IGB Real Estate Investment Trust (April 27, RM1.51)

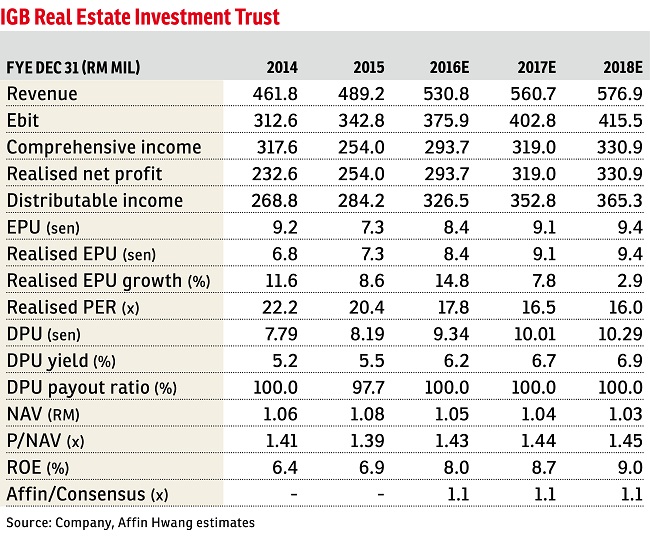

Maintain buy with an unchanged target price of RM1.60: IGB Real Estate Investment Trust’s (IGB REIT) first quarter ended March 31, 2016 (1QFY16) realised net profit of RM72.8 million (+4.2% year-on-year [y-o-y]) was in line with our expectations (accounting for 24.8% of Affin Hwang Capital’s FY16 estimates) and within consensus estimates.

The key drivers are primarily revenue growth (+4.6% y-o-y) on the back of a stronger rental income (+4.8% y-o-y) and other income growth (+4.0% y-o-y), subsequent to renewals at Mid Valley Megamall (which is staggered at an average of 33% of net lettable area each year) and higher turnover sales (given the festive season in February 2016). This resulted in a 4% y-o-y expansion in net property income.

Quarter-on-quarter (q-o-q), realised net profit was up 37% q-o-q due to higher revenue, lower overheads as well as a dip in interest expense. No distribution per unit was proposed in 1QFY16 (1QFY15: Nil).

We maintain a “buy” on IGB REIT with a discounted dividend model-derived 12-month TP of RM1.60 based on the following underlying unchanged assumptions: 8.2% cost of equity, 6% equity risk premium and a 3% terminal growth rate.

Despite the country’s overall weaker consumer sentiment, we continue to like IGB REIT due to occupancy rates consistently at 100% even during challenging economic times, efficient cost management initiatives, and both Mid Valley Megamall and The Gardens Mall being key suburban shopping destinations. In 2016, approximately 45% of The Gardens Mall will be up for renewal and therefore will be another boost to IGB REIT’s portfolio rental reversion in 2016.

Longer-term key catalysts include asset injections, such as the Southkey Megamall and 18@Medini post-2020. Key risks include a slowdown in consumer spending, competition from new supply of retail space (2016 to 2018) and higher debt-refinancing rates. — Affin Hwang Capital, April 27

Start your search for a condominium of your choice HERE.

This article first appeared in The Edge Financial Daily, on April 28, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Oakland Commercial Centre

Seremban, Negeri Sembilan

Sungai Rampai Terrace Factory

Telok Panglima Garang, Selangor

Kinrara Residence

Bandar Kinrara Puchong, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)