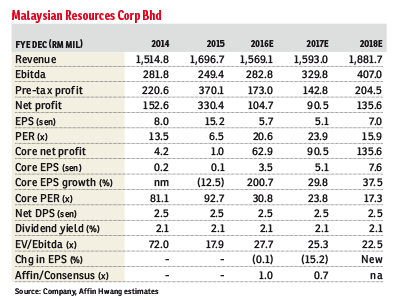

Malaysian Resources Corp Bhd (Feb 23, RM1.19)

Maintain buy with a lower target price (TP) of RM1.46: Malaysian Resources Corp Bhd’s (MRCB) net profit more than doubled to RM330 million in the financial year ended Dec 31, 2015 (FY15), due to gain on disposal of investment properties. Core net profit of RM1 million was below expectations, due to high financing and operating costs. We cut our FY16 estimate earnings by 15% to reflect the higher costs and delays in new property launches. Its strong pipeline of projects will drive long-term earnings growth. We reiterate our “buy” call on MRCB, with a reduced TP of RM1.46, based on a 20% discount to revalued net asset valuation (RNAV).

MRCB’s core net profit of RM1 million was below the consensus forecast of RM60 million and our estimate of RM54 million. We were surprised by the high financing and operating costs. MRCB incurred a core net loss of RM38.6 million in the fourth quarter ended Dec 31, 2015 (4QFY15), due to preliminary project costs for its construction division (RM15 million) and high financing costs. But an RM70 million gain from the sale of its 51% stake in Nu Sentral Mall and write-back of deferred tax led to a net profit of RM26.8 million for 4QFY15.

MRCB reaped one-off gains of RM329.4 million from the sale of Platinum Sentral (RM220.5 million), Paradigma Berkat Sdn Bhd (RM38.8 millon) and Nu Sentral Mall (RM70.1 million). It has agreed to sell its Shell Tower to MRCB-Quill REIT for RM640 million and stands to reap an estimated gain of RM76 million (not factored into our forecasts).

Besides the proposed sale of Shell Tower, MRCB is close to completing the sale of Sooka Sentral for RM90.8 million (RM38 million gain) and its 40% stake in Ekovest-MRCB Construction Sdn Bhd for RM8.5 million (RM3.8 million gain) in 2016. This is reflected in our FY16 estimated earnings. MRCB is targeting property sales of RM1 billion in FY16, with the launch of The Grid, 3 Residences and Semarak City  new projects.

new projects.

MRCB has a record construction order book of RM4.59 billion after securing major projects, such as the Klang Valley Light Rail Transit Line 3, KL Sports City, Kwasa Utama C8, and Cardiac and Vascular Medical Centre projects in 2015. Property sales of RM597 million in FY15 were lower than the RM1.08 billion achieved in FY14, due to delays in new property project launches, ie The Grid, 3 Residences and Semarak City.

The proposed private placement of up to 20% of its share capital is expected to be completed in 2QFY16.

We reduce our TP to RM1.46 from RM1.60 to reflect lower valuations of its concession and asset disposals in our RNAV estimates. We maintain “buy”. A key risk is further property launch delays. — Affin Hwang Capital, Feb 23

This article first appeared in The Edge Financial Daily, on Feb 24, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Razak City Residences

Salak Selatan, Kuala Lumpur

Taman Tasik Semenyih (Lake Residence)

Semenyih, Selangor

Taman Tasik Semenyih (Lake Residence)

Semenyih, Selangor

Taman Tasik Semenyih (Lake Residence)

Semenyih, Selangor

Suadamai, Bandar Tun Hussein Onn

Cheras, Selangor

Suadamai, Bandar Tun Hussein Onn

Cheras, Selangor

RIMBUN KIARA @ SEREMBAN 2

Seremban, Negeri Sembilan

D'Summit Residences @ Kempas Utama

Johor Bahru, Johor

Biji Living (Seventeen Residences)

Petaling Jaya, Selangor

Ryan & Miho @ Section 13

Petaling Jaya, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)