This is the third in a series of four snapshots on South Central Petaling Jaya. Look out for the finbal part tomorrow.

- We continue our focus on South Central Petaling Jaya (PJ) by analysing average prices on a per square foot (psf) basis. Based on transactions analysed by theedgeproperty.com, the average price of non-landed residences in the area was RM414 psf in 3Q2014, up 10.6% y-o-y.

- With numerous commercial centres, shopping malls and amenities, South Central PJ is the address of choice for many residents.

- In the 12 months to 3Q2014, some 33.8% of secondary transactions occurred in the RM401 – RM600 psf range, while another 11.6% were for properties priced between RM601 – RM800 psf.

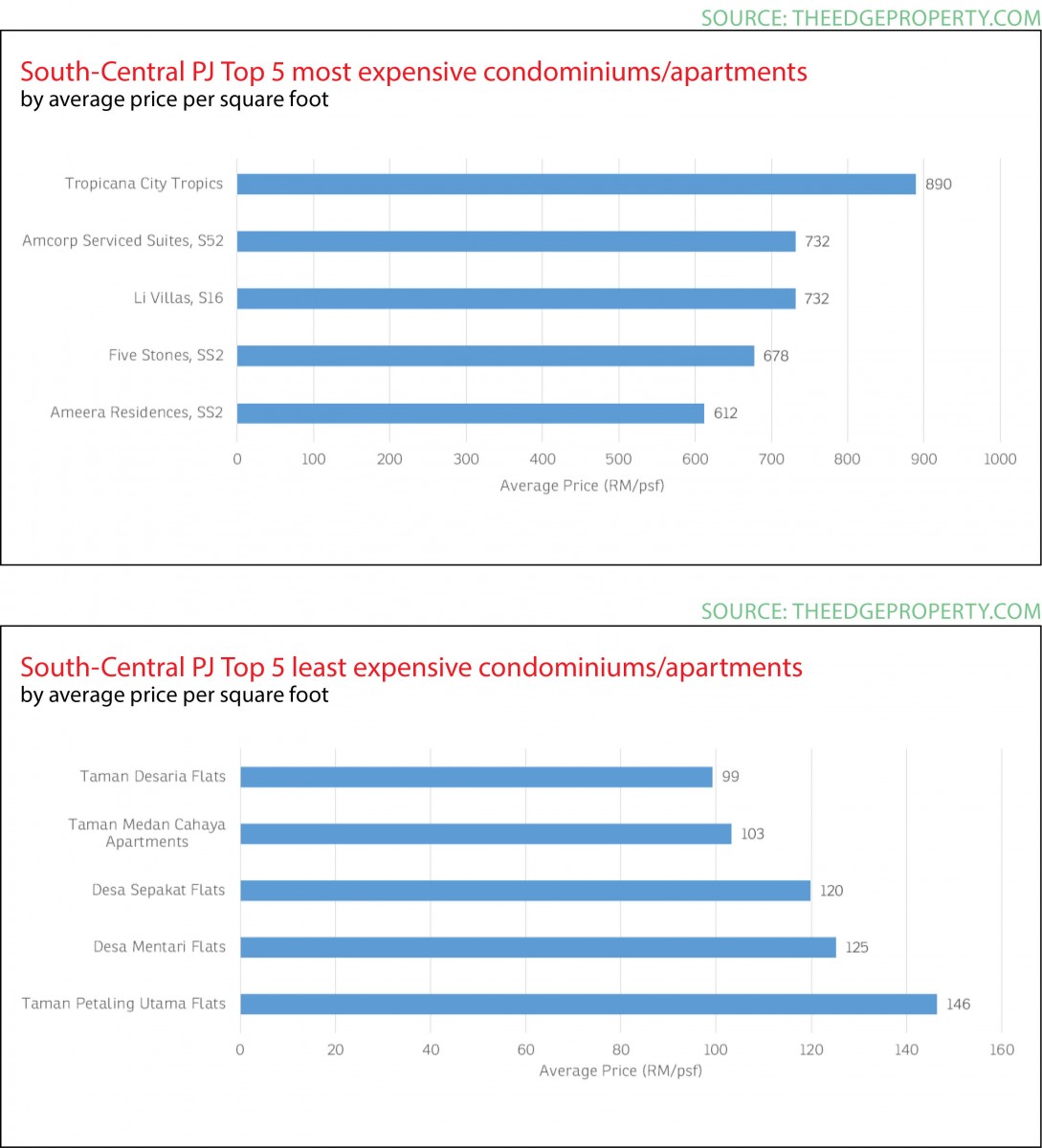

- The costliest address is Tropicana City Tropics, with an average transacted price of RM890 psf, almost 22% higher than the next-most costly projects, Amcorp Serviced Suites and Li Villas (RM732 psf each).

- Completed in 2010, Tropicana City Tropics sits atop Tropicana City Mall in SS2. Its units are compact (624 to 1,176 sq ft) thus the average absolute unit price remains relatively low at RM616,000. Several transactions of smaller units have breached RM1,000 psf.

- Amcorp Serviced Suites (RM732 psf) is a similar project, sitting atop Amcorp Mall. Although slightly dated, its location is excellent, in the heart of PJ Section 52 and within walking distance of an LRT Station. New commercial developments being built in the vicinity include Pinnacle @ PJ and the PJ Sentral Garden City.

- Some reasonable, mid-priced options include Park 51 Residency (RM424 psf) in Sungei Way, and 1120 Park Avenue (RM450 psf) in PJS 1.

Related stories:

PROPERTY SNAPSHOT 1: The ever-popular South Central Petaling Jaya

PROPERTY SNAPSHOT 2: What’s affordable in South-Central PJ?

Can the skyward prices of Tropicana City Tropics keep going up? Tap here for the data that might hold some answers.

The Analytics are based on the data available at the date of publication and may be subject to revision as and when more data is made available to us.

TOP PICKS BY EDGEPROP

Lake Vista Residence (Tasik Vista Residen)

Cheras, Selangor

Lake Vista Residence (Tasik Vista Residen)

Cheras, Selangor

Taman Bukit Rahman Putra

Sungai Buloh, Selangor

Botania Residence, Saujana Rawang

Rawang, Selangor

Jalan Setia Permai U13/42F

Setia Alam/Alam Nusantara, Selangor

Periwinkle @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Shamelin Star Serviced Residences

Cheras, Kuala Lumpur