KUALA LUMPUR: Selangor’s property market saw the value of its transactions rise by 2% to RM47.46 billion despite volume dropping by 2.9% to 79,565, said the National Property Information Centre (Napic) in its recently published Property Market Report 2014.

KUALA LUMPUR: Selangor’s property market saw the value of its transactions rise by 2% to RM47.46 billion despite volume dropping by 2.9% to 79,565, said the National Property Information Centre (Napic) in its recently published Property Market Report 2014.

In contrast, the state’s property market in 2013 recorded 81,955 transactions worth RM46.52 billion, the report said.

The residential segment retained its lion share of the market, taking up 76.5% of total transactions, followed by commercial (10.6%), agriculture (6.3%), development land (3.4%) and industrial (3.2%).

Only the commercial and development land segments saw transactions picking up -- by 18.7% and 4.3% respectively, compared with double-digit contractions experienced in 2013.

In terms of value, the residential and industrial subsectors rose by 3.3% and 28.3% respectively, while the commercial, agricultural and development land subsectors recorded otherwise.

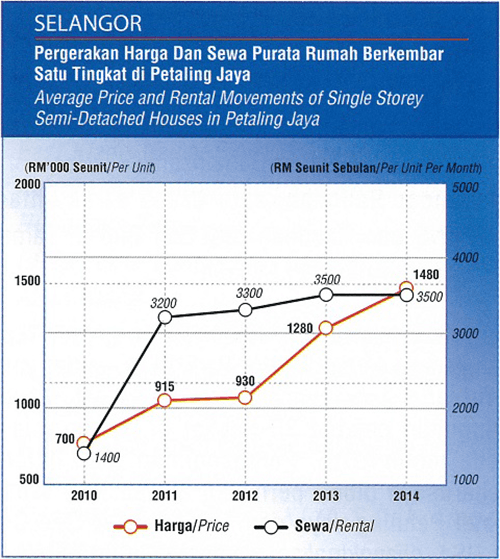

Homes in “prominent and established areas” continued to appreciate, especially one-storey and two-storey terraced homes in Petaling Jaya, Subang Jaya and Shah Alam, with increases of over 16%.

“Houses near institutions of higher learning and located along LRT and MRT routes also experienced capital gains,” it said.

“The spillover housing demand from Kuala Lumpur drove up prices of similar properties located nearby… two-storey terraced houses in Temasya Glenmarie led with the highest price in the state, transacted at between RM1.2 million and RM2.31 million,” it said.

Similarly, the residential rental market showed an upward trend, with homes in prominent schemes and areas bordering Kuala Lumpur obtaining premium rents.

The primary market saw 12,285 units launched last year, up 34.8% against 2013. However, take-ups dipped to 47.4%, from 49.2% in 2013.

Serviced apartments, condominiums and two- and three-storey terraced houses formed the bulk of new launches.

Residential overhangs rose by 7.9% to 1,889 units while value dropped by 12.3% to RM941.3 million. Most of the overhang units were low-cost flats, condominiums and serviced apartments.

Meanwhile, shop overhang numbers and value fell by 33.2% to 215 units and 62% to RM49.68 million respectively, whereas industrial overhangs were a marginal eight units worth RM570,000.

Residential property completions fell 7.7% from 19,003 units to 17,537 units, while new planned supply went up by 11.5% from 24,229 units in 2013 to 27,023 units last year.

“The property market in Selangor has experienced less fluctuations and is relatively more stable when compared with Kuala Lumpur, due to the larger population base in Selangor that supports the demand,” said managing director of DTZ Nawawi Tie Leung Property Consultants Sdn Bhd Eddy Wong.

“The property market in Selangor has experienced less fluctuations and is relatively more stable when compared with Kuala Lumpur, due to the larger population base in Selangor that supports the demand,” said managing director of DTZ Nawawi Tie Leung Property Consultants Sdn Bhd Eddy Wong.

He noted that the property market for the state had been trending sideways between 2013 and 2014, and he believed this year will see a similar trend.

He added that while there is demand for property, cooling measures such as the tightening of lending policies leave many without the means to purchase.

The report states that property prices are expected to remain firm and that future developments will continue to sprawl to the north and south of the state, driven by infrastructure projects such as the upcoming MRT Line 2 or the Sungai Buloh-Serdang-Putrajaya Line.

(Source: Napic)

TOP PICKS BY EDGEPROP

Jalan Cakera Purnama 12/19

Bandar Puncak Alam, Selangor

Bandar Baru Kuala Selangor

Kuala Selangor, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Avenham Garden @ Eco Grandeur

Bandar Puncak Alam, Selangor

Edusentral @ Setia Alam

Setia Alam/Alam Nusantara, Selangor