Pavilion Real Estate Investment Trust (Dec 29, RM1.53)

Pavilion Real Estate Investment Trust (Dec 29, RM1.53)

Maintain buy with a target price of RM1.88: Over the past month, we conducted surveys at Pavilion Kuala Lumpur (Pavilion KL) in order to gauge consumer sentiment in the all-important holiday season.

Our take on the shopping atmosphere was a little subdued initially, but it gradually picked up towards the middle of this month as Christmas approached.

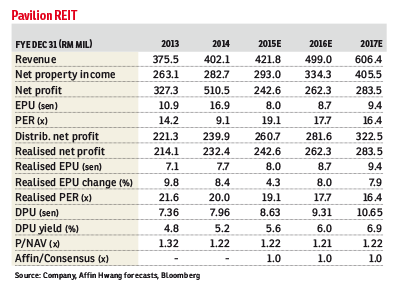

We cross-checked our findings with the management, and believe that Pavilion Real Estate Investment Trust (Pavilion REIT) can achieve a 3% to 4% year-on-year (y-o-y) growth in retail spending for 2015, given the anticipation of a robust fourth quarter (4Q15).

Our channel checks also showed that some neighbouring malls saw a decline in annual retail spending instead.

Pavilion REIT will see 68% (906,180 sq ft) of its net lettable area of 1.3 million sq ft at Pavilion KL expiring in 2016.

While the average rental reversion was 9% in 2014 and stood at mid-single digits as at end-November, we believe the upcoming reversion of 68% of lettable space will be much higher, at least by 13% to 15%.

This is due to the nature of the renewing tenants, whose cash flows are more stable, driven by proven track records at Pavilion KL (since opening in September 2007) and established brands.

This is due to the nature of the renewing tenants, whose cash flows are more stable, driven by proven track records at Pavilion KL (since opening in September 2007) and established brands.

Consumer spending remains intact, despite cautious sentiment. In our view, 2016 may not necessarily be a year which will see consumers pulling back sharply on spending at Pavilion KL, as the mall caters to the middle and upper-middle classes of society.

This is also based on our strategist’s view on Malaysia’s private consumption growth, whereby the more significant moderation in growth rates to 4.1% y-o-y in 3Q15 was likely to be temporary, attributable to weakness of the ringgit.

We reaffirm our rating based on: i) an 8.14% cost of equity; ii) a 6% equity risk premium; and iii) a 3% terminal growth rate. Key risks include a slowdown in the high-end retail market, negative effects of imported inflation and competition from upcoming retail space supply. — Affin Hwang Capital, Dec 29

This article first appeared in The Edge Financial Daily, on Dec 30, 2015. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Royal Strand @ Country Garden Danga Bay

Johor Bahru, Johor

Kawasan Perindustrian Balakong

Balakong, Selangor

Kawasan Perindustrian Balakong

Balakong, Selangor

Kawasan Perindustrian Kajang Jaya

Semeyih, Selangor

Balakong Jaya Industrial Park

Balakong, Selangor