WCT Holdings Bhd (Oct 20, RM1.39)

Maintain buy with an unchanged target price of RM1.75: WCT Holdings (WCT) has been awarded a contract from 1Malaysia Development Bhd’s Real Estate Sdn Bhd for the construction of infrastructure and roadway works at the Tun Razak Exchange (TRX) worth RM754.8 million.

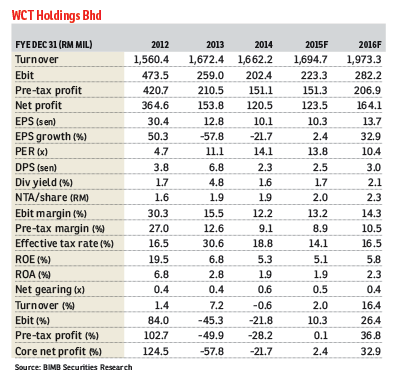

The project will commence later this month and shall be completed in September 2017. Based on our assumption of an 8% profit before tax (PBT) margin, the contract will contribute about RM27.8 million and RM32.6 million to its financial year 2016 (FY16) and FY17 PBT respectively.

Year to date, WCT has secured a total of RM1.8 billion worth of projects which have surpassed our initial assumption of RM1 billion.

We are indeed surprised by this project as it came in earlier than our expectations. Including this contract, WCT’s outstanding order book stands at approximately RM3.2 billion, which should sustain its construction revenue for the next three years.

In the same announcement, WCT also entered into a sale and purchase agreement with KLIFD Sdn Bhd for the acquisition of 71,986 sq ft (6,688 sq m) land at the TRX district for a total consideration of RM223 million, translating into RM3,098 per sq ft (psf).

The acquisition is expected to be completed by the fourth quarter of 2017.

Based on recently transacted prices, the market value for the area is between RM3,500 and RM4,800 psf. Hence, we deem the purchase price of RM3,098 psf as rather fair backed by demand in the prime area and the close vicinity of established shopping malls such as the Pavilion Kuala Lumpur, Berjaya Times Square and Bukit Bintang City Centre — just to name a few — as well as close to numerous Grade A offices, 5-star hotels and other amenities.

The area also has excellent connectivity and accessibility via a well-planned and integrated network of trunk roads, underground tunnels and mass rapid transit lines.

The acquisition enables the group to gain ownership of the land for future development in the prime location with strong growth and earnings potential.

The management indicated that the proposed development on the land will comprise a tower block of high-end serviced apartments with retail components.

The estimated gross development value of the proposed development is approximately RM1.1 billion, and will be developed via a joint venture with other property developers.

We are positive on the developments, hence revising our FY16 earnings forecast by 17.8% to account for earnings contribution from the construction project and maintain our FY15 numbers as we believe there will be no additional contribution over the next two months. — BIMB Securities Research, Oct 20

This article first appeared in The Edge Financial Daily, on Oct 21, 2015.

TOP PICKS BY EDGEPROP

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

Clarinet @ Taman Desa Tebrau

Johor Bahru, Johor

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor