Ever feel like your money disappears faster than you earn it?

Between daily expenses, pressure to keep up, and social expectations, managing your finances in your 20s can feel overwhelming, leaving many young adults unsure of where to even begin.

But here’s the real talk: building healthy money habits now, even by starting small, can set the foundation for financial stability and growth later in life. It’s less about making big moves overnight and more about creating smart, repeatable habits that compound over time. Here’s how to start taking control of your money, one habit at a time.

Basics to growing wealth in your 20’s

You don’t have to be an investing guru to start growing your wealth. But learning the fundamentals helps:

● Emergency fund: Aim to save three to six months’ living expenses to cover unexpected costs like medical bills or job loss.

● Interest-bearing savings: Use accounts that grow your money passively with compounding interest.

● Low-risk options: Stick to savings tools that protect your deposits from loss while providing steady returns.

Take advantage of compounding interest—Save early, reap more later

Thanks to the magic of compounding interest, your savings don’t just add up, they multiply. The earlier you start, the more time your money has to grow exponentially.

For example, if you saved RM50 a month starting at age 23, by 33 you’d have contributed RM6,000 in total. But thanks to compounding interest, that amount can grow well beyond what you put in, depending on your savings rate and the interest earned. With Boost Bank, you can grow your money based on the initial deposit and accumulated interest.

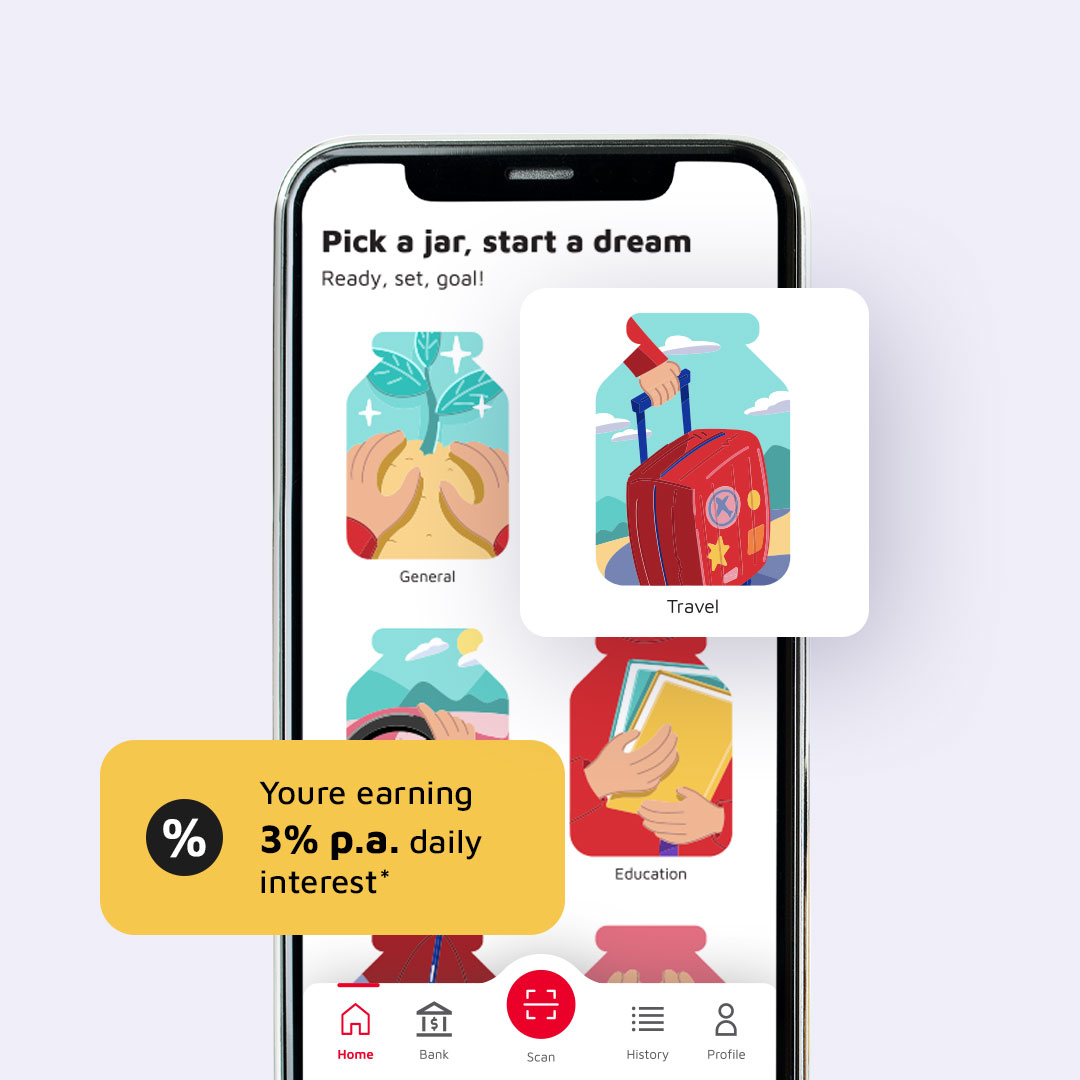

This isn’t just a theory. It’s a proven way to build wealth over time. For example, Boost Bank’s Savings Jar makes your money work harder towards your goal, with 3.0% p.a. daily interest.

If you start with an RM1,000 deposit, compounding interest can give you approximately RM1,031 after a year. If that sounds like a small amount – hold on! Think of long-term savings. When you consistently add more savings to the Savings Jar, this amount can grow even further over the next few years.

That’s it. No complex investing required, just a simple and straightforward path to your goal.

Build smart, repeatable habits

When it comes to wealth-building, it isn’t about one-time decisions or big wins. Building smart, consistent money habits is the foundation for growing your savings over time.

HELP University cognitive psychologist Khor Khai Ling explains how our brains naturally crave instant rewards, which is why saving money can feel like a drag.

“Our brains are wired to seek immediate satisfaction, which makes it tough to focus on long-term goals like saving,” she says.

A game-changing way to break this loop is through automation. With Boost Bank’s Savings Jar, you can set up automatic transfers without the hassle of manually transferring your savings each time.

Boost Bank CEO Fozia Amanulla explains: “With the Savings Jar, you can organise your savings towards different goals, whether it’s a home deposit or an emergency fund, so you don’t have to think about it every month. The money moves in the background, and over time, those small, consistent savings add up.”

Here are additional habits you can start building now:

● Track your spending: Create a budget to categorise and track where your money goes, such as rent, food, entertainment, and subscriptions.

● Use calendar reminders to review your budget regularly and adjust as life changes.

● Practice mindful spending: Before buying non-essential items, pause and ask: Do I really need this? This mental check helps curb impulse buys that chip away at your savings.

● Set specific, visual goals like naming a Jar “Home in 3 Years” to keep your motivation up.

These small but steady habits can shift your financial baseline over time without overwhelming your lifestyle.

Wants vs goals—Can you really have both?

Short answer: yes.

It’s okay to enjoy life in your 20s and build memories, whether you want to buy the latest phone or go on a holiday with your best friends, and so on. But that doesn’t mean neglecting your financial goals, such as saving up for a home.

The key is finding balance. With a bit of planning, you can enjoy the present and still take care of your future. This ensures you can have the best of both worlds.

One way to do that is with Boost Bank’s Special Jars that offer higher interest rates through exclusive partnerships. For example, the EdgeProp Special Jar offers 3.3% p.a. daily interest to help you grow your home savings faster. Park some money in this Jar so that your savings can grow at a high interest rate, while in the meantime, you can still allocate some money for fun things, like nights out or concerts.

This way, you can indulge guilt-free, knowing your wants and goals are still on track.

Real talk: Why starting now matters

Life gets complicated. Bills increase, rent climbs, and social pressures never stop. It’s easy to push saving to “later” for when you get that raise, pay off debts, or find a better job.

But here’s the catch: the later you start, the harder it gets to catch up. Delaying savings means missing out on years of compound growth, making your goals more expensive and stressful down the road.

Building wealth in your 20s isn’t about radical sacrifices or complicated investing. It’s about structure, consistency, and using smart tools that make saving easy. Even if it’s just RM10 a week, starting now builds momentum and confidence.

So start small, and start now.

In this Series

Learn how banks are transforming

Video: Innovation at work

Video: The new digital bank

Video: The new digital bank