Pavilion Real Estate Investment Trust (Sept 18, RM1.55)

Maintain hold with an unchanged target price of RM1.50: Pavilion Real Estate Investment Trust (Pavilion REIT) announced that it had entered into a conditional sale and purchase agreement with Equine Park Country Resort Sdn Bhd and Revenue Concept Sdn Bhd for the acquisition of da:men USJ, a five-storey shopping mall with a lower ground floor of approximately 420,920 sq ft of net lettable area and two levels of basement car parks with 1,672 bays. The property sits on a piece of freehold land in Petaling Jaya, Selangor, measuring approximately 3.499ha.

The property is strategically located in Jalan Kewajipan, within the thriving locality of USJ 1, Subang Jaya, and broadly sandwiched between two major highways, namely the Shah Alam Expressway to its north and the Damansara–Puchong Expressway to its south.

It is part of an integrated commercial development comprising the shopping mall, 41 units of contemporary shops and offices, as well as 480 units of apartments housed in two tower blocks with six levels of podium car parks.

The property is expected to commence operations in November, with a trade mix of food and beverage, beauty and fashion. Among the major tenants expected in the mall are Jaya Grocer, Popular Bookstore and Royal Sporting House.

The proposed acquisition is expected to be completed by the first quarter of 2016. It will be fully funded via debt, increasing Pavilion REIT’s gearing ratio from 15% as at June 30 to 23%, which is below its gearing limit of 50%.

We are positive on the proposed acquisition as we expect it to be accretive to Pavilion REIT’s distributable income as the property is surrounded by established neighbourhoods, a ready captive market with a local population currently dominated by the middle-income group, besides being easily accessible via various major highways.

While earnings contributions are uncertain for now, we note that it is likely to be valued at a cap rate of 6.5%, which implies a potential 10% to 11% earnings bump.

The proposed acquisition will enlarge Pavilion REIT’s portfolio of investment properties from RM4.4 billion as at June 30 to RM4.9 billion, as well as provide geographical diversification to Pavilion REIT’s portfolio.

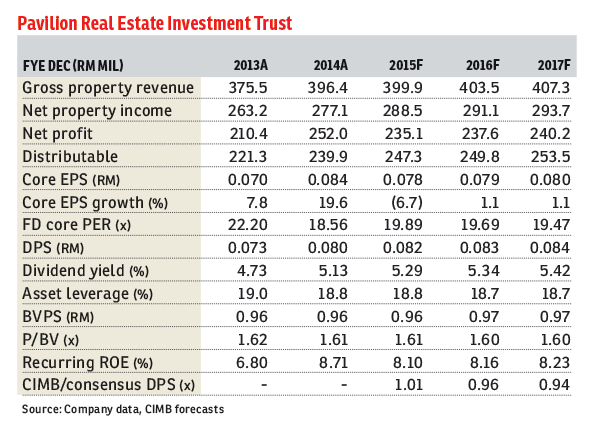

As the acquisition will be 100% funded by debt, we expect the acquisition of da:men USJ to be yield-accretive. Assuming a 6.5% cap rate, we estimate that the acquisition will enhance Pavilion REIT’s earnings per unit (EPU) by 0.3 sen, a 3.8% increment over our pre-acquisition EPU forecast. — CIMB Research, Sept 18

This article first appeared in the digitaledge DAILY on Sept 21, 2015. Subscribe here.

TOP PICKS BY EDGEPROP

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Bandar Rimbayu

Telok Panglima Garang, Selangor

Ridgewood Canary Garden @ Bandar Bestari

Klang, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)