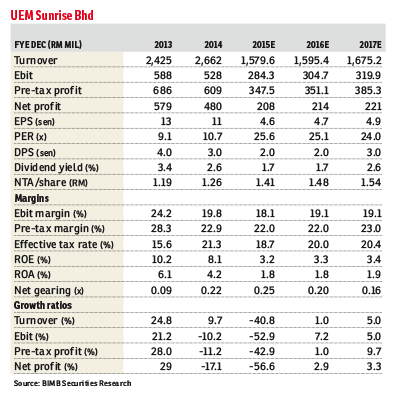

UEM Sunrise Bhd (Nov 27, RM1.14)

Downgraded to sell call with an unchanged target price (TP) of 94 sen: We maintain our earnings forecast for estimated financial year ending Dec 31, 2015 (FY15E) and FY16E and TP of 94 sen, based on a blended valuation of historical price-earnings ratio and price-to-book value of 10 times and one time respectively premised on FY16E.

We are wary of the local property and land sales moving forward due to the unfavourable sentiments surrounding Nusajaya and the general weaker outlook for the sector. The stock was removed from the MSCI Malaysia Index on May 13, 2015.

Year-to-date property development sales achieved amount to RM1.18 billion with 53% contributed by international sales, namely Aurora and Conservatory in Australia.

Third quarter ended Sept 30, 2015 (3QFY15) unbilled sales were RM4.1 billion (3QFY14: RM4 billion), mainly contributed by Aurora @ Melbourne of RM1.7 billion.

As of the nine-month cumulative period ended Sept 30, 2015, the group launched a total of four projects of which The Conservatory @ Melbourne, a high-rise residential, contributed the largest chunk at 45% (RM930 million) of the total gross development value of RM2.05 billion.

We could also see the management switching its strategy to landed residential properties where supply is scarce in the Klang Valley.

This article first appeared in The Edge Financial Daily, on Nov 30, 2015. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Kawasan Perindustrian MIEL

Batang Kali, Selangor

Livia @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Robin @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Chimes @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor