PENANG’S property market remains subdued in 2Q2015 with the average values in several locations and of property types staying flat, according to The Edge/Raine & Horne International Zaki+Partners Penang Housing Monitor 2Q2015.

“One of the factors that have contributed to lack of [transaction] activity is that no advertising and developers’ licences have been forthcoming,” says Raine & Horne International Zaki+Partners Sdn Bhd senior partner Michael Geh (pictured, right).

“Demand is there, but developers cannot sell. So, it has taken a toll on our statistics.”

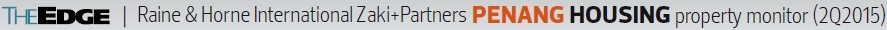

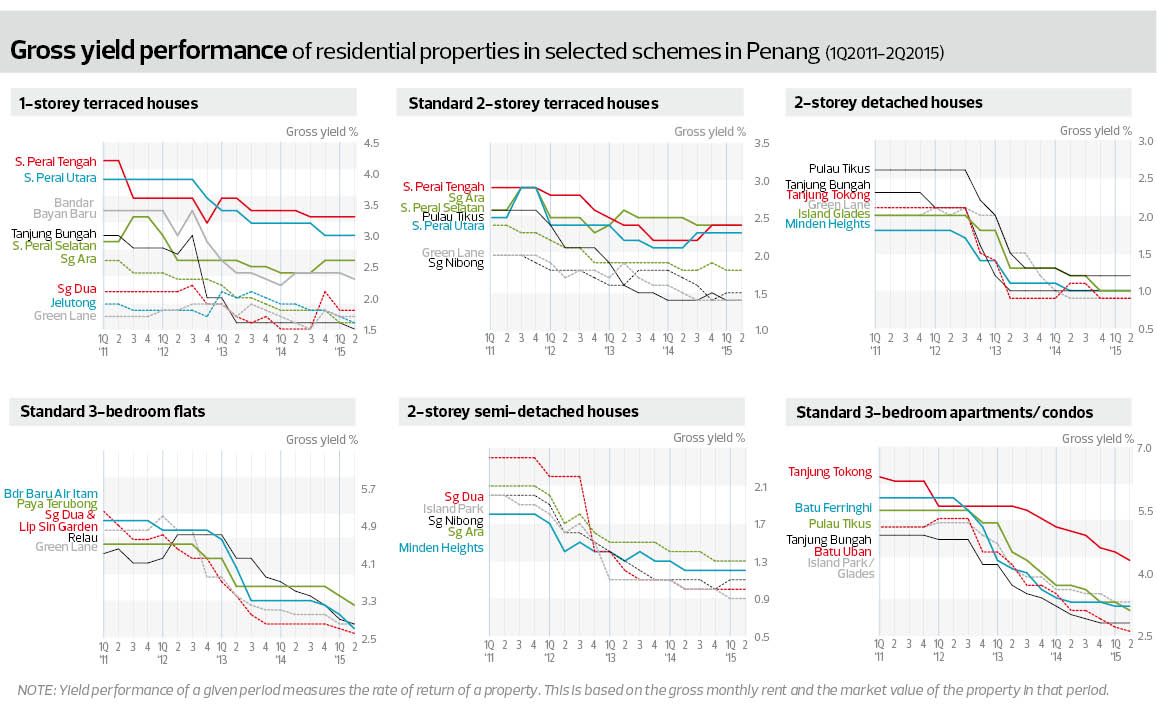

Only 1-storey homes, standard 3-bedroom flats (700 to 750 sq ft) and standard 3-bedroom apartments/condominiums (over 900 sq ft) in selected areas showed price growth during the period.

Only 1-storey homes, standard 3-bedroom flats (700 to 750 sq ft) and standard 3-bedroom apartments/condominiums (over 900 sq ft) in selected areas showed price growth during the period.

One-storey homes that showed capital appreciation were in Jelutong (+5.88% to RM900,000), Sungai Dua (+2.56% to RM800,000), Bandar Bayan Baru (+1.96% to RM520,000) and Tanjung Bungah (+2.63% to RM780,000).

Also seeing growth were standard 3-bedroom flats in Bandar Baru Air Itam (+10% to RM220,000), Paya Terubong (+6.25% to RM170,000), Relau (+3.45% to RM300,000), and Sungai Dua and Lip Sin (+6.06% to RM350,000).

Last but not least, only standard 3-bedroom apartments/condos in three areas saw growth — Tanjung Tokong (+4.83% to RM650,000), Pulau Tikus (+4.83% to RM650,000) and Batu Uban (+5% to RM420,000).

It is worth noting that properties in some areas have not seen growth in value for at least two consecutive quarters. For 1-storey terraced houses, these included Green Lane, Sungai Ara, Seberang Perai Utara, Seberang Perai Tengah and Seberang Perai Selatan.

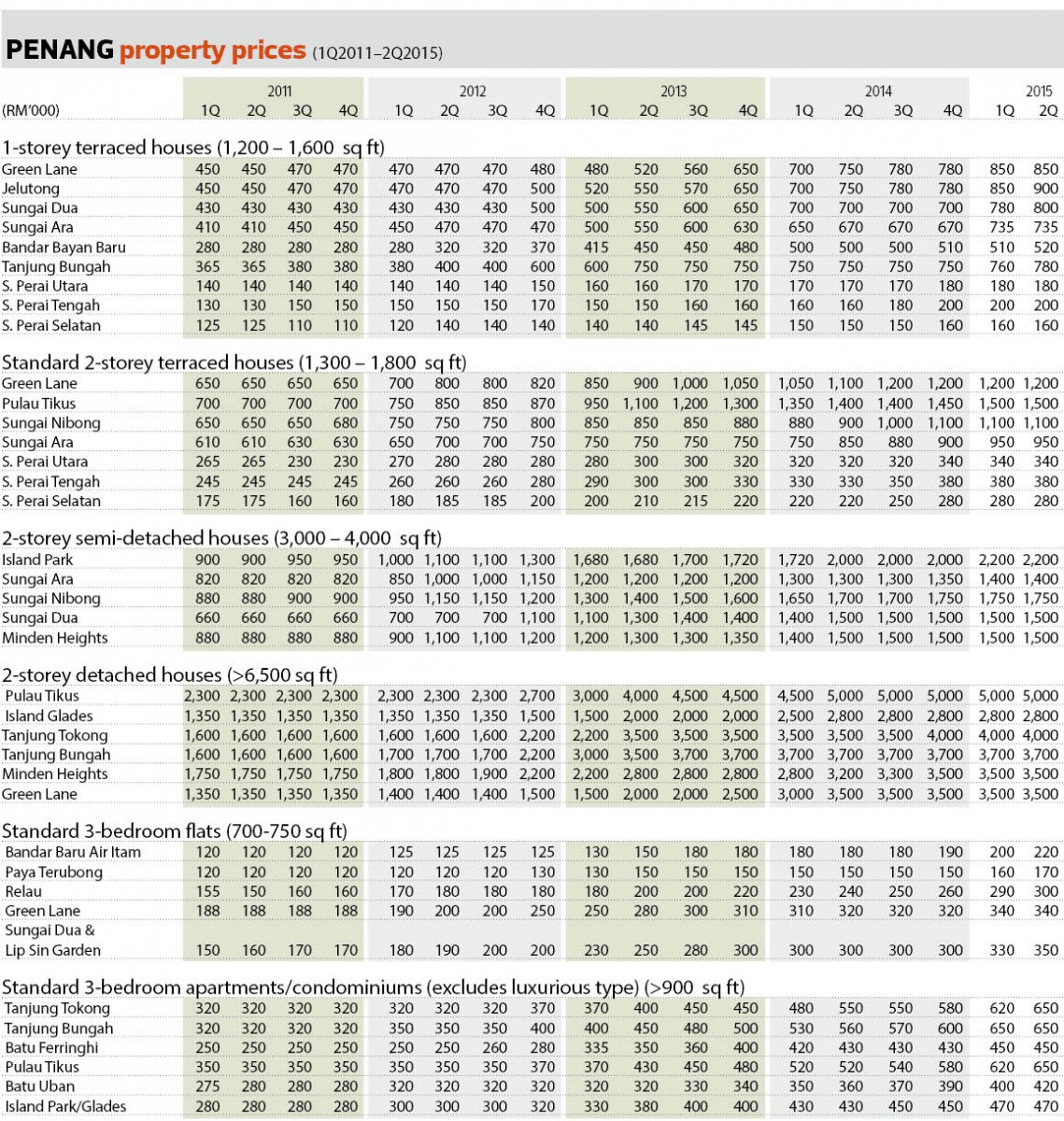

Monthly rents also stayed flat, leading to lower yields. However, the decline in yields was slowed by a lack of capital appreciation.

Spanning the gulf between the island and the mainland

The gulf between Penang Island and Seberang Perai in terms of progress and development is slowly but surely narrowing. The past six months have been eventful for the mainland, with the state government hitting a number of milestones.

For instance, Eco World Development Group Bhd (EcoWorld) struck a deal to buy 450 acres of leasehold land in Bandar Cassia, Batu Kawan, from Penang Development Corporation (PDC) for RM796 million.

The developer plans to build Eco Marina, a waterfront city with a shopping mall, hotels and serviced apartments.

According a filing with Bursa Malaysia, the acquisition comprises two parts. Firstly,

EcoWorld will acquire 300 acres with a 99-year lease for RM731 million, which will be developed into residential and commercial properties. The group will also acquire 150 acres with a 30-year lease, with an option to renew it for another 30 years, for the development of a golf course and a clubhouse, for RM65 million.

Another notable development was Sime Darby Property Bhd’s collaboration with PDC to build a high-tech industrial park in Byram and Changkat, south of Bandar Cassia.

Sime Darby has signed a memorandum of understanding with PDC to develop the park under a master plan on what is currently farmland. It entails the development of a high-tech industrial park for small and medium enterprises (SMEs) on a 930-acre tract with a gross development value (GDV) of RM1.8 billion. Meanwhile, PDC will develop 4,017.44 acres into an industrial park that will cater for heavy industries and SMEs as well as a mixed-use development.

On news that the redevelopment of the 1,007-acre Royal Malaysian Air Force base in Teluk Air Tawar, Butterworth, may not happen, Geh says he will not be surprised if it is true.

“Why am I not surprised? The politicians [Penang state government] will never approve of the redevelopment because the base only has 10 years left on its tenure. So, to redevelop the land, they must extend the lease by another 99 years. Then, they may borrow money from the banks, redevelop and sell the properties. [Moreover] it is federal land,” he says.

To recap, last February, TSR Capital Bhd had announced to Bursa Malaysia that it would team up with Lembaga Tabung Angkatan Tentera Pembinaan Bukit Timah Sdn Bhd to redevelop the base into an integrated development with a potential GDV of over RM10 billion. TSR Capital is involved in property development and construction.

In return, the three parties are expected to build a new air force base in Ara Kuda in Seberang Perai Utara for RM3 billion.

According to a digitaledge Daily report in August, a source said the relocation of the air base may be scrapped after it came under fire as it could potentially disrupt the livelihood of people and business operators in the vicinity.

Geh says it is hard to develop around the current air base as it is surrounded by padi fields. In fact, the area, which stretches from neighbouring Kepala Batas to Alor Setar, Kedah, is all padi fields. “It is not easy to convert padi fields into development land,” he adds.

According to him, the only catalyst for the northern part of Seberang Perai — which includes Butterworth — is the underwater tunnel that links Jalan Pangkor on Penang island to Bagan Ajam in Seberang Perai.

Consortium Zenith BUCG — which comprises Zenith Construction Sdn Bhd, China Railway Construction Co Ltd, Beijing Urban Construction Group, Sri Tinggi Sdn Bhd and Juteras Sdn Bhd — was awarded the proposed underwater tunnel project, which spans 6.5km and will cost about RM6.3 billion, according to reports from 2014. Construction is expected to start next year.

“I don’t see much development here unless and until the tunnel is built ... Maybe 10 years from now? I don’t know,” says Geh.

Hot spots on the mainland

Geh notes that Bukit Mertajam, Alma and Kulim have been growing slowly but steadily, thanks to an increasing working population at the nearby Kulim Hi-Tech Park. In fact, he proposes that the three areas be combined into a growth zone.

“Kulim is a sleepy hollow. It’s okay during daytime, but during the night, it is quiet,” he says, adding that Alma and Bukit Mertajam offer more excitement.

“I think [Bukit Mertajam, Alma and Kulim] have been very hot the last three years and it will continue to be hot for a longer while,” he says.

He adds that Bertam is an up-and-coming place, thanks to the Mydin and Sunshine hypermarkets that opened in Bandar Baru Bertam late last year.

Last but not least is Juru, particularly any area within a 10km radius of the toll, which links to the second Penang bridge, as it is seeing much development.

Geh says moving forward, properties in prime, highly desirable areas will continue to see growth and sales, while those in less prime markets and less desirable properties will experience flat movements in prices and sales.

“I believe the market is awaiting the announcement of the implementation of the Penang Transportation Master Plan (TMP), and this will positively change the value landscape of Penang island’s property market,” he says.

The RM27 billion TMP is intended to mitigate the state’s traffic congestion by 2030 and ensure the state’s prosperity by 2050.

In August, SRS Consortium was appointed the project delivery partner (PDP) for the plan. The consortium comprises Gamuda Bhd, which has a 60% stake in the partnership, Loh Phoy Yen Holdings Sdn Bhd (20%) and Ideal Property Development Sdn Bhd (20%).

The plan entails building a sea-crossing light rail transit (LRT) and cable car. The proposed alignment of the LRT begins at the middle bank of Penang island (near Gazumbo Island) next to the first Penang bridge before ending on the mainland.

In a speech at the Butterworth Fringe Festival in August, Penang Chief Minister Lim Guan Eng said the LRT was expected to boost major areas on the mainland such as Bagan Ajam, Prai, Seberang Jaya, Bukit Mertajam and Batu Kawan.

“The TMP will bring property prices down because it makes locations more equal in terms of accessibility. The LRT will bridge the gap,” Geh says.

On a recent report by Khazanah Research Institute, which says Penang properties are seriously unaffordable, he comments, “I am very happy that a reputable organisation like Khazanah has said this, and I agree 100%. Yes, in the prime areas of Penang, property prices will continue to be seriously unaffordable. “While home prices seem to double every seven years, I don’t see salaries rising more than 15% per annum, so there is definitely a disparity between income and home prices.”

Thinking of buying a property in Penang after reading this article?

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on Oct 5, 2015. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

Jalan Sri Petaling

Bandar Baru Sri Petaling, Kuala Lumpur

Taman Perusahaan Sungai Lokan

Bagan Lalang, Penang

Country Heights Damansara

Country Heights Damansara, Kuala Lumpur

East Residence @ KLGCC

Damansara, Kuala Lumpur

The Residence, Mont Kiara

Mont Kiara, Kuala Lumpur

The Ritz-Carlton Residences

KLCC, Kuala Lumpur

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur

Monterez Golf & Country Club

Shah Alam, Selangor