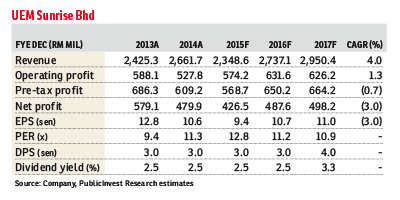

UEM Sunrise Bhd (Oct 22, RM1.27)

Reaffirm outperform call with an unchanged target price (TP) of RM2.15: UEM Sunrise’s (UEMS) stock price has rebounded about 50% from its all-time low of 76 sen recently on rumours of privatisation by its holding company while trading volume has spiked up accordingly.

Looking at the steep discount to its value, the privatisation story may make sense. That said, we believe Khazanah Nasional Bhd will not “take under” the company just because the sector is now facing headwinds, primarily due to the bad press on its high exposure in Iskandar Malaysia (78% of its total landbank).

If anything, we believe that UEMS has low holding costs for its landbank in Iskandar Malaysia and hence, should be able to weather the current down cycle.

We believe UEMS should be able to meet its sales target for financial year 2015 (FY15), despite a slow start in the first half of 2015 after achieving only RM600 million in new sales.

Following the hugely successful launch of its maiden project at La Trobe Street last year, which saw 95% of the available apartments sold within three weeks, its second project with a gross development value (GDV) of RM965 million is on track to be just as successful.

Meanwhile, its launches in the Klang Valley (Sefina, Mont'Kiara and Serene Heights) also saw sales exceeding 70% on average. SiLC (Southern Industrial & Logistics Clusters), its industrial park in Nusajaya, Johor, will also be launched soon and we believe demand will be good.

Hence we believe new sales, especially in the fourth quarter, will be strong, driven by several other projects.

Iskandar Malaysia is still challenging. Demand is still slow, with concerns of oversupply, especially that of high-end condominiums. Of late, most developers have either deferred launches or cancelled land deals. And UEMS, being the largest landowner, is also hit with lower sales. It sold RM263 million in Iskandar Malaysia in FY14 from RM1.9 billion achieved in FY13.

UEMS has 80% of its GDV in Iskandar Malaysia, which has been the main drag on its stock performance, we believe. That said, longer-term prospects are still encouraging, with RM166 billion investments committed to Iskandar Malaysia, and about 47% of it already realised according to the Iskandar Regional Development Authority.

UEMS has 80% of its GDV in Iskandar Malaysia, which has been the main drag on its stock performance, we believe. That said, longer-term prospects are still encouraging, with RM166 billion investments committed to Iskandar Malaysia, and about 47% of it already realised according to the Iskandar Regional Development Authority.

UEMS, being the first mover, has the advantage of low-cost land bank. If anything, Nusajaya is said to be one of the stops of the proposed Kuala Lumpur-Singapore high-speed rail project, which we believe will add value to the group’s flagship development once it’s completed. —

PublicInvest Research, Oct 22

Interested in properties in Nusajaya? Click here.

This article first appeared in The Edge Financial Daily, on Oct 23, 2015. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Centra Residences @ Nasa City

Johor Bahru, Johor

Taman Taynton (Taynton View)

Cheras, Kuala Lumpur

Bandar Puteri Puchong

Bandar Puteri Puchong, Selangor

De Tropicana Condominium

Kuchai Lama, Kuala Lumpur