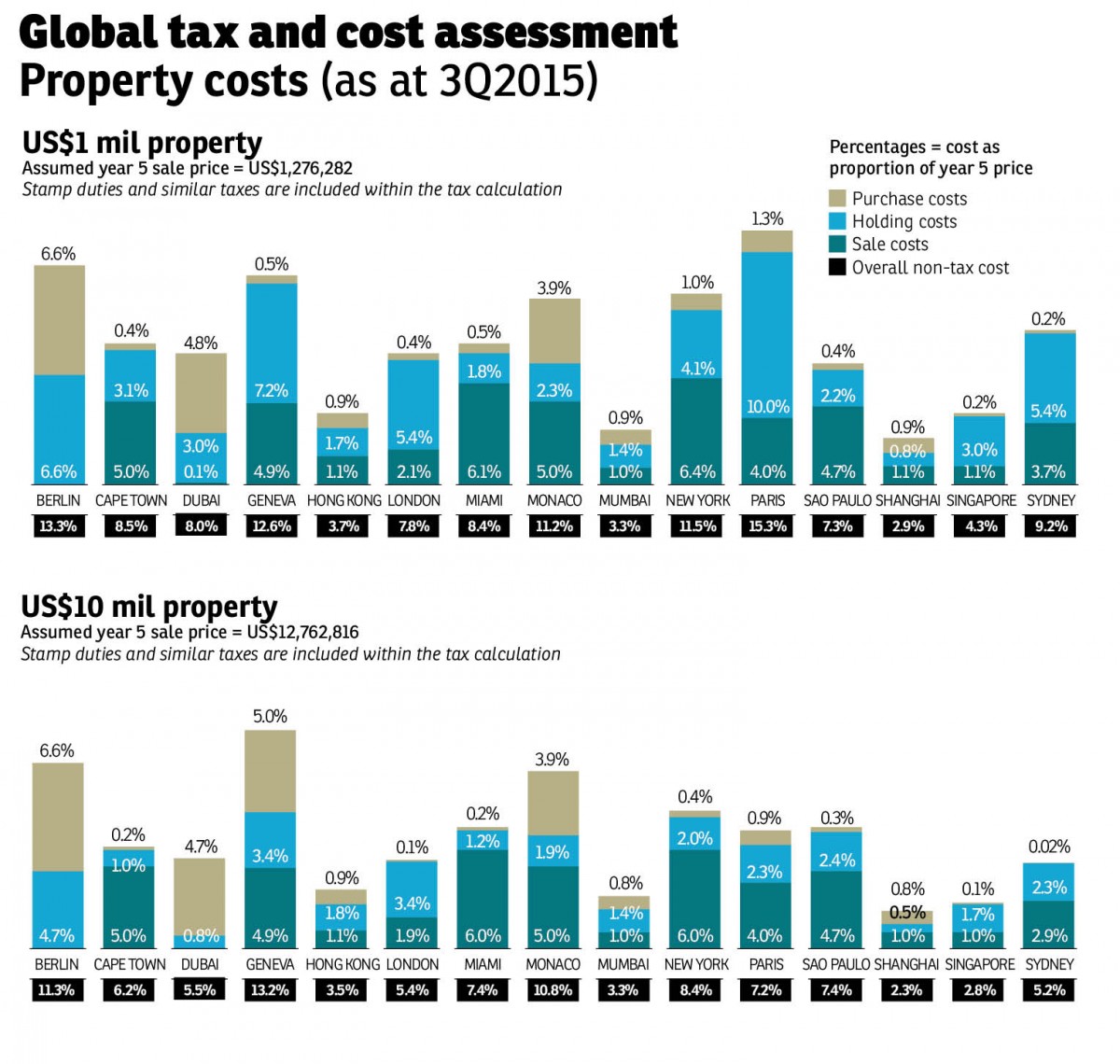

To make comparisons of property taxes and costs in various countries, the analysts assumed that a non-resident investor has a sum of money (US$1 million or US$10 million) to invest in property overseas. The purchase, holding and disposal costs of owning a property over five years were then calculated.

The report analysed the costs that a foreign individual would have to bear when buying a US$1 million or US$10 million property as an investment, and renting it out over a five-year period.

As a result, the report was able to show the buying, holding and selling costs for foreign buyers of prime residential property over a five-year period (starting from 2015) while providing the illustrative taxation costs in 15 key cities worldwide, including four cities from Asia (Hong Kong, Mumbai, Shanghai and Singapore).

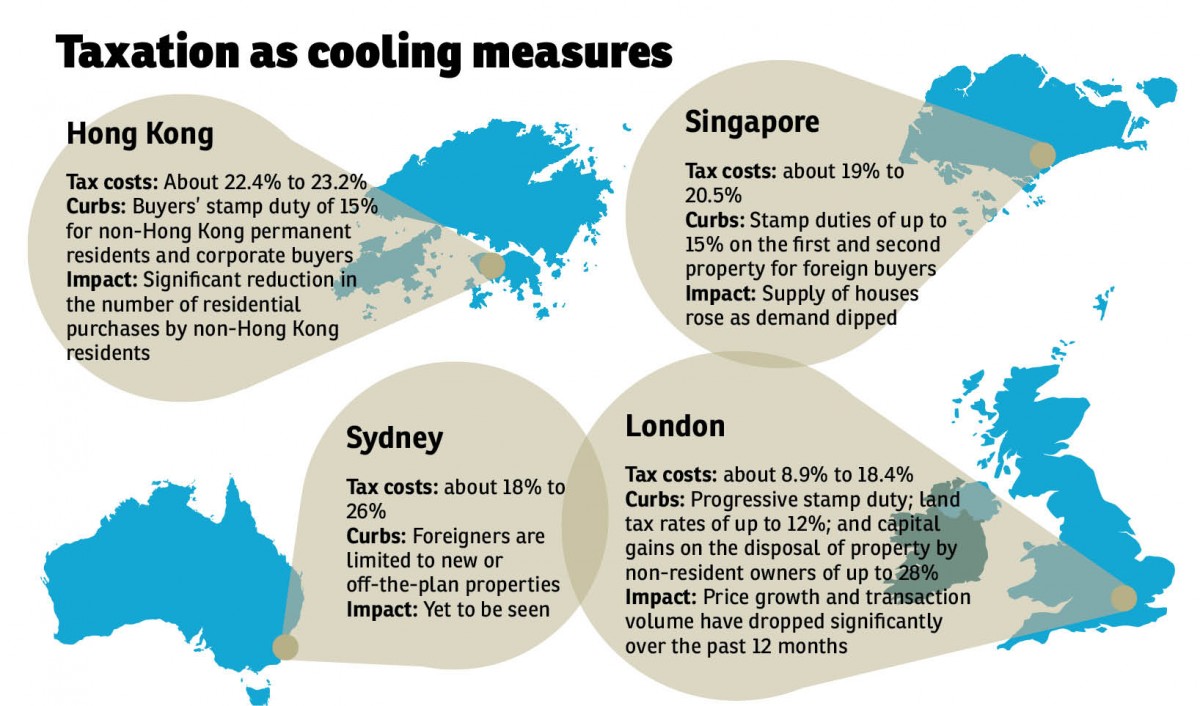

Knight Frank Global head of research Liam Bailey said in the report, policymakers in many markets have used tax as a macro-prudential measure to slow down booming markets and address domestic issues of affordability.

“Singapore and Hong Kong have been high-profile advocates of macro-prudential measures aimed at reducing speculative interest. Australia has seen a number of reforms in recent months, the UK has seen considerable reform to prime property taxation, and even Dubai, a famously low tax jurisdiction, has seen an increase in purchase costs in recent years,” he said.

The findings also showed that taxation is seen to be an effective cooling measure in curbing speculation, especially in Asian markets.

“Singapore and Hong Kong, as examples, have seen more muted price growth. Prime prices in Singapore dipped 8% in the year to September 2015, whilst annual growth slowed to 2% in Hong Kong,” Bailey added.

He noted that Sydney and Shanghai are the only two cities to have recorded double-digit price rises in 2015.

“The weak Australian dollar and a strong local economy are behind Sydney’s accelerating prices, whilst in Shanghai the reversal of strict housing policies, as well as tax and interest rate cuts, have fuelled demand,” according to Bailey.

Besides market conditions, currency, management and liquidity costs and risks, Ernst & Young global private client leader Marnix Van Rij advised investors to understand the tax implications of cross-border property investments in making their investment decisions.

Malaysia

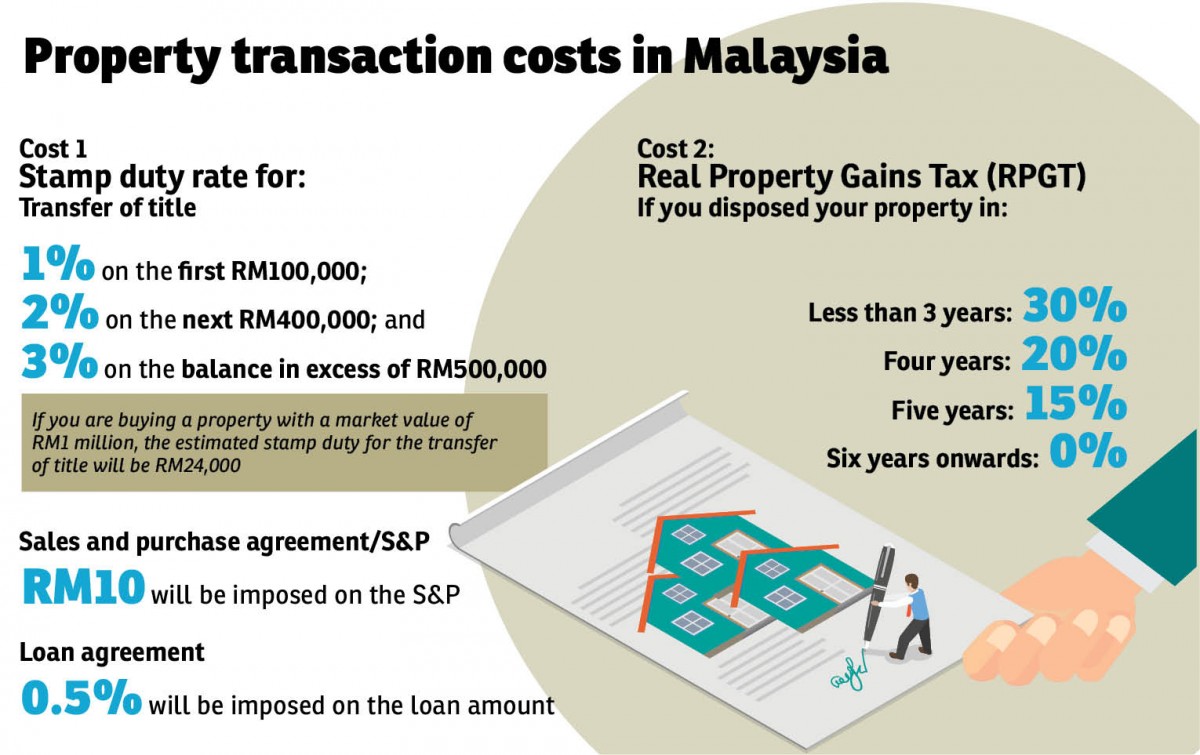

The report did not include Malaysia. However, Ernst & Young Tax Consultants Sdn Bhd partner Farah Rosley said the cost of property transactions in Malaysia includes stamp duty for the transfer of title and loan agreements as well as the Real Property Gains Tax (RPGT).

She noted that buyers will be subject to an ad-valorem stamp duty (1% to 3%) on the selling price or the market value of the property, whichever is higher. In addition, there will be a nominal stamp duty imposed on the sale and purchase agreement.

On the loan agreement, there will be another 0.5% in stamp duty to be imposed on the loan amount.

Meanwhile, RPGT will be imposed on the seller on the chargeable gains arising from the disposal of the property. RPGT rates for the property disposal within three years after the date of acquisition is 30%; the rate will be reduced to 20% and 15% in the fourth and fifth year, respectively,” she explained.

For sellers who sell their property in the sixth year, there will be no RPGT charge.

Other than RPGT, if the buyer is buying commercial-titled property, he or she will be charged 6% Goods and Services Tax (GST).

“The above costs are all tax costs in relation to the acquisition of property. We have not taken into account other non-tax costs such as legal fees, valuation fees and agent’s fee,” Rosley added.

This story first appeared in TheEdgeProperty.com pullout on May 20, 2016, which comes with The Edge Financial Daily every Friday. Download TheEdgeProperty.com here for free.

TOP PICKS BY EDGEPROP

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor