VIEW VIDEO

WHAT do the burgeoning townships of Bandar Utama, Mutiara Damansara and Damansara Perdana have in common?

Apart from being in Petaling Jaya and the Klang Valley’s prime property markets, they are some of the first suburbs in the country to be designed around the cathedral of consumer life: the shopping mall.

It’s now almost impossible to think of Bandar Utama without recalling 1Utama, the world’s fourth-largest mall, according to CNN and Travel and Forbes. In fact, it’s arguably something of a national landmark as much as a mall.

This triumph of branding — or ‘placemaking’, the trending neologism of developers from London to Melbourne — is also found in Mutiara Damansara, home of the country’s first Ikea store, thronged by shoppers till today. Opposite it is the The Curve that currently identifies Damansara Perdana for those who’ve never been there.

All three neighbourhoods share a second thing in common: hotels. One World Hotel feeds into 1 Utama (and vice versa), while The Royale Bintang The Curve and The Royale Chulan Damansara are connected to The Curve and e@Curve respectively.

Predating them all is Petaling Jaya’s other prime Damansara area, Damansara Utama, which lies next to Bandar Utama and provides what the newer areas have been fast catching up with: schools (SK and SMK Damansara Utama) and a hospital (KPJ Damansara Specialist Hospital in Damansara Kim). But Damansara Utama too is getting a piece of the placemaking business: the See Hoy Chan Sdn Bhd Group’s UPtown redevelopment is a mixed-use project intended as a new Klang Valley landmark.

Connecting them all is a network of highly prospective highways that has made it easy for the rest of the Klang Valley to reach their shopping meccas. Via a combination of the New Klang Valley Expressway, Sprint Highway, Lebuhraya Damansara-Puchong (LDP) and Penchala Link, Mont’Kiara and Sri Hartamas can theoretically be reached in 10 minutes on a clear day, and Kuala Lumpur city centre in 20, barring detours for the MRT project.

How they stack up

“Mutiara Damansara and Damansara Perdana have newer developments and more facilities such as shopping malls, international schools and offices compared with Damansara Utama and Damansara Kim, which are older housing estates,” says KGV International Property Consultants Sdn Bhd director, Anthony Chua.

Of the prime Damansara areas, Damansara Perdana might be the only one that still has available land bank for development, says Knight Frank real estate negotiator, Zack Ng. “And if there are new upcoming developments, it will come with a hefty price tag,” he adds.

Damansara Perdana also has the most non-landed residential properties and the most upcoming developments. One of its biggest is Empire City, a mixed-use development located across the LDP, which Damansara Perdana straddles. The developer is Cosmopolitan Avenue, part of Mammoth Empire Holdings Sdn Bhd. Mammoth Empire has two other projects in Damansara Perdana, Empire Residence and Empire Damansara.

Sitting on 23 acres of leasehold land, Empire City includes serviced apartments, soho units, corporate offices and a mall. (The last, Empire Mall, has had its opening date postponed from the end of this year to next September, according to The Edge Financial Daily). Two international hotels will also be opening in Empire City: the Marriott, and Autograph Boutique Hotel.

One of the non-landed residential projects in Empire City is Halo Sunday, which consists of 641 studio units housed in two blocks called Halo and Sunday. Halo units have a built-up area of 462 sq ft, and Sunday, 456 sq ft. Halo Sunday was launched in 2010 with a starting price of RM500 per square foot (psf).

“Today, Halo Sunday units are going for close to RM800 psf which translates to about RM350,000 for each unit,” Knight Frank’s Ng says.

Other upcoming non-landed residential projects in the prime Damansara areas include the Nucleus serviced apartments by the Boustead group and Reflection Residence by the Glomac group in Mutiara Damansara, and UPtown Residences in Damansara Utama.

According to DTZ-Nawawi Tie Leung managing director, Eddy Wong, units at UPtown Residences are going for about RM1,000 psf.

Knight Frank’s Ng says that older condominiums in Damansara Utama have experienced an annual price growth of about RM50 psf, while newer ones such as UPtown Residences have seen growth of about RM200 psf since being launched.

"These units were sold at RM850 psf at their launch in April 2012, but we are already witnessing transactions at RM1,150 psf today," Ng says. "These prices won't stay the same after completion, as holding cost increases," he adds.

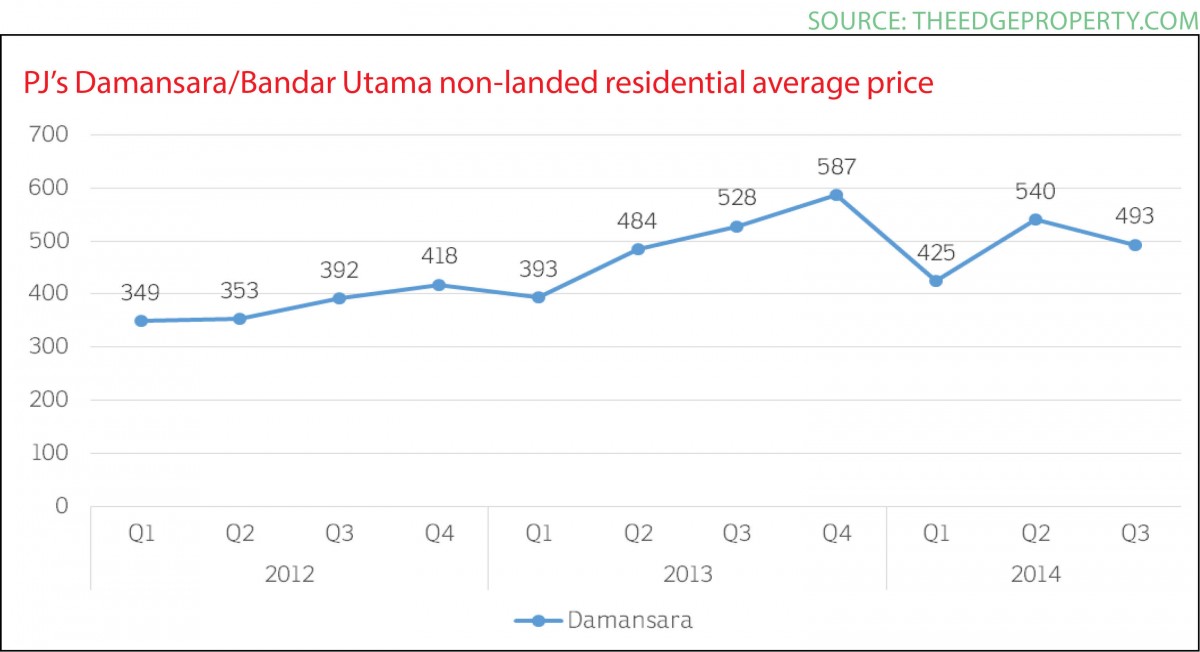

According to theedgeproperty.com, the combined average price of condominiums and apartments in the Bandar Utama and prime Damansara areas was RM493 psf in 3Q2014, down 6.6% y-o-y.

In the 12 months to 3Q2014, some 26.2% of secondary transactions occurred in the RM401-RM600 psf range, while 25.3% comprised properties priced between RM601-RM800 psf and 24.1% fell in the RM201-RM400 psf range. Units sold for above RM1,000 psf accounted for 3.2%.

On closer inspection, the falling average prices were not caused by falling capital values. Instead, transaction activity in the upper-segment stalled, especially at the beginning of 2014. "Prices have moved sideways for the past one year due to the tight credit situation but demand is still generally positive due to the location, accessibility and amenities such as shopping malls," DTZ’s Wong says.

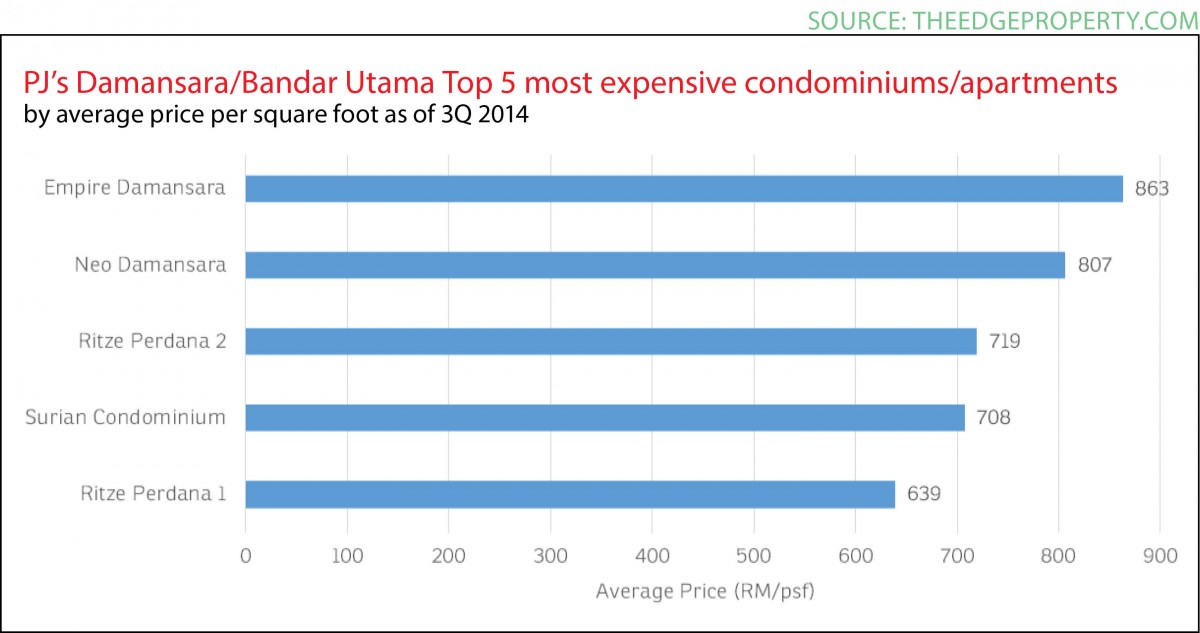

Empire Damansara takes the lead as the most expensive address in the areas surveyed, with an average transacted price of RM863 psf.

In fact, the most expensive properties on a psf basis in 3Q2014 were all located in Damansara Perdana. The next-most expensive properties after Empire Damansara were Neo Damansara (RM 807 psf), Ritze Perdana 2 (RM 719 psf) and Ritze Perdana 1 (RM 639 psf). The transactions were primarily for studio or 1-bedroom units.

Meanwhile, 1 Bukit Utama at Bandar Utama, a development by Bandar Utama Development Sdn Bhd, recorded the highest average transacted price per unit at RM7.172 million. The units here have a built-up area of between 1,980 sq ft and 2,300 sq ft for a 3+1 bedroom layout and are situated within the Bukit Utama Golf Course.

“The British International School shares the same entrance as 1 Bukit Utama, so there are many British teachers and families living in 1 Bukit Utama,” Ng says.

Another property similar to 1 Bukit Utama is 9 Bukit Utama, conceived by the same developer, which is also located within the golf course but has larger units measuring between 2,286 and 2,668 sq ft for a 4+1 bedroom layout.

Meanwhile, the least expensive projects by average price per unit are led by the low and middle-cost Desa Mutiara Apartments at Mutiara Damansara and Flora Damansara at Damansara Perdana. These projects have an average transacted price per unit of between RM175,000 and RM180,000.

Other relatively less costly projects include Empire Damansara (RM332,000), Ritze Perdana 2 (RM333,000) and Ritze Perdana 1 (RM360,000). These comprise mainly studio units, hence the low average price per unit. Medium-cost apartments like Flora Damansara (RM 212 psf) and Desa Mutiara Apartment (RM 253 psf) are the least expensive properties in the prime Damansara areas on a psf basis.

From a price psf basis, Armanee Terrace (RM388 psf) appears to be a bargain. The upmarket condominium is located in a quiet enclave at the end of Jalan PJU 8/1 on the hillside of Damansara Perdana. Although the price psf is on the low side for the product offered, the average price per unit remains quite high at an average of RM923,000 due to the large unit sizes (2,300 sq ft to 2,700 sq ft for a typical 4-bedroom unit).

“Most of the units in Damansara Perdana consist of studio units. The target market here are mostly working professionals from Kota Damansara or the nearby offices in Bandar Utama and Mutiara Damansara. There are also people who are working in the Mont’Kiara area who are staying here because the rental in Mont’Kiara is more expensive than the rental rates here [Damansara Perdana],” Ng says.

“I also see many young people living here, mostly those starting out in their careers. Some parents purchase these affordable studio units for their children, Ng adds.

Wong notes that larger units may face challenges given their pricing and current market conditions. “The smaller units [studio units] tend to fill up quite well,” he says.

While transactions at the market’s upper end have slowed, capital values at most projects have either been maintained or appreciated slightly. From an analysis of transactions by theedgeproperty.com, mid-cost apartments at Flora Damansara (22% y-o-y) appears to have gained the most in the 12 months to September 2014 for relative growth. This is likely due to its strategic location in the prospective Damansara Perdana.

According to theedgeproperty.com’s analysis of rental yields as at June 2015, rental rates are about RM 2.10 psf for the older condominiums, and about RM3.10 for the smaller, newer units. Asking rents appear to be fairly average with indicative yields ranging between 3.9% and 6.1% per annum.

Outlook

New public transport infrastructure is expected to add to the popularity of Bandar Utama and PJ’s prime Damansara areas. The MRT Line 1 Sungai Buloh-Kajang is due for completion in 2017 and will have stations at Mutiara Damansara, 1 Utama and Taman Tun Dr. Ismail, while the LRT3 (Bandar Utama-Klang Line) that begins at 1 Utama and includes a station at Damansara Utama is due in 2020.

Meanwhile, the proposed and controversial 20.1km Damansara-Shah Alam Highway (Dash) links Puncak Perdana U10 in Shah Alam to the Penchala Interchange at Damansara Perdana.

According to Prolintas, the developer of the RM 11.5 billion Dash will serve to link Puncak Perdana, Alam Suria, Denai Alam, Kampung Melayu Subang, Jalan Sungai Buloh, RRIM, Kota Damansara, Damansara Perdana and Mutiara Damansara. Dash is being opposed by residents of Mutiara Damansara and Damansara Perdana.

Henry Butcher Malaysia chief operating officer Tang Chee Meng says the proposed LRT3 line will be a strong catalyst for Bandar Utama and the prime Damansara areas but may be negated by weak market sentiment. “Price increases have tapered off to a single-digit pace due to the low demand arising from the difficulty in getting financing loans,” he adds.

“Demand for landed residences is stronger than the demand for non-landed residences in Bandar Utama, Damansara Utama and Mutiara Damansara whereas there is a higher demand for non-landed residences in Damansara Perdana which has more strata residential projects at a more affordable price,” Tang says.

“I foresee very positive long-term prospects for Bandar Utama and the Damansara areas where there are bountiful amenities and better connectivity will only add more value to the township,” he adds.

DTZ’s Wong also believes the MRT which will improve connectivity to the areas and augur well for an already strong residential market here. “The market here will not be very much affected by the softening of the overall property market,” Wong says. “As for the long-term outlook, it is looking positive for these mature areas as they are well located with good connectivity and amenities.”

Related stories:

PROPERTY SNAPSHOT 1: The ever-accelerating Bandar Utama / Damansara 'hood

PROPERTY SNAPSHOT 2: What’s affordable in Damansara / Bandar Utama?

PROPERTY SNAPSHOT 3: What are the prices of developments in Damansara / Bandar Utama?

PROPERTY SNAPSHOT 4: What's hot in Damansara / Bandar Utama?

This article was first published in The Edge Property pullout, Dec 4, 2015, which appears every Friday with The Edge Financial Daily. Tap here to download The Edge Property pullout for free.

TOP PICKS BY EDGEPROP

Springfield Residences @ Setia EcoHill 2

Semenyih, Selangor

Saville Residence

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Royal Strand @ Country Garden Danga Bay

Johor Bahru, Johor