LBS Bina Group Bhd (Feb 26, RM1.35)

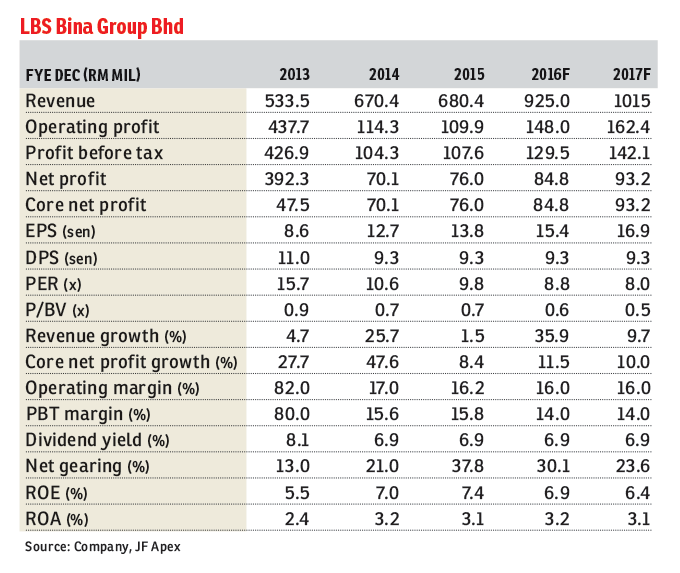

Maintain buy with an unchanged target price of RM1.70: LBS Bina Group Bhd (LBS) recorded a fourth quarter ended Dec 31, 2015 (4QFY15) bottom line of RM23 million, up 16.8% quarter-on-quarter (q-o-q), but marginally down 2.1% year-on-year (y-o-y) on the back of a higher top line, +39.1% q-o-q and +11.2% y-o-y.

For financial year ended Dec 31, 2015 (FY15), LBS chalked up a net profit of RM76 million (+8.4% y-o-y), which is in line with our full-year estimate of RM74.8 million.

On a q-o-q basis, LBS posted a better net profit backed by higher progress billings as more houses were handed over to buyers and higher product margin. However, on a y-o-y basis, the group’s net earnings were slightly lower, affected by a higher effective tax rate despite achieving higher revenue and profit before tax. For FY15, LBS achieved better results attributable to higher revenue and lower financing cost incurred.

LBS achieved stellar new sales of slightly more than RM1 billion in 2015, 60% higher than RM645 million recorded in 2014. The majority of sales, about 85% of sales value, was derived from Bandar Saujana Putra (BSP) and D’Island in the Klang Valley. Moving forward, the group is striving to achieve RM1.2 billion new sales in 2016 amid the challenging property outlook.

In tandem with the rising new sales, the group’s unbilled sales also surged strongly to RM1.1 billion as of end-January 2016, which could sustain its future earnings to one and a half years, that is equivalent to 1.6 times 2015’s top line.

For 2016, LBS plans to launch RM1.7 billion gross development value (GDV) of projects with 82% of sales value concentrated in the Klang Valley. List of launches are: i) BSP in Southern Klang Valley — serviced apartments with a total GDV of RM385 million; ii) D’Island Residence in Southern Puchong — two-storey semi-D, superlink and serviced apartments with a total GDV of RM498 million; iii) Desiran Bayu, Puchong — two-storey cluster link and semi-D (bumi lots) with a GDV of RM157 million; iv) Telok Gong, Klang — industrial factories with a GDV of RM125 million; v) Bukit Jalil — serviced apartments (PPA1M) with a GDV of RM209 million; vi) Bandar Putera Indah, Batu Pahat — terraced homes and semi-D with a total GDV of RM86 million; vii) Golden Hills and Centrum, Cameron Highlands — terraced homes and shop lots with total GDV of RM93 million; and viii) Midhills, Gohtong Jaya, Pahang — serviced apartments with GDV of RM137 million.

We learnt that the group is looking out to expand its land bank in the Klang Valley, aiming for sizeable acreage for future township development as its existing BSP township comes into maturity. To date, LBS has an undeveloped land bank of 2,658 acres (1,076ha), rendering a potential GDV of RM22 billion.

No change to our earnings forecast for 2016: RM84.8 million (+11.5% y-o-y) and 2017: RM93.2 million (+10.0% y-o-y). These are premised on our respective new sales assumption of RM1 billion and RM1.2 billion for 2016 and 2017.

Maintain “buy” on LBS with an unchanged TP of RM1.70. However, we have fine-tuned our revalued net asset valuation (RNAV) after updating the projects’ GDV, unbilled sales, net debt, China assets, and including newly issued Warrant B. Our TP is now based on 45% discount (previously 60% discount) to our revised fully-diluted RNAV/share of RM3.11 (previously RM4.24). Our fair value for LBS implies 14 times 2016 forecast fully-diluted earnings per share of 12 sen.

We favour LBS for its: i) resilient sales and clear earnings visibility; ii) diversified product offerings and geographical exposures (mid- to high-end property across the Klang Valley, Pahang, Johor, Sabah); iii) attractive dividend yield of 6.9%; iv) sturdy balance sheet with current low net gearing of 0.2 times; and v) unlocking the potential land bank values in Zhuhai International Circuit (ZIC) following the signing of a memorandum of understanding between LBS and JiuZhou Group Holdings Ltd on the upgrading of ZIC. — JF Apex Securities, Feb 26

This article first appeared in The Edge Financial Daily, on Feb 29, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Country Heights Kajang

Country Heights, Selangor

Country Heights Kajang

Country Heights, Selangor