Matrix Concepts Holdings Bhd (Nov 18, RM2.43)

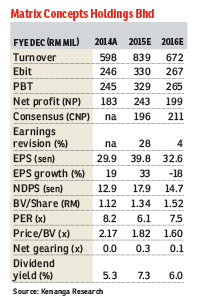

Maintain market perform with an unchanged target price (TP) of RM2.46: Matrix Concepts Holdings Bhd’s nine months ending Sept 30, 2015 (9MFY15) net profit of RM176.4 million accounts for 93% and 90% of our and consensus full-year estimates, respectively.

We deem the performance as broadly within both our and consensus expectations as we are expecting a weaker fourth quarter ending Dec 31, 2015 (4QFY15), given that Matrix has enjoyed the accelerated recognition of its ongoing residential and industrial projects prior to the implementation of the goods and services tax (GST). In terms of sales, Matrix has performed exceptionally well, recording total sales of RM612 million for 9MFY15, which accounted for 98% of our total estimates of RM625 million.

On a separate note, Matrix announced that it is changing its financial year end from December 2015 to March 2016. A third interim dividend of 3.5 sen was declared, as expected. Year-on-year, 9MFY15 net profit of RM176.4 million grew 40% due to the strong growth in revenue of 25%, mainly due to accelerated recognition of its ongoing residential and industrial properties (the latter generally commands superior margins versus residential and commercial properties) prior to the GST implementation. The recognition of its industrial properties also lifted its earnings before interest, taxes, depreciation and amortisation margin by 7 percentage points to 58%.

Quarter-on-quarter, 3QFY15 net profit of RM31.1 million still saw a marginal growth of 4% mainly due to a lower effective tax rate of 23% registered in 3QFY15 vis-à-vis 28% in 2QFY15.

Quarter-on-quarter, 3QFY15 net profit of RM31.1 million still saw a marginal growth of 4% mainly due to a lower effective tax rate of 23% registered in 3QFY15 vis-à-vis 28% in 2QFY15.

Its unbilled sales remain healthy at RM640.5 million, sufficient to sustain the group for another one to one and a half years, and we remain positive on Matrix’s outlook, which is underpinned by strong demand for affordable housing within the Greater Klang Valley.

Following the change in financial year end, we adjusted our FY15E (estimate) sales and earnings higher to RM854 million and RM243 million, factoring in 15 months of financial reporting.

We are reiterating our “market perform” call on Matrix with an unchanged TP of RM2.46 with a discount of 30% to its forward revised net asset value of RM3.51. Our TP of RM2.46 implies FY16E price-earnings ratio of 7.5 times, which is still below its peers’ average of 8.4 times. — Kenanga Research, Nov 18

This article first appeared in The Edge Financial Daily, on Nov 19, 2015. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Kawasan Perindustrian MIEL

Batang Kali, Selangor

Livia @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Robin @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Chimes @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur