Click here to check out the listings for Leisure Farm Resort (pictured).

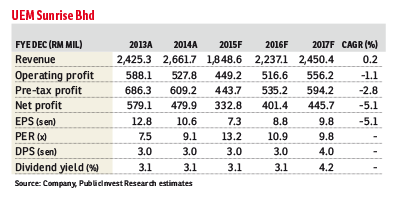

UEM Sunrise Bhd (Feb 17, RM1)

Maintain outperform with a target price (TP) of RM2.15: UEM Sunrise Bhd (UEMS) entered into a joint venture (JV) and shareholders’ agreement with Mulpha International Bhd (MIB) to jointly develop and optimise the value of 38 parcels of freehold land with a combined land size of 231.35 acres (93.62ha), of which two parcels (140.13 acres) belong to UEMS and the rest to MIB.

The land is at Gerbang Nusajaya and near MIB’s flagship development, Leisure Farm Resort. Each company will own a 50% stake in the JV company undertaking the mixed development spanning 20 years with an estimated gross domestic value (GDV) of over RM5 billion.

Earnings are kept unchanged as we believe the contribution from the JV will not be meaningful in the near term. We maintain “outperform” with a TP of RM2.15, which is a 30% discount to revalued net asset valuation.

The base price of UEMS land is RM315.2 million or RM51.64 per sq ft (psf), while MIB’s land is valued at RM312.7 million or RM78.70 psf. Hence, the JV is similar to the JV with Kuala Lumpur Kepong in which minimal cash outlay is involved. UEMS might have to incur some costs in rezoning the land and obtaining approvals for the proposed density of the development.

We are positive on the deal as it will expedite the development for Gerbang Nusajaya and also leverage on MIB’s strength in premium  lifestyle development as reflected in its Leisure Farm Resort.

lifestyle development as reflected in its Leisure Farm Resort.

We understand that UEMS and MIB will develop the land into a mixed residential and commercial development which, among others, consists of luxury landed villas and neighbourhood retail shops.

We understand that planning for the development will start in the second half of 2016 (2H16), with Phase 1’s estimated GDV of RM150 million expected to be launched in 2018. — PublicInvest Research, Feb 17

TOP PICKS BY EDGEPROP

Baypoint @ Country Garden Danga Bay

Johor Bahru, Johor

Menara Bintang Goldhill

Bukit Bintang, Kuala Lumpur

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur