• This week the spotlight falls on Brickfields, which is enjoying healthy interest spurred by the ongoing development of KL Sentral and its proximity to the city centre. The 72-acre KL Sentral is the heart of Brickfields, offering an integrated transportation hub, hotels, retail, commercial and luxury residential space.

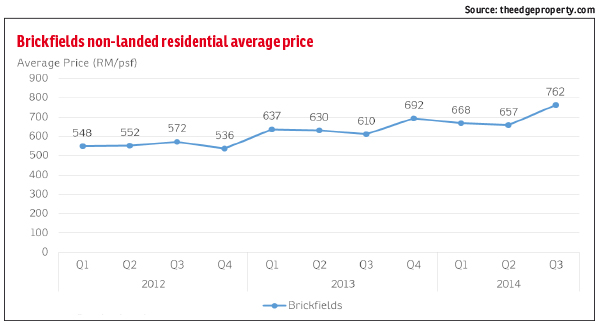

• The average price per square foot (psf) for non-landed properties in Brickfields has grown steadily. Based on theedgeproperty.com’s analysis of transactions concluded, prices hit a new high in 3Q2014 at RM762 psf, up 25.0% y-y from RM610 psf in 3Q2013. This follows a healthy annual growth of 6.6% in the preceding year.

• On closer examination though, the spike was due to the lack of transactions in units of older apartment buildings. Brickfields is a two-tier market with projects within KL Sentral commanding a large premium over the older ones outside it.

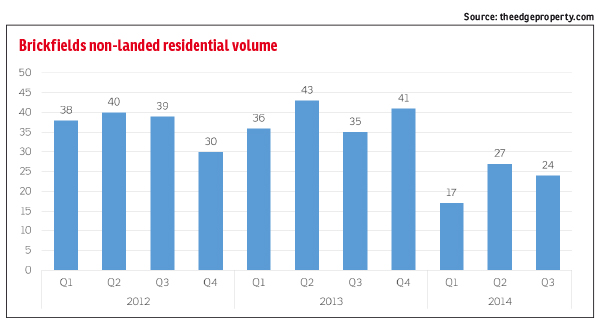

• For the 12 months to 3Q2014, transaction volume fell 24.3% y-y from 144 to 109 units. The thin volume is both reflective of the lack of new launches, as well as softer market sentiment.

The Analytics are based on the data available at the date of publication and may be subject to further revision as and when more data is made available to us.

TOP PICKS BY EDGEPROP

Wangsa Maju Seksyen 5

Wangsa Maju, Kuala Lumpur

Duduk Se.Ruang @ Eco Sanctuary

Kuala Langat, Selangor