KUALA LUMPUR (Jan 24): Bank Negara Malaysia's Monetary Policy Committee has decided to maintain the overnight policy rate (OPR) at 3.25%, saying that the latest indicators for Malaysia pointing towards sustained economic expansion.

In a statement, it said that domestic demand will remain the country's key driver of growth this year.

"Private consumption will continue to be underpinned by stable employment and wage growth, while private investment will be supported by ongoing multi-year projects in both export- and domestic-oriented industries.

*Bank Negara stands pat on key interest rate at 3.25%

*Time for BNM to reimpose financing quota — HBA

*Bank Negara land deal, unanswered questions

"Sustained growth in private sector activity is expected to offset lower public spending arising from the ongoing fiscal consolidation by the government. With moderating global growth, the external sector is likely to soften. Risks to growth are tilted to the downside, primarily from potential escalation of trade tensions and commodity-related shocks. On balance, the Malaysian economy is expected to remain on a steady growth path in 2019," it said.

Inflation, it said is expected to average moderately higher this year, after averaging at 1% last year.

"The impact of the consumption tax policy on headline inflation in 2019 will start to lapse towards the end of the year. However, the trajectory of headline inflation will be dependent on global oil prices. Underlying inflation is expected to remain contained in the absence of strong demand pressures," it said.

It further highlighted that the domestic financial markets have remained resilient despite bouts of volatility due to global developments, and that the financial sector is sound, with financial institutions operating with strong capital and liquidity buffers.

"Importantly, the domestic economy maintains its underlying fundamental strength, with steady economic growth, low unemployment and surplus in the current account of the balance of payments. Bank Negara Malaysia's monetary operations will continue to ensure sufficient liquidity to support the orderly functioning of money and foreign exchange markets and intermediation activity," it said.

"At the current level of the OPR, the degree of monetary accommodativeness is consistent with the intended policy stance. The MPC will continue to monitor and assess the balance of risks surrounding the outlook for domestic growth and inflation," it added. — theedgemarkets.com

TOP PICKS BY EDGEPROP

Desa ParkCity (The Breezeway Garden Condo)

Desa ParkCity, Kuala Lumpur

BANDAR AINSDALE FASA 3B (TENANG)

Seremban, Negeri Sembilan

Hijayu 1, Bandar Sri Sendayan

Siliau, Negeri Sembilan

Taman Senawang Perdana

Seremban, Negeri Sembilan

Taman Bukit Senawang Perdana

Seremban, Negeri Sembilan

Taman Bukit Senawang Perdana

Seremban, Negeri Sembilan

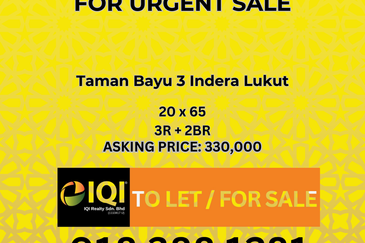

TAMAN BAYU INDERA, LUKUT

Port Dickson, Negeri Sembilan

Springfield Residences @ Setia EcoHill 2

Semenyih, Selangor