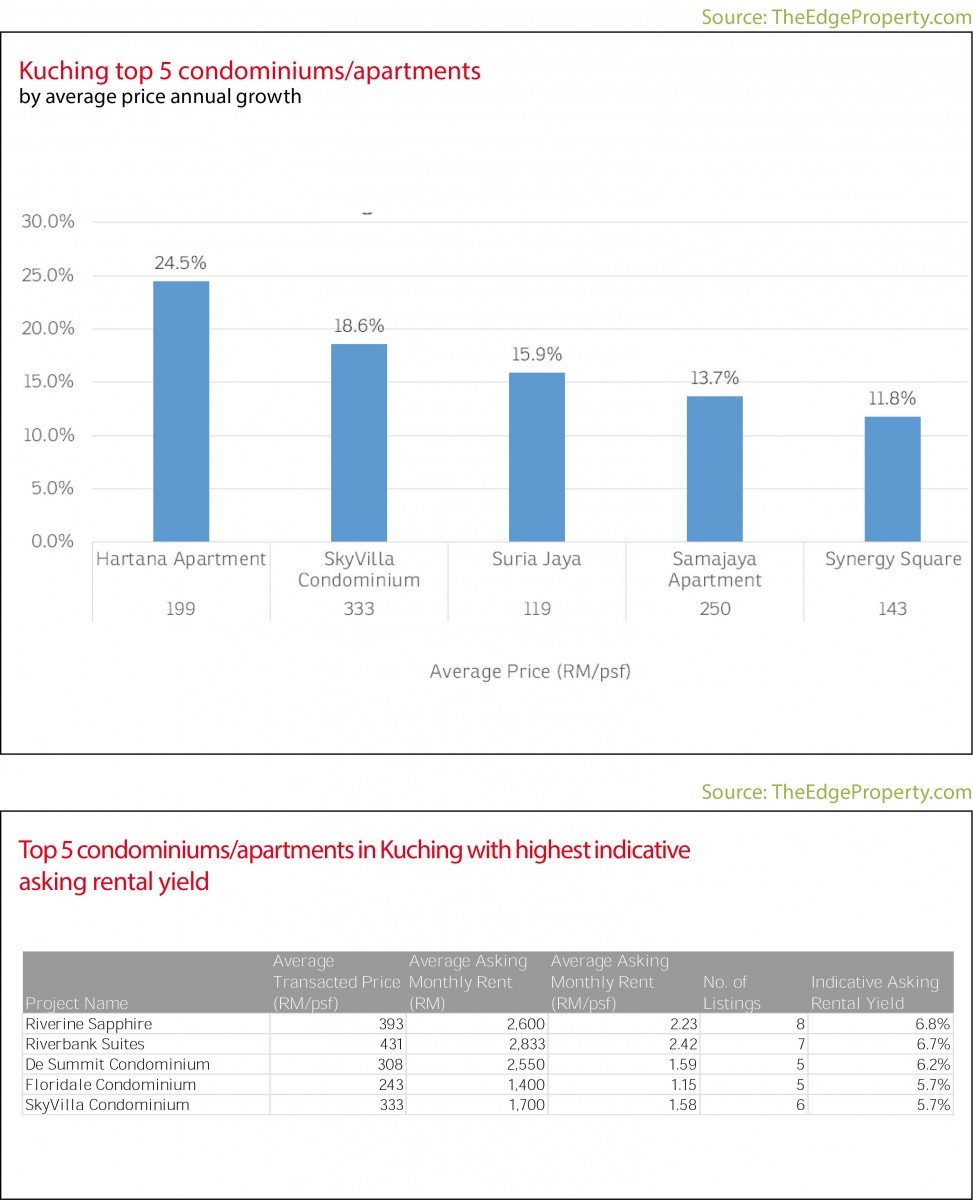

- These are the price growth and indicative asking rental yields for non-landed residences in the district of Kuching, Sarawak. An analysis of transactions by TheEdgeProperty.com shows the average transacted price for non-landed residences in the secondary market was RM193 psf in 1Q2015, up 10.8% y-o-y.

- The highest relative price growth was found at Hartana Apartment in Demak Laut, an established industrial area which counts companies such as Nestle and Lazada among its tenants. Average prices here grew 24.5% y-o-y to RM199 psf in the 12 months to 1Q2015.

- The highest absolute price growth can be found at SkyVilla Condominium, where the average price rose 18.6% y-o-y to RM333 psf. Completed fairly recently, this project was positioned in the upper middle-class segment and can be found in the burgeoning Batu Kawah New Township, a 265-acre satellite town developed by MJC City Development.

- Rents as observed of June 2015 were above RM2 psf for projects located within the touristy Padungan area. Other projects generally command rates between RM1.15 psf to RM1.90 psf depending on location, age and unit size.

- Indicative annual rental yields range are fairly decent, ranging between 5.5% and 6.8% per annum. The highest yields can be found at Riverine Sapphire (6.8%) and Riverbank Suites (6.7%), where the asking monthly rent for the larger units ranges between RM2,500 and RM3,300.

Rental yields by the river are kinda hot

The Analytics are based on the data available at the date of publication and may be subject to revision as and when more data becomes available.

SHARE

TOP PICKS BY EDGEPROP

SALE

FEATURED

Taman Nusa Bestari, Skudai

Iskandar Puteri, Johor

RM 240,000

2 beds |

2 bath |

753 sqft