HONG KONG: China needs to be alert to the danger of asset bubbles, but headline inflation is unlikely to be a risk for some time, Fan Gang, a member of the People's Bank of China's monetary policy committee, said.

Speaking at a forum in Hong Kong on Nov 18, Fan said Chinese gross domestic product could expand between 8% and 9% in 2010. Growth this year would be above the government's target of 8%, he added.

Whereas China ran no risk of a double dip following its recovery from the economic downturn, there was such a threat for the US, Fan said.

Once the stimulus injected into the US economy faded in the second half of 2010, it was not obvious what would sustain the momentum of the present rebound, said Fan, who holds the seat on the advisory body reserved for an academic.

His warning of potential asset bubbles builds on stinging criticism of ultra-loose US monetary policy by Chinese banking regulator Liu Mingkang.

"It is boosting speculative investment in stock and property markets and will pose new, insurmountable risks to the global recovery and, particularly, to the recovery in emerging markets," Liu, chairman of the China Banking Regulatory Commission, said on Nov 15.

Economists say the risk of asset price bubbles is especially acute in economies such as Hong Kong and China, which effectively import US monetary policy because they peg their currencies to the dollar.

Although he flagged the risk of bubbles and said real estate in cities such as Beijing, Shanghai and Shenzhen was expensive, Fan said nationwide property prices in China were not "crazy".

"If that can be contained to a few places, it will not cause a crisis like the one that happened in the US," Fan said. -- Reuters

TOP PICKS BY EDGEPROP

Baypoint @ Country Garden Danga Bay

Johor Bahru, Johor

Menara Bintang Goldhill

Bukit Bintang, Kuala Lumpur

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

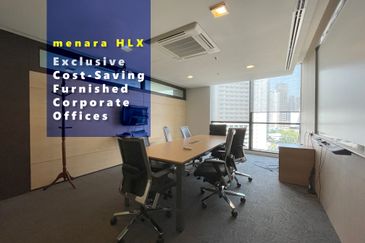

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur