UEM Sunrise Bhd (Jan 11, RM1.04)

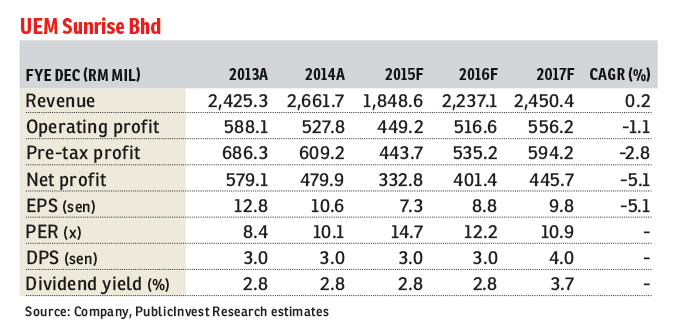

Maintain outperform with a target price (TP) of RM2.15: A recent meeting with the management revealed that the group’s base target of RM2 billion will be easily met, underpinned by recent en-bloc sales (Aurora serviced apartments for about RM371 million and Teega office for about RM138 million). Recall that nine months ended Sept 30, 2015 new sales achieved were about RM1.2 billion, which would already be RM1.7 billion if inclusive of the en-bloc sales.

While no sales target and headline key performance indicator were given as yet, we believe that the group should still be looking at launches worth about RM1 billion to RM2 billion at the least, and a similar sales target of RM2 billion to maintain its earnings. As for land disposal (about RM300 million in sale value), the deal which was supposed to be concluded last year is now slated to be sealed by the first half of 2016 (1H16). We maintain our “outperform” call on UEM Sunrise Bhd, with a TP of RM2.15 (a 30% discount to revised net asset value).

We understand that main launches will still be primarily in the central region and overseas, i.e. Australia. In Johor, it will focus on disposing the unsold inventories from Almas and Estuari. Based on our estimates, the unsold units from these two projects alone are about RM1.1 billion. Hence, we agree that there’s no urgency to launch other comparable products in the current soft market.

That said, the group still has plans to unveil some projects, albeit smaller in size, which are mostly mid- to low-end products, such as an affordable apartment project in Gerbang Nusajaya (gross development value [GDV]: about RM62 million) and Signature Residences (Phase 1; GDV: about RM83 million; 110 units).

Key launches in the central region are new phases of Serene Heights and Solaris 3 (total GDV: RM1.3 billion), while for overseas projects, St Kilda (GDV: RM722 million) redevelopment in Melbourne, Australia, might be unveiled by end-2016.

We understand that its land disposal deal in Puteri Harbour should be concluded by 1H16, with about RM300 million proceeds expected. As for its joint venture (JV) with WCT Holdings Bhd, we understand that UEM Sunrise is doing the land conversion and master planning, with the project expected to be launched by 2017.

Also, the GDV is expected to be enhanced from the RM3 billion reported earlier. We have stated in our previous report that the GDV per acre will be easily enhanced to about RM7 million per acre or potentially yielding a GDV of RM4 billion. The case in point is Eco World Development Group Bhd’s proposed township in Ijok, Selangor, which is said to have RM15 billion in GDV for its 2,198-acre (889.5ha) land or about RM7 million per acre.

We understand that UEM Sunrise is exploring more land deals to increase its exposure to the central region. Elsewhere, its JV to develop the RM3.5 billion Motorsports City in Gerbang Nusajaya is expected to break ground in May. — PublicInvest Research, Jan 11

Interested in investing in properties in Nusajaya after reading this article? Click here.

This article first appeared in The Edge Financial Daily, on Jan 12, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Jalan Taman U Thant 1

Taman U-Thant, Kuala Lumpur

Jalan Taman U Thant 1

Taman U-Thant, Kuala Lumpur