KUALA LUMPUR: Malaysia Airports Holdings Bhd (MAHB) has inked a deal with Mitsui Fudosan Co Ltd of Japan to jointly develop an upscale factory outlet centre and its complementary facilities in KLIA at an estimated cost of RM335 million.

MAHB said in an announcement yesterday that the successful implementation of the project is poised to further boost investor and developer confidence in the commercial potential of the land in KLIA.

“The project will act as a catalyst to spur growth and further enhance the value proposition of the KLIA retail market,” it added.

Mitsui Fudosan is a real estate company listed on the Tokyo Stock Exchange. It is mainly engaged in the development of office buildings, shopping centres and factory outlets, hotels, sports and leisure, and resort facilities.

The project to be developed on a 50-acre (20.2ha) site in KLIA will be implemented over three phases. Upon completion, the project is expected to have a total lettable area of 47,000 sq m.

MAHB said the purpose of the MoU is for the parties to understand the outlined structure and schedule of the project, the joint venture and lease arrangement.

This is the second major initiative by MAHB to strengthen its retail business in the airport area in Sepang within the last two years.

Last year, MAHB inked an agreement with WCT Bhd to develop and operate an integrated complex with a net lettable area of 350,000 sq ft in its klia2 project. Under the joint venture, WCT will have a 70% stake, with MAHB owning the rest.

|

| The project to be developed on a 50-acre site in KLIA will be implemented over three phases. upon com- pletion, the project is expected to have a total letta- ble area of 47,000 sq m. |

The klia2 project caters mainly for low-cost carriers.

This MoU signing announcement came a day after Khazanah Nasional Bhd reduced its stake by more than 8% to almost 40% in the company.

At the book closure, almost all the shares were taken up by local funds at RM5.50 per share, less than 2% to the closing price of RM5.60 per share on Wednesday.

For the cumulative nine months ended Sept 30, MAHB recorded a pre-tax profit of RM467.9 million against RM2.22 billion in revenue, compared with a profit of RM438.37 million on revenue of RM1.94 billion a year ago.

Yesterday, MAHB’s share price closed at RM5.53, down 1.25% from the previous day.

“This was in adjustment to the run-up of the shares last week in anticipation of Khazanah’s divestment,” said a dealer.

This article first appeared in The Edge Financial Daily, on Nov 23, 2012.

TOP PICKS BY EDGEPROP

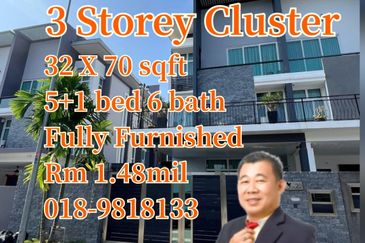

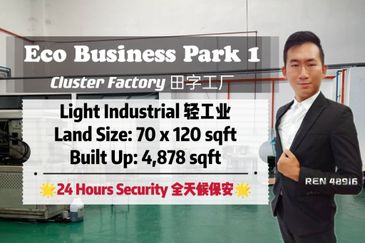

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Halya @ Daunan Worldwide

Bandar Puncak Alam, Selangor

Teega Residences, Puteri Harbour

Kota Iskandar, Johor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)