WCT’s placement a dilutive exercise

WCT Holdings Bhd (Jan 19, RM1.79)

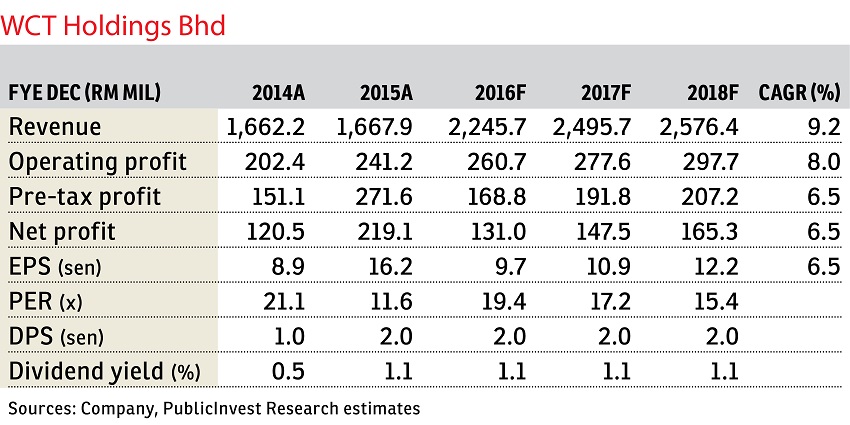

Maintain neutral with an unchanged target price (TP) of RM1.70: WCT Holdings Bhd has proposed to place out up to 10% of its existing issued and paid-up share capital, or approximately 125 million shares. The issue price of the placement shares will be fixed and announced later, but the price may be fixed at a discount of not more than 10% to the five-day volume weighted average market price of WCT shares immediately preceding the price-fixing date. The placement, using an illustrative price of RM1.70 (or 9.6% discount to the last closing price), is estimated to raise up to RM212.5 million and to be used to pare down debts and for working capital purposes. This move comes as a surprise and seemingly values the company a little too low considering the current controlling shareholder, Tan Sri Desmond Lim, purchased his 20% stake at an average price believed to be RM2.50 less than three months ago. Furthermore, we expected that the group would dispose of certain noncore assets to pare down its debt earlier. Our sum-of-parts-derived TP remains unchanged at RM1.70 as we maintain our “neutral” call for now.

The proceeds raised from the placement will be used to pare down debts and for working capital purposes. Assuming the placement price is at RM1.70, which will raise the RM212.5 million, we understand that RM80 million is earmarked to pare down debts (from 0.99 times to 0.86 times), RM130 million for working capital and RM2.5 million for placement expenses. Borrowings of the group comprising among others, bank overdraft, revolving credit and term loan facilities stand at approximately RM1.02 billion. The estimated interest savings based on the weighted average, effective interest rate of 4.85% per annum, is approximately RM3.9 million per annum.

About 60% of the gross proceeds will be used to fund some of the ongoing construction projects and property development projects of the group which include the mass rapid transit Line 2 project, Pan Borneo Highway, Petroliam Nasional Bhd’s Refinery and Petrochemical Integrated evelopment, Paradigm Mall in Johor Bahru, The Lead Residences in Klang and The Waltz Residences in Kuala Lumpur.

The placement, which will likely be priced below its net asset value, is a dilutive exercise. With about 20% of the shares crossed at RM2.50 per share less than three months ago, we are surprised by the move in placing out shares at such a steep discount though we acknowledge the above transaction was done at the shareholder level. This could, however, mean the disposal of its remaining noncore assets could take longer than expected, in our view. — PublicInvest Research, Jan 19

This article first appeared in The Edge Financial Daily, on Jan 20, 2017. Subscribe to The Edge Financial Daily here.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.