HONG KONG: Mainland house prices are expected to continue falling sharply in the coming months, analysts say.

The predictions come against a background of further measures expected from the central bank to curb the flow of credit to the market to contain demand and price growth.

Investment bank Barclays Capital expects further declines in mainland house prices of up to 30% in the next few quarters, while Royal Bank of Scotland (RBS) said the worst was yet to come for the market.

"We believe relatively flat prices recently amid weak market sentiment and poor transaction volumes are not enough to pacify policymakers," RBS analyst David Ng said in his latest research report.

He refers to the latest cooling measures over the past few days. On June 3, it was reported by mainland media that the State Administration of Taxation (SAT) has set the pre-collection rate in accordance with property price appreciation. For example, the rate should not be less than 2% in eastern, 1.5% in central and northern, and 1 per cent in western provinces.

Meanwhile, the Ministry of Housing and Urban-Rural Development, People's Bank of China and China Banking Regulatory Commission jointly issued a notice clarifying the second mortgage tightening policies.

According to mainland website Soufun, deal volumes in four tier-one cities showed a 46% month-on-month drop in May, though prices had not yet fallen significantly.

"The majority of developers plan to launch new supply in the third quarter of 2010, so we think property price corrections will happen then," Ng said. "We believe price cuts [by developers] are inevitable."

Barclays said home prices would fall significantly in light of Beijing's determination to take care of those left behind by rampant price growth. -- South China Morning Post

The predictions come against a background of further measures expected from the central bank to curb the flow of credit to the market to contain demand and price growth.

Investment bank Barclays Capital expects further declines in mainland house prices of up to 30% in the next few quarters, while Royal Bank of Scotland (RBS) said the worst was yet to come for the market.

"We believe relatively flat prices recently amid weak market sentiment and poor transaction volumes are not enough to pacify policymakers," RBS analyst David Ng said in his latest research report.

He refers to the latest cooling measures over the past few days. On June 3, it was reported by mainland media that the State Administration of Taxation (SAT) has set the pre-collection rate in accordance with property price appreciation. For example, the rate should not be less than 2% in eastern, 1.5% in central and northern, and 1 per cent in western provinces.

Meanwhile, the Ministry of Housing and Urban-Rural Development, People's Bank of China and China Banking Regulatory Commission jointly issued a notice clarifying the second mortgage tightening policies.

According to mainland website Soufun, deal volumes in four tier-one cities showed a 46% month-on-month drop in May, though prices had not yet fallen significantly.

"The majority of developers plan to launch new supply in the third quarter of 2010, so we think property price corrections will happen then," Ng said. "We believe price cuts [by developers] are inevitable."

Barclays said home prices would fall significantly in light of Beijing's determination to take care of those left behind by rampant price growth. -- South China Morning Post

SHARE

TOP PICKS BY EDGEPROP

SALE

FEATURED

Seksyen 5, Kota Damansara

Kota Damansara, Selangor

RM 900,000

3 beds |

3 bath |

2000 sqft

SALE

FEATURED

Bandar Kinrara 2

Bandar Kinrara Puchong, Selangor

RM 850,000

3 beds |

2 bath |

1500 sqft

SALE

FEATURED

Seksyen 8, Kota Damansara

Kota Damansara, Selangor

RM 850,000

4 beds |

3 bath |

2200 sqft

SALE

FEATURED

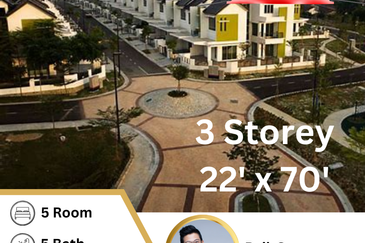

Triana @ Tropicana Amans

Telok Panglima Garang, Selangor

RM 2,200,000

- beds |

- bath |

4478 sqft

RENT

FEATURED

Bandar Baru Sri Petaling

Bandar Baru Sri Petaling, Kuala Lumpur

RM 3,300

- beds |

2 bath |

2000 sqft

SALE

FEATURED

Apartment Putra 1 (Pangsapuri Putra 1)

Kajang, Selangor

RM 320,000

3 beds |

2 bath |

865 sqft