KUALA LUMPUR: Colliers International’s latest October 2009 quarterly update sees office markets in Asia-Pacific showing encouraging signs of recovery during 3Q2009. Due to the improvement of global economic fundamentals, there are positive indications of market stabilisation and improvement in market confidence.

Strong office sales performance, in volume of activity and achieved price levels, has strengthened market confidence. Office investment sales transactions were most active in the Greater China region due to the positive sentiment among the number of state-owned enterprises.

Three enbloc sales transactions were recorded in Beijing. The city chalked up a gross floor area (GFA) of about 69,965 sq ft for lease even without any new projects completed during the third quarter. This created a small increase in Grade A office stock.

Financial institutions in China’s capital lead the way with the leasing of several large spaces. The Beijing Rural Commercial Bank leased approximately 538,195 sq ft in the north tower of Financial Street Centre. Shanghai Pudong Development Bank leased about 322,917 sq ft in Fortune Resource International Centre. In total, the vacancy rate dropped 2.2% to 16.98% at the end of 3Q2009.

In Shanghai, domestic investors and end-users, including SOHO China, the Shanghai Rural Commercial Bank and the Agricultural Bank of China, acquired either enbloc or strata-titled office buildings located in Jing’an and Pudong districts.

The Shanghai Grade A office market stablised in 3Q2009, with the average rental standing at RMB7.0 per sq m per day. Three office buildings were completed in the third quarter such as HSBC Building (Shanghai ifc South Tower) in Lujiazui and the GC Tower and the China Diamond Exchange Centre in Zhuyuan. This quarter’s vacancy rate of Grade A office space fell 0.4% to 13.7% q-o-q.

Meanwhile, office rentals registered increased stabilization on the leasing front. George McKay, managing director of corporate services of Colliers International Asia-Pacific said: “For most of the centres in the Asia-Pacific, there were more signs that office rentals are edging closer toward their cyclical trough during 3Q2009,” and adds, “Across the region, the pace of rental decline tapered off further from 3.6% q-o-q in 2Q2009 to 2% q-o-q in 3Q2009.”

The cheaper office rental offers and expectations of better gains next year saw several occupiers reactivating their real estate plans. One example was AIG in Singapore, which moved from the fringe of the CBD to take up five floors in the newly completed 78 Shenton South Tower.

McKay said the low interest rate environment over the short term will continue to stimulate strong investment demand with certain private investors as well as small and medium-sized enterprises wanting office space for long-term use. As for the leasing market, he expects it to pick up positive momentum if tenants are encouraged by the potential for growth in their top line revenue in 2010 as compared with 2009.

TOP PICKS BY EDGEPROP

Trillium, Perdana Lakeview East

Cyberjaya, Selangor

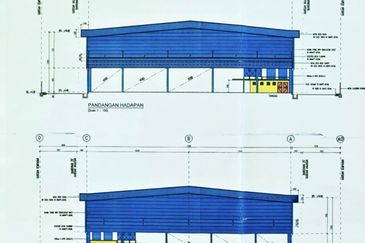

Sungai Rampai Terrace Factory

Telok Panglima Garang, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Kinrara Residence

Bandar Kinrara Puchong, Selangor

Telok Panglima Garang Industrial Zone

Telok Panglima Garang, Selangor