THE office markets in Kuala Lumpur and Beyond Kuala Lumpur (Selangor) remained firm in 2Q despite completions with a total NLA of 1.13 million sq ft, according to the digitaledge/Knight Frank Klang Valley Office Monitor 2Q2015.

“The market remains challenging. Having said that, there are companies looking for opportunities... following the depreciation of the ringgit. These companies are exploring consolidation as well as asset acquisition,” says Knight Frank Malaysia managing director Sarkunan Subramaniam.

The review period saw the completion of Naza Tower (NLA: 506,000 sq ft), Crest Jalan Sultan Ismail (NLA: 190,000 sq ft) and Menara Centara (NLA: 166,000 sq ft), bringing the cumulative supply of office space in Kuala Lumpur City to about 49.82 million sq ft. There were no completions in KL Fringe, so its cumulative supply remained at 21.72 million sq ft.

The cumulative supply of office space Beyond Kuala Lumpur (Selangor) was recorded at 17.73 million sq ft following the completion of Top Glove Tower (NLA: 267,000 sq ft), a Grade A office building in Shah Alam.

As at 2Q, the total cumulative supply of purpose-built office space in both Kuala Lumpur and Beyond stood at 89.21 million sq ft, and is expected to grow by about 4.8% to 93.53 million sq ft by the end of 2015.

“With prolonged political uncertainties in the country, market sentiment and confidence remain weak and low. Potential investors and companies who have plans to invest in the country or to expand their work space are likely to adopt a wait-and-see attitude before committing,” says Sarkunan.

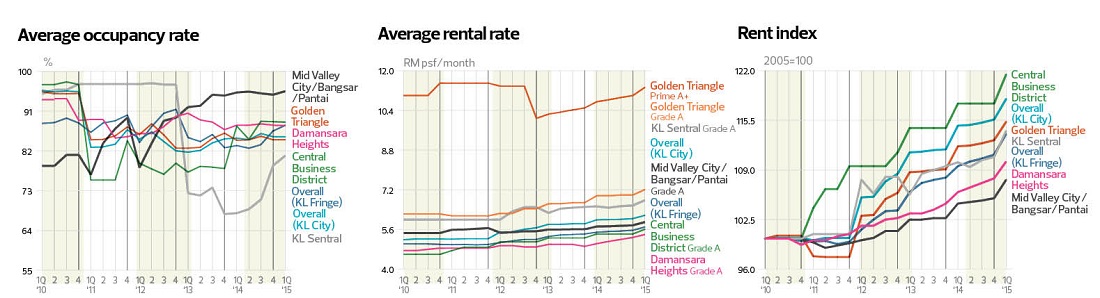

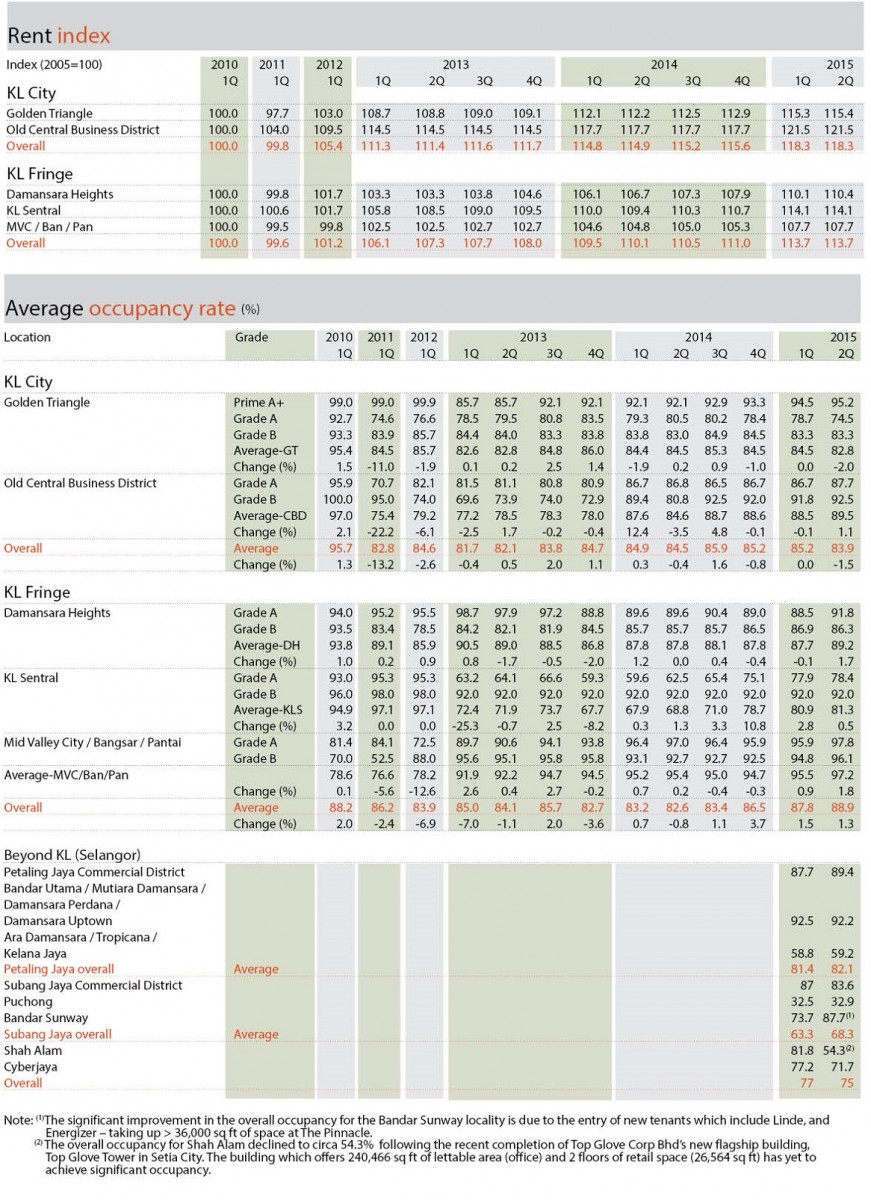

According to the monitor, the overall occupancy rate in KL City dipped 1.5% quarter-on-quarter (q-o-q) to 83.9% due to the newly completed Naza Tower. The average occupancy rate dropped 2.6% q-o-q to 75%.

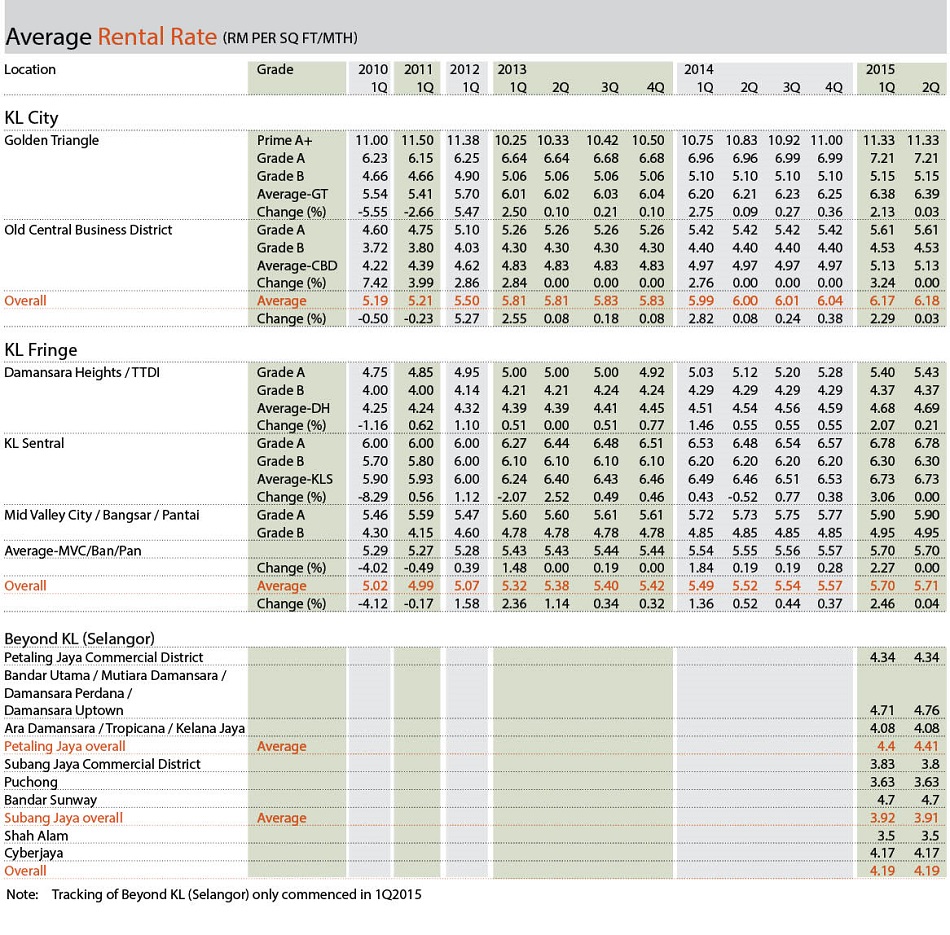

The review period saw the average rental rate in both KL City and KL Fringe improve marginally to RM6.18 and RM5.71 psf respectively. Beyond Kuala Lumpur, the average rental rate remained stable with no change at RM4.19 psf.

“Interest level in the oil and gas (O&G) segment has declined significantly following the plunge in crude oil prices, which has consumed their earnings, with some already undertaking [cost] cutting measures,” adds Sarkunan.

The quarter saw net absorption in Kuala Lumpur of about 315,596 sq ft, which was a sharp increase of 89.2% q-o-q but a decline of 50.78% y-o-y. For Beyond Kuala Lumpur, net absorption was recorded at 69,371 sq ft.

As for the outlook for 3Q, overall occupancy and rental levels are expected to drop due to the high level of incoming supply, particularly in 2H when about 4.3 million sq ft of office space is expected to be completed) together with the effect of the Goods and Services Tax and challenging office sentiment.

“Moving forward, market sentiment may remain weak due to a slowing economy, further depreciation of the local currency and political uncertainties, among other reasons,” he says.

Nonetheless, the investment market is expected to remain active. With several good grade buildings in the market for sale, offering yields of 5% to 6%, and the weak ringgit, there are opportunities for funds and investors, both local and foreign.

“[However], there will be fewer leasing enquiries in general as the market awaits closure in response to the current political concerns that are affecting confidence levels and market outlook. Still, with cost-cutting measures by O&G companies, and fewer contracts in general, there will be more work space available for subletting,” says Sarkunan.

“[However], there will be fewer leasing enquiries in general as the market awaits closure in response to the current political concerns that are affecting confidence levels and market outlook. Still, with cost-cutting measures by O&G companies, and fewer contracts in general, there will be more work space available for subletting,” says Sarkunan.

There will also be more pressure on occupancy levels due to more impending completions, he adds.

Meanwhile, rental rates for well-located good grade offices “are expected to hold firm in the short term”, and landlords of newly completed buildings with none or limited pre-leasing commitments are expected to offer more incentives to attract tenants in a highly competitive market.

Steady rents amid lower occupancy

Overall rental rates in Kuala Lumpur remained steady despite the weakening market and poor sentiments. Grade A rents in KL City — Golden Triangle (GT) Prime A+ (RM11.33 psf), GT Grade A (RM7.21 psf) and central business district (CBD) Grade A — were unchanged from the previous quarter.

Concurrently, Grade A rental rates in KL Fringe remained unchanged for the most part. KL Sentral (KLS) Grade A and Mid Valley City/Bangsar/Pantai Grade A were at RM6.68 psf and RM5.90 psf, respectively. Still, there was a 0.56% increase to RM5.43 psf from the last quarter for Damansara Heights (DH).

The average rental rate for Beyond Kuala Lumpur in 2Q was RM4.19 psf q-o-q. Likewise, rental rates for Petaling Jaya (RM4.41 psf), Subang Jaya (RM3.91 psf), Shah Alam (RM3.50 psf) and Cyberjaya (RM4.17 psf) were more or less the same as in the last quarter.

“For 2Q, there were marginal movements in the average rental rate and occupancy level in KL City, KL Fringe and Beyond KL,” says Sarkunan.

Meanwhile, the overall occupancy rate in Kuala Lumpur dipped from the last quarter, to 83.9% from 85.2%. “Naza Tower, with 506,000 sq ft NLA, has yet to achieve significant occupancy,” he notes. The average CBD occupancy has risen to 89.5% from 88.5% in the previous quarter. The GT recorded a 2% decline, from 84.5% to 82.8%.

Nonetheless, the occupancy rate in KL Fringe improved across all its categories, with the overall average up by 1.3% to 88.9%. KL Fringe covers Damansara Heights, KL Sentral, and Mid Valley City/Bangsar/Pantai, where occupancy has increased by 1.7%, 0.5%, and 1.8%, respectively. “The decentralisation trend continues,” says Sarkunan. “There were notable movements and expansions in selected office buildings in these locations. For example, in KL Sentral, space committed during the review period totalled about 92,000 sq ft, including Menara Allianz Sentral, Nu Tower 2 and One Sentral.”

For Beyond KL, the overall occupancy rate declined to 75% from 77% in the first quarter.

Petaling Jaya has recorded 82.1%, thanks to the rising Petaling Jaya commercial district (89.4%) and Ara/Damansara/Tropicana/Kelana Jaya (59.2%), and stability in Bandar Utama/Mutiara Damansara/Damansara Perdana/Damansara Uptown (92.2%). Subang Jaya saw an overall increase to 68.3% from the previous quarter, with Subang Jaya commercial district, Puchong and Bandar Sunway recording 83.6%, 32.9% and 87.7%, respectively.

However, there was a considerable decline in occupancy levels in Shah Alam, dropping from 81.8% to 54.3%. The decline followed the recent completion of Top Glove Corp Bhd’s new flagship building, Top Glove Tower in Setia City. The building, which offers 240,466 sq ft of lettable area (office) and two floors of retail space (26,564 sq ft) has yet to achieve significant occupancy.

“Generally, Shah Alam is not a well-established office location compared with Petaling Jaya, Subang Jaya and Bandar Sunway. Unlike Shah Alam, these vibrant commercial locations and established townships are well populated and enjoy good connectivity and accessibility — these areas also have public transport links such as the LRT (existing and extensions), KTM Komuter and BRT. These factors are important for staff recruitment and rentention,” says Sarkunan.

“Lesser-known office areas such as Shah Alam and Puchong attract different classes of tenants. This is due to location, accessibility, connectivity, office grade and so on,” he adds. Cyberjaya also experienced a decline, from 77.2% in the last quarter to 71.7% in 2Q.

Noteworthy transactions and movements

In 2Q, there were three noteworthy transactions — Menara Raja Laut (NLA: 397,939 sq ft) in Kuala Lumpur for RM553 psf, Wisma AmanahRaya (NLA: 153,908 sq ft) in Kuala Lumpur for RM507 psf, and 22 storeys of stratified parcels within Iconic Office (Block N), Empire City @ Damansara (NLA: 238,932 sq ft) in Petaling Jaya for RM650 psf.

In addition, there were a few notable movements in 2Q. In KL City, they were at Menara Binjai, Cap Square Tower and Naza Tower among others. In KL Fringe, there were movements in Sunway Tower, Menara Allianz Sentral, Nu Tower 2 and One Sentral. In Beyond KL, movements were recorded in Prima 6 in Cyberjaya and The Pinnacle in Sunway.

BAE Systems Detica (M) Sdn Bhd will expand its office in Menara Binjai to 11,200 sq ft, while Tenaga Nasional Bhd will expand its office in Nu Tower 2 by 28,000 sq ft. However, Ranhill Worley Parsons is looking to downsize its office in Sunway Tower by 38,000 sq ft.

In terms of new tenancy, Nettium Sdn Bhd will take up 11,200 sq ft in CapSquare Tower, while Naza Group will take up 25,000 sq ft in Naza Tower. Danajamin Nasional Bhd will take up 24,000 sq ft in Menara Allianz Sentral and Nu Tower 2, while Pelaburan Mara Bhd will take up 40,000 sq ft in 1 Sentral. Ansell Malaysia Sdn Bhd is set to take up 47,000 sq ft in Prima 6, while Linde, Energizer and a few others are set to take up 36,000 sq ft in The Pinnacle.

Notable announcements

Hong Leong Bank Bhd is disposing of a freehold, 27-storey office building in Jalan Raja Laut, Kuala Lumpur, to Hong Leong Assurance Bhd for RM220 million (about RM552.85 psf on NLA). The property is part of the assets and liabilities of the former EON Bank Bhd that were vested in HLB in July 2011, in light of the EON Bank takeover.

Meanwhile, e-government services provider M.Y. EG Services Bhd (MyEG) plans to borrow RM108.74 million to acquire part of an office tower at Empire City, Damansara Perdana, Petaling Jaya. It has proposed to acquire 22 storeys of a 35-office tower known as Iconic Office at Block N for RM155.35 million (or RM650 psf on lettable area), that is expected to be built by December 2015.

Goldis Bhd is putting its nine-year-old GTower on the market for RM1.2 billion. GTower is an integrated building with 1.4 million sq ft in gross built-up and 820,000 sq ft of NLA. It is Malaysia’s first green commercial building and was awarded Singapore’s Building and Construction Authority Green Mark Gold Standard certification.

Meanwhile, South Korea-based Hana Daol Fund Management is in the process of finalising the sale of Nu Tower 1 in KL Sentral to the Malaysian Communications and Multimedia Commission (MCMC) for over RM200 million. The Nu Tower 1 and Nu Tower 2 are part of the Lot G offices and hotel jointly developed by Aseana Investment Ltd — an associate of Ireka Corp — and Malaysian Resources Corp Bhd, the master developer of KL Sentral.

Over at the international financial district, Tun Razak Exchange (TRX), Indonesia’s leading property developer Mulia Group is planning to develop the landmark Signature Tower. The developer has entered into a sale and purchase agreement for the development rights of the plot with 1MDB Real Estate Sdn Bhd, the master developer of TRX, for RM665 million. The tower is poised to be a Prime Grade A office in Kuala Lumpur.

In Brickfields, Seni Nadi Land Sdn Bhd will undertake the development of two parcels of land worth an estimated RM2 billion where the former Brickfields district police headquarters and barracks were located. Seni Nadi, through Senibina Sentral Sdn Bhd, plans to build two Grade A buildings on the 107,865 sq ft site.

It is also likely that the other parcel (measuring 101,669 sq ft) will comprise a 31-storey office block (first phase) and a 24-storey office block (second phase) atop a seven storey podium with parking bays and one floor of retail space.

The Federal Land Consolidation and Rehabilitation Authority’s (Felcra) Menara Felcra project, meanwhile, on a 4.26-acre site in Jalan Semarak, will comprise a 35-storey office tower that will serve as the authority’s new headquarters, a 43-storey residential tower, a retail mall, and an auditorium and a banquet hall. Part of the office will be leased out, while 12 floors will be occupied by Felcra.

In Petaling Jaya, food and beverage company Fraser and Neave Holdings Bhd is poised to launch Fraser Square, a RM2 billion integrated project at Section 13, by 2Q2016. It is a joint venture with Singapore-based Frasers Centrepoint Ltd. Fraser Square is set to be developed over five phases and will comprise 900 serviced apartments on top of a shopping mall, small offices/home offices (SoHo), and corporate office and hotel components.

Top Glove unveiled its 23-storey Top Glove Tower in Setia City, Shah Alam. In addition to 14 floors of office space, the building also offers 26,564 sq ft of retail space over two floors and another seven floors of parking space. The total cost of the land and building is RM141 million. The company will occupy two floors while the rest of the floors will be leased out.

This article first appeared in property, a section of the digitaledge WEEKLY, on Sept 21, 2015. Subscribe here.

TOP PICKS BY EDGEPROP

Livia @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Chimes @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Robin @ Bandar Rimbayu

Telok Panglima Garang, Selangor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor