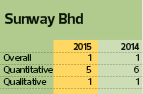

Sunway Bhd has retained its top spot in the overall ranking of The Edge Malaysia Top Property Developers Awards for the second year running. It also takes the sub award for Best in Qualitative Attributes again.

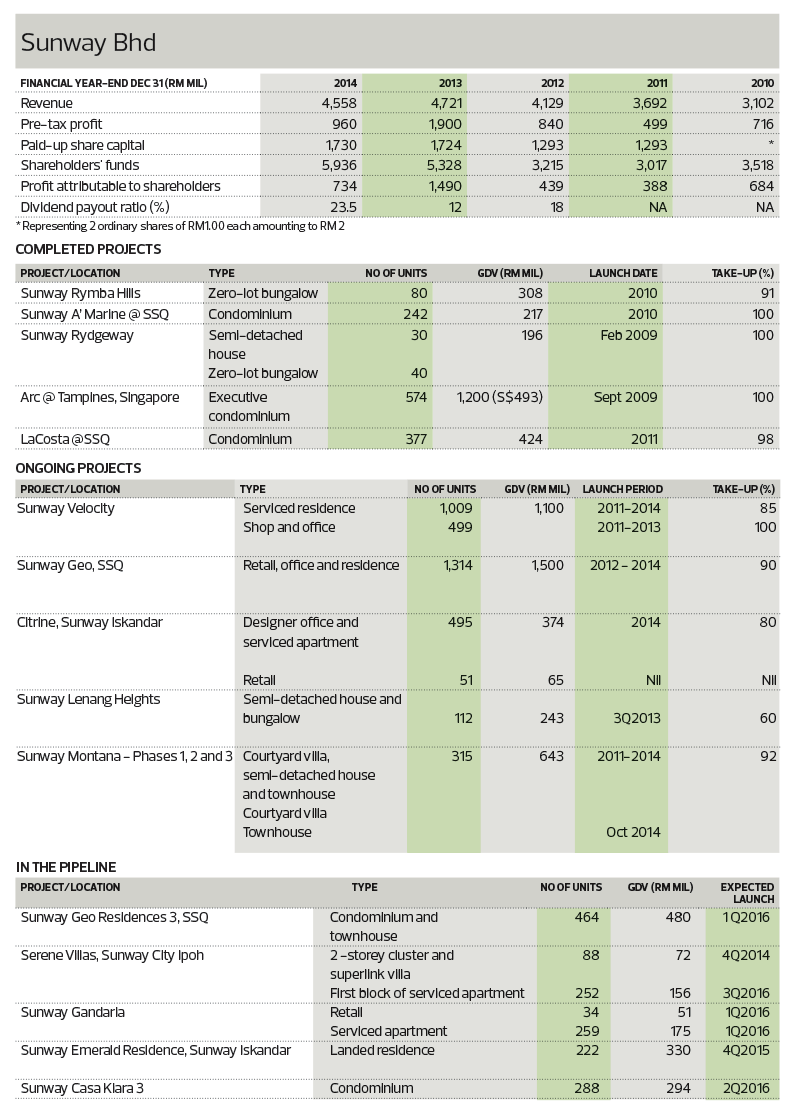

The four-decade-old conglomerate — whose operations range from construction, retail, hospitality, leisure, healthcare, trading and manufacturing to quarrying across Malaysia, Singapore and China — has had an eventful year.

For starters, its construction arm was relisted at end-July this year, raising RM478.4 million. Given the warm reception of the initial public offering, Sunway is looking at similar ways to capitalise on its massive portfolio of investment assets, Malaysia and Singapore managing director Sarena Cheah tells The Edge.

The group has weathered two financial crises so far, emerging from each one stronger than before.

“The key to riding out the slowdown or consolidation is holding power, especially in the property market, which is very capital intensive.

“Compared with the 1997 crisis, we are more comfortable with our gearing level at 0.3. We also recently rewarded our shareholders at the [group holding company] level with a dividend of 26 sen per share,” she says.

“We want to recognise shareholders and reward them for being with us through our ups and downs, and to also tell them that we are financially stable.”

She shares Sunway’s plans for its property division, its strategies during this slow period and what else needs to be done.

The Edge: How have the past 12 months [since October last year] been?

Sarena Cheah: If you look at the property market in the last five years, after the global financial crisis of 2008 to 2009, the property market experienced a lot of growth in terms of value and units, especially in 2010 and 2011.

So, as in a typical cycle, it will have to come down to a period of consolidation and I think the past 12 months were perhaps the start of it all. This was together with new events such as the imposition of the Goods and Services Tax and the tightening measures — all very significant to the property industry.

Of course, one saving grace is that interest rates remain very low.

Otherwise, the overall environment, together with political sentiments and the weakening ringgit, have resulted in uncertainty in the market. It is very uncertain globally as well.

Some people have described it as the perfect storm. We at Sunway should prepare for the rainy days, and also prepare to catch the market when it comes back up again. It’s very typical for markets to go up and down.

Do you think the property market has hit bottom? If so, how prepared is Sunway to face this?

I think there are a few things to look at, especially unemployment and interest rates. These two things are key to whether the market will pick up or go down even further.

We have been hearing of some form of unemployment, such as in the banking sector, but overall unemployment numbers are fair.

Another concern obviously is household debt. These are all very relevant to any property purchaser. We are on the high side, and the only way to alleviate that is to make the gross domestic product (GDP) grow.

From the recent tabling of Budget 2016, the government plans to sustain growth at 4.5% to 5.5% next year. As citizens and corporations, we will work towards that, but whatever we cannot control we will just have to manage as best as we can.

This is especially so in the property market, which is very capital intensive. The key to riding out the slowdown or consolidation is holding power.

In this sense, compared with the 1997 crisis, we are more comfortable with our gearing level at 0.3. We also recently rewarded our shareholders at the [group holding company] level with 26 sen [dividend per share]. This is because we want to recognise our shareholders and reward them for being with us through our ups and downs, and to also tell them that we are financially stable.

But more importantly, we must plan ahead and be careful with our launches and the kind of captive investments we have.

As a company, we not only plan and develop properties but also invest a lot in our investment properties. To date, we have about RM2.3 billion investments that are being constructed.

We have completed The Pinnacle [a 27-storey office tower in Bandar Sunway] and the new Sunway University block [12 storeys and 880,000 sq ft]. In 2016 and 2017, we will have the Sunway Velocity mall [in Cheras] and the hotel next to Sunway Lagoon.

When they are completed, they will start earning revenue and income for us. It is really a balancing act of allocating resources between development and investment products.

A lot of your properties, such as retail, are part of your strategy to ride out the property cycles. However, people are not spending. So, are you earning enough from the investment properties to protect you from the cycles?

Of course, when the economy is down, everyone is affected. But the diversification of our offerings will help because even if consumers don’t buy property, they will shop for other things that they need.

We have to stand out first. We know that, for instance, there is an oversupply of malls. But which are the ones that can truly stand out and thrive?

What makes these malls stand out? Sometimes it’s their size, sometimes it’s what’s around them. Accessibility also matters.

Malls also have to deal with the growth in e-commerce. So, how do malls and entertainment correlate and become one? We have both, so we can create a stronger offering, as opposed to just another mall.

The weakening ringgit is also an opportunity for local retailers and hospitality operators. For example, Sunway Lagoon will be a destination of choice. We just came back from [the Lost World of Tambun in] Ipoh, and it is doing well.

Our terrain for the theme parks is a unique selling point. For instance, Sunway Lagoon is the only one you can look into from outside. It is also considered the city centre and is water-based. Meanwhile, our Tambun theme park is built against limestone caves, and the Iskandar one [in Nusajaya] will be in a river.

People are becoming more conscious about returning to nature, so that is the space we play in. They are outdoors and family-oriented.

Hotels should also do better because people will prefer to travel domestically now instead of abroad to places such as Singapore, whose currency is three times stronger than ours. So, we have that perspective.

We also lease hospitals, which offer a very resilient income stream. We are looking at expanding that business. We are expanding the Sunway Medical Centre here [in Sunway Integrated Resort City] to 600 rooms from 300, while we will open another 300-room hospital in Sunway Velocity. The Seberang Jaya one will have 250 rooms. We are looking at a hospital in Ipoh, and potentially one in Johor.

The beauty of this is that we can list it separately, just like Sunway Construction Group Bhd. We can get higher returns if we list it.

The whole idea of listing and capitalisation is different financing strategies. We can list different parts of the business, while the talent and knowledge all remains under the Sunway umbrella.

All of our investment products now are about RM3.3 billion. We have the REIT (real estate investment trust), and if we do it well, the capital will come back.

So, even in a downturn, there is a silver lining. Because of our diverse offerings, we are able to leverage this downturn.

Are you planning to buy or sell anything?

We have built this business model with property development, investment and REIT. We will continue to build and give the first right of refusal to the REIT because we feel that as long as we are managing the property — and the REIT is a kind of financing recycling capital mechanism for us — that gives us the ability to reuse our capital for expansion to different locations.

So, we are not saying we will not sell outside, but the first right of refusal is for the REIT.

We will be looking for things to buy. If the market is slowing down now, we are standing on a strong foundation and can look for opportunities. We will look for landbank and depressed and distressed assets. Perhaps we [the property arm] or the REIT will buy it … it depends. But it must be at a price that makes sense.

Yes, property sales are slow, but we can afford the time to review our strategies and plan properly to catch the market when it returns, and at the same time, look for these assets and land.

How big is your war chest?

Our gearing is at about 0.3 times. I will not name the exact budget but as a company with diversified earnings, we can go up to 0.5 times as a guide if we are buying good assets to ride out the property cycle. The banks must obviously be comfortable and do their due diligence.

As for returns [yields], because we can buy different types of assets, they should be at least around 20%.

Have these kind of assets started appearing in the market? What kind of yields and discounts are you seeking?

They are starting to appear, but I think this time around, more people are holding strong as the economy and corporations are stronger this time. Previously, we were in a very bad shape as well and we had to sell some of our assets.

We’re looking for at least 20% to 30% [discounted to market value]. Assets should generate a yield, depending on the type of asset. Currently, we feel that there is a bit of oversupply in all segments, so we may require something that offers more than our regular yields. Therefore, we expect to pay less. Perhaps the cost profile of everything has changed, with inflation and all. One of the things that we need to become a progressive country is foreign investors. I can understand the need to set a limit on property prices for foreign investors, but perhaps the government can give waivers for certain locations such as international zones.

This is because we are not a big country. Our population at 30 million is quite small. We need people with the purchasing power to come and stay with us, work here and spend here.

So, a relaxation of the foreign property investment threshold, with incentives from InvestKL, and trying to get multinational corporations to set up offices here will actually help quite a bit … because the amount of supply coming up compared with [the number of] foreign purchasers, it’s minute. They comprise less than 3% of the overall market.

That of course needs to be balanced with good policies that take care of Malaysians who cannot afford homes. But there are many factors that could be driving prices up, not just foreign investors.

What are your views on Budget 2016?

Actually, the property industry did not get a lot of goodies. But in the end, the focus is to get the GDP up so that the banks can start lending again, and obviously the banks are not lending because household debt is very high.

Datuk Alan Tong wrote a very good article about household debt. He pointed out that only 40% of it is due to property.

Property is a hard asset that’s right in front of you, it’s a very good hedge against inflation and it does not depreciate.

You had lowered your sales target by 40% to RM1 billion for FY2015. It sounds drastic. Why did you reduce it by that much?

If you remember, during the middle of the year, I said we were going to keep to the same target but continue watching and reviewing, because the first half of the year is traditionally a slow period for us.

There are two reasons why we had to review the target. Firstly, the market is slow. If it sounds a bit drastic, it’s because we strategically delayed some launches such as the final phase of Sunway Geo 3 [at Sunway South Quay]. That project is worth RM500 million, so obviously it’s going to have a huge impact.

We feel that our potential buyers would be better able to appreciate the value of the project closer to the township’s completion, and we are also going to open our hotel and Nickelodeon Lost Lagoon early next year. They can then see the value the township will give them, so why not time the launches with the opening of the hotel and theme park?

We timed it like this because we are in a township, and once we have put an investment product up, with the publicity we put in, it will bring a different light to the overall township. So, we will strategically launch it next year.

Also, because all the indicators and sentiments are weak, it’s about not wanting to shoot ourselves in the foot. We timed it in such a way that it will not affect our profits as much because what I sell now will affect our profits in the next few years.

So for the calendar year, the numbers might look low. But to launch during the year end when the sentiment is weak will not do it justice. We are, however, very proud and confident of the product. It’s just that we don’t want to come out when it will not get the due response.

If I had high gearing and a lot of holding cost, I would have no choice but to launch. But we are still launching at Sunway Iskandar. It is different because it is a new township and I need people to see that I am developing.

We have a launch in Bangi that we’ve moved to next year, as well as two smaller launches. But these are more due to delays in getting approvals.

Most of our launches will be in Singapore because the government will not let you sit on your projects! Our exposure to Singapore currently is only 30%, as we have a minority share in joint ventures. We’ve sold

S$2 billion so far, and we have only three projects left to sell. Royal Square at Novena, that’s 60% sold. It has medical suites and a hotel, which we will sell to our partner [Hoi Hup Realty Pte Ltd].

There’s also Sophia Hills at Mount Sophia. It’s in District 9 near Bras Basah and Orchard Road, which is a very strong location.

Of course, we launched during a slow market — and Singapore’s tightening measures are very, very tough! — but we believe over time, it will sell because it is a very good location. Last but not least is a landed development in Sembawang.

Singapore, Australia and London are on our radar screen. We are currently studying some potential areas and we will see how that goes. China, we are there. But we don’t want to spread our resources too thin. During times like these, to be diversified and earn in different currencies is quite helpful.

We are not one to chase sales for the sake of it. Instead, it is more important to create the community feel and the value, reinvesting and appreciating with the township.

So, if you look at us as a whole, property sales alone are not reflective of our business.

What is your outlook?

We are cautious, but we will look for opportunities. I think during slowdowns, it is a good time to spend internally, reflect on how our new generation of consumers is spending, restructure and reinvent ourselves to be more relevant going forward.

Now, the property market is crowded. Everyone is a developer. How do we differentiate ourselves?

We have the build-and-operate model, but what I think we really need to look at is the service-level model.

Everyone can build, but how do we maintain and take good care to maintain value? How do we bring in traffic?

We have done all that but there is room for improvement. TEPEA 2015

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on Dec 7, 2015. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

Yayasan FAS Business Avenue

Petaling Jaya, Selangor

Trio by Setia

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Asteria Apartment @ Bandar ParkLand

Klang, Selangor