This is the final part in a series of four snapshots on South Central Petaling Jaya.

• Today, we look at price growth and indicative asking rental yields for non-landed residences in South Central Petaling Jaya (PJ).

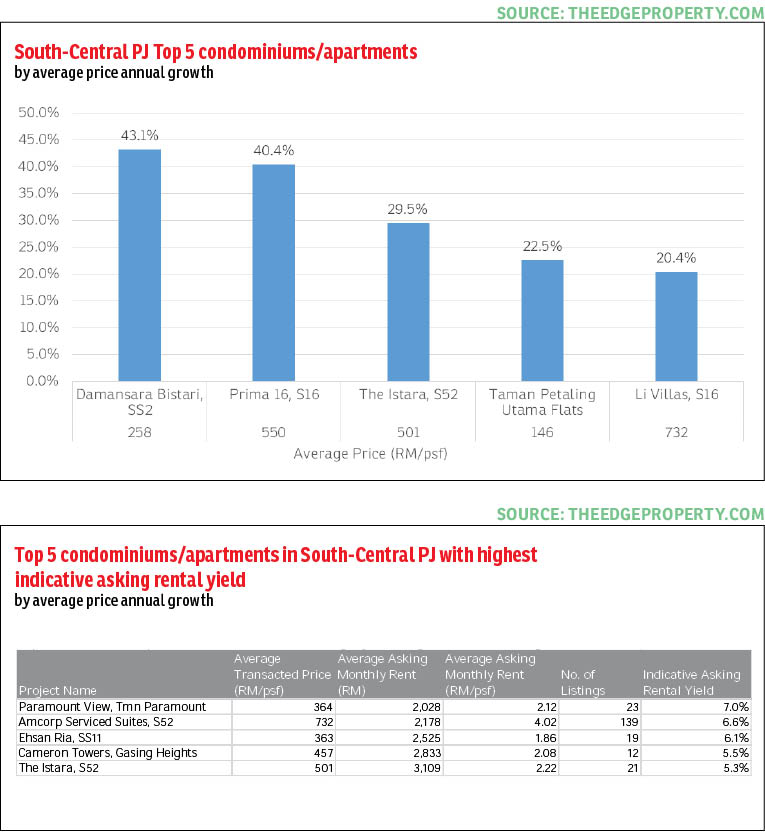

• Based on analysis of transactions by theedgeproperty.com, average prices grew 10.6% y-y to RM414 per square root (psf) in 3Q2014. Capital values at many of the projects observed have appreciated significantly.

• In terms of relative growth, Damansara Bistari in SS2 (43.1% y-y) and Prima 16 in Section 16 (40.4% y-y) appear to have gained the most in the 12 months to 3Q2014. On closer inspection, there were unusually undervalued sales in both projects in the preceding year, thus the average prices in the base year are skewed downwards. The Istara in Section 52 is next, with average prices up 29.5% y-y.

• From observation of asking rentals as at June 2015, asking rental yields for the wider area appear to be fairly average, with indicative yields ranging between 3.9% - 7.1% per annum.

• The highest rental yields can be found at Paramount View (7.0%) in Taman Paramount. Capital values here are depressed by its location close to LRT lines and power lines, with a low average transacted price of just RM364 psf. However the rental market here is buoyed by its proximity to an LRT station. The average unit asking monthly rental price is RM2,028 per unit or RM2.12 psf.

• The projects strategically located closer to the city centre and the Federal Highway also appear to generate decent rental yields. They are Amcorp Serviced Suites in Section 52 (6.6%), Ehsan Ria in section 11 (6.1%) and The Istara in Section 52 (5.3%).

Click here to look at the price trend in Damansara Bistari.

Related stories:

PROPERTY SNAPSHOT 1: The ever-popular South Central Petaling Jaya

PROPERTY SNAPSHOT 2: What’s affordable in South-Central PJ?

PROPERTY SNAPSHOT 3: What are the prices of developments in South Central PJ?

The Analytics are based on the data available at the date of publication and may be subject to further revision as and when more data is made available to us.

TOP PICKS BY EDGEPROP

Yayasan FAS Business Avenue

Petaling Jaya, Selangor

Damansara Heights

Damansara Heights, Kuala Lumpur