Prices not likely to move much this year

“Things will be more of the same. Prices may not decline drastically but there will be little growth in the residential market, primarily in prime KL areas,” says Jeffri Rahim, Savills Malaysia vice-president, agency/project marketing, in his presentation of The Edge/Savills Klang Valley Residential Monitor 3Q2016.

Despite the subdued outlook, Jeffri says there will likely be better deals to be found in KL suburban areas, as long as families are willing to commute.

“While we expect to see some attractive deals, history has shown us that there is hardly ever a systematic market correction in the housing market in Greater KL. Instead, expect to hear increasing anecdotal stories about great deals but no large-scale decreases in prices,” opines Jeffri.

With much of the city and its fringes saturated with developments, opportunities may still exist.

“There are areas within KL that we believe are ripe for extensive redevelopment. Take, for example, Jinjang, which is often referred to as KL north. It is centrally located and near higher-value neighbourhoods such as Mont’Kiara, yet it is quite undeveloped,” says Jeffri.

He believes that with the new MRT lines coming into play over the next few years, neighbourhoods like Jinjang could easily be transformed into more

premium areas.

A stagnant quarter

The quarter under review showed little change from the previous quarter.

“Overall, the quarter was fairly stagnant. There was either no growth or slight price decreases in some areas. We certainly have not seen much price growth in the last quarter,” says Jeffri.

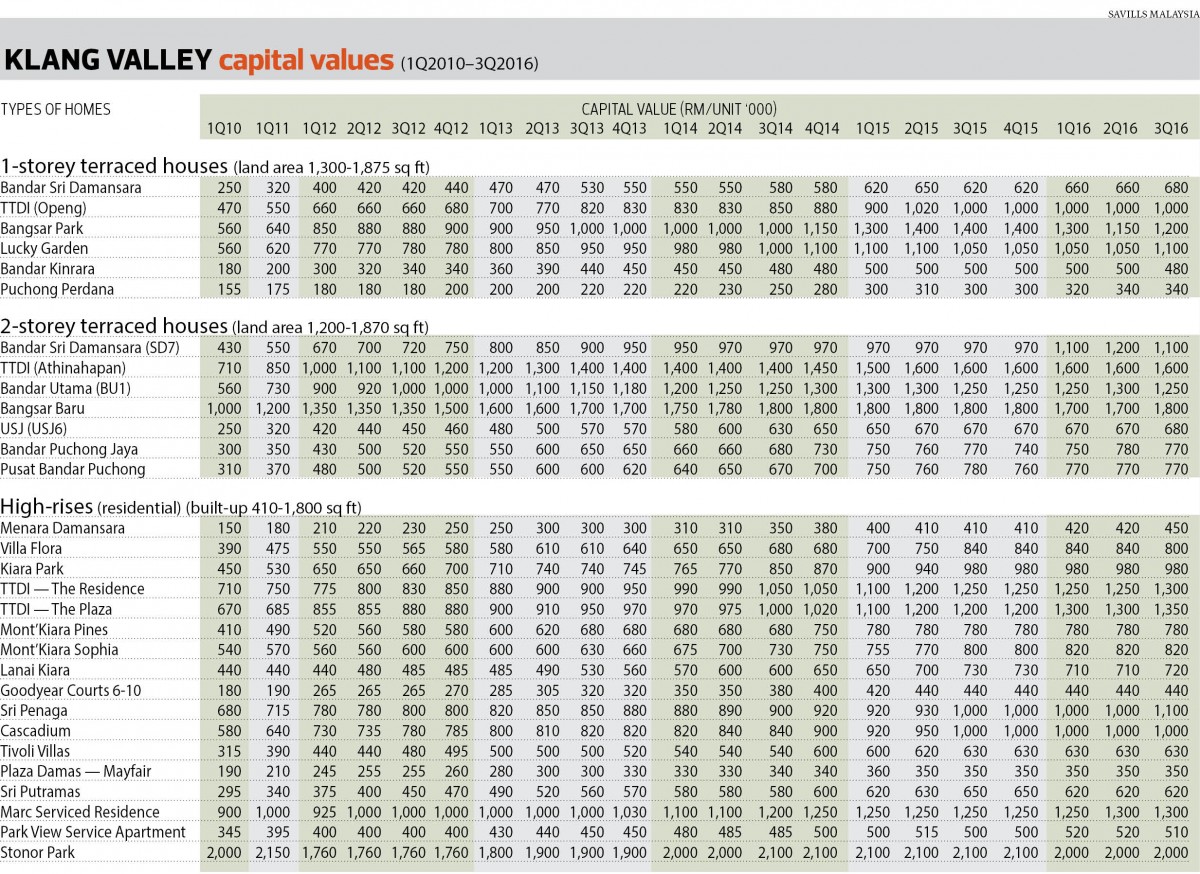

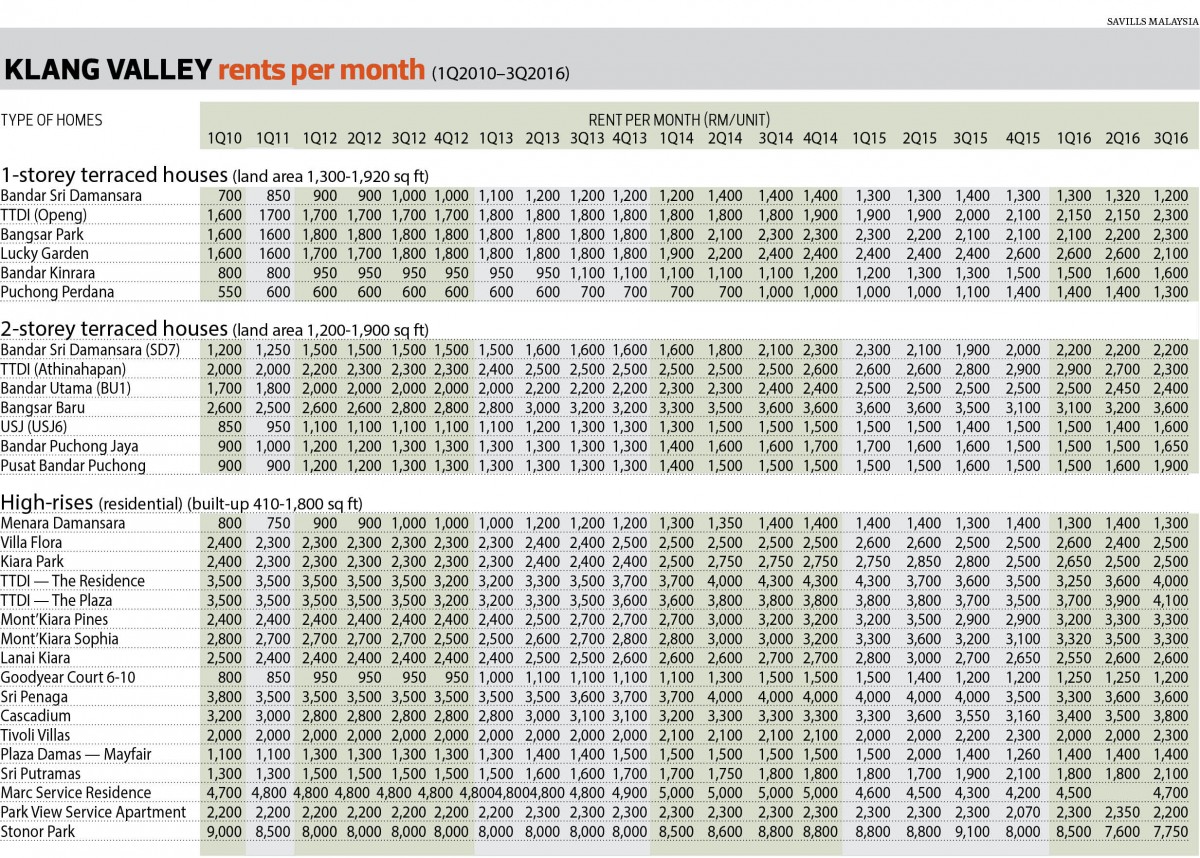

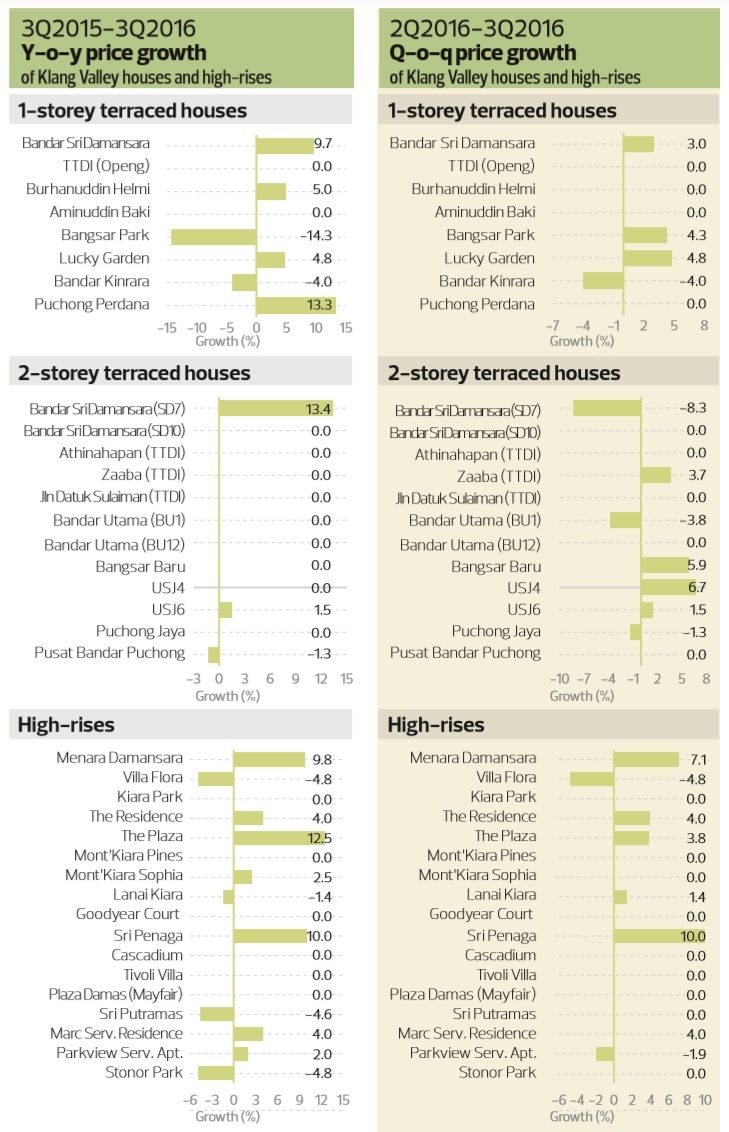

Most of the sampled standard 1-storey terraced houses saw no price growth. However, Lucky Garden, Bangsar Park and Bandar Sri Damansara recorded quarter-on-quarter increases of 4.76%, 4.35% and 3.03% respectively. Bandar Kinrara saw a 4% drop q-o-q.

The average price of 1-storey houses in Lucky Garden, Bangsar Park and Bandar Sri Damansara stand at RM1.1 million, RM1.2 million and RM680,000, respectively, while Bandar Kinrara dropped to RM480,000.

On a year-on-year basis, Puchong Perdana leads the way with an increase of 13.33% (RM340,000), followed by Bandar Sri Damansara with 9.68%, TTDI (Burhanuddin Helmi) with 5% (RM1.05 million) and Lucky Garden with 4.76%.

Standard 2-storey terraced houses saw more mixed results in 3Q2016. USJ4 recorded a q-o-q price growth of 6.67% (RM800,000), followed by Bangsar Baru with 5.88% (RM1.8 million), TTDI (Zaaba), 3.7% (RM1.4 million), and USJ 6 1.49% (RM680,000).

Meanwhile, sampled houses in Bandar Sri Damansara (SD7) saw quarterly declines of 8.33% (RM1.1 million), Bandar Utama (BU1), 3.85% (RM1.25 million) and Bandar Puchong Jaya, 1.28% (RM770,000).

In terms of yearly performance, SD7 had the largest increase of 13.4%, followed by USJ6 with 1.49%. Only Pusat Bandar Puchong saw a drop, 1.28% y-o-y.

Sri Penaga leads the way in q-o-q price growth of high-rises with 10% (RM1.1 million), followed by Menara Damansara, 7.14% (RM450,000), TTDI-The Residence, 4% (RM1.3 million), TTDI-The Plaza, 3.85% (RM1.35 million), and Lanai Kiara, 1.41% (RM720,000). Villa Flora and Parkview Serviced Apartment did not fare as well, dropping 4.76% (RM800,000) and 1.92% (RM510,000) respectively.

On a yearly basis, TTDI-The Plaza increased by 12.5%, Sri Penaga by 10%, Menara Damansara, 9.76%, TTDI-The Residence, 4%, Marc Residence, 4% (RM1.3 million), Mont’Kiara Sophia, 2.5% (RM820,000), and Parkview Serviced Apartment, 2%.

According to Jeffri, the reason some developments, such as Menara Damansara, did better than others is their more affordable prices.

“Menara Damansara offers the type of units that are in higher demand these days — 2 or 3-bedroom units of about 1,000 sq ft — at affordable prices for new families. Sri Penaga, though a much older development compared with others in Bangsar, is still in good demand [for a higher price] due to any number of reasons — good renovations, prime units with a view, not to mention its close proximity to Bangsar Shopping Centre,” he says.

Marginal movement

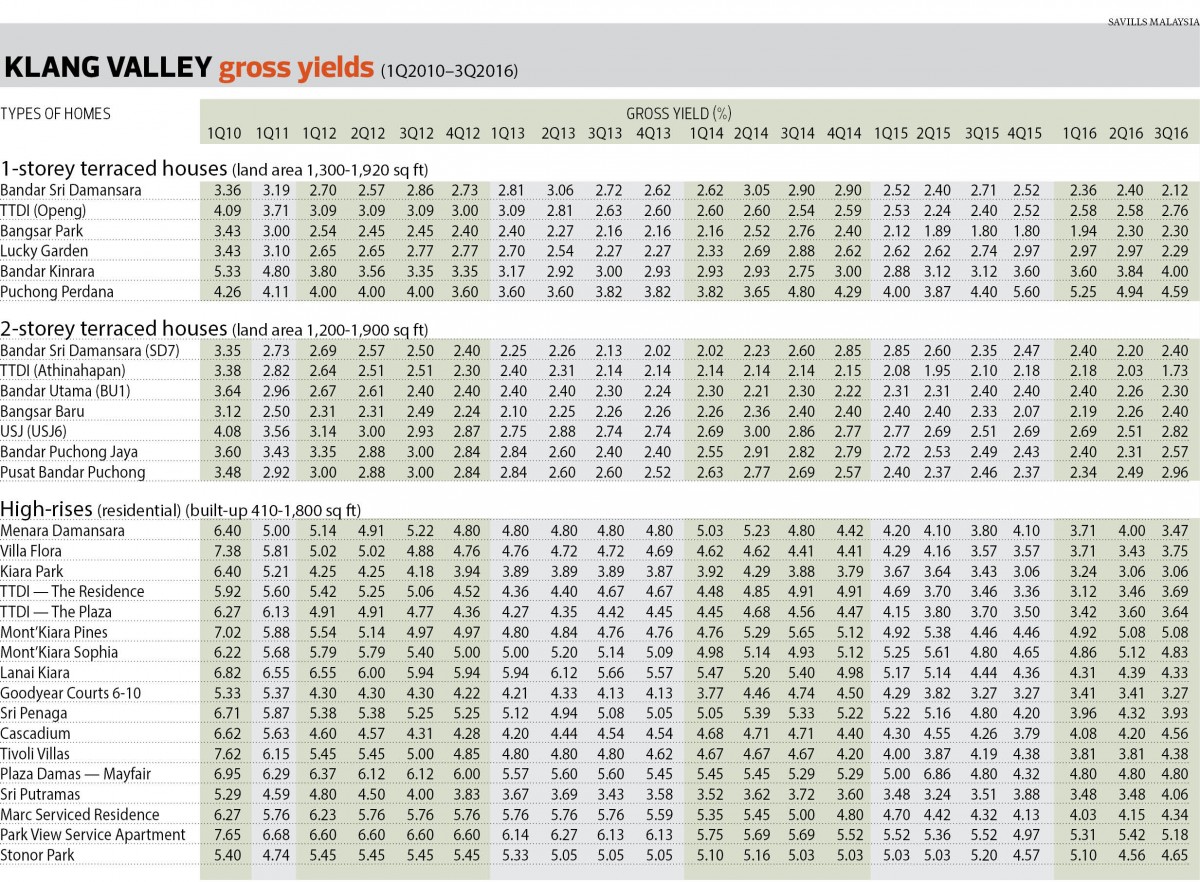

With little change in prices, yields have showed minimal movement. Among the sampled 1-storey terraced houses, only TTDI (Openg; 1,760sq ft) and Bandar Kinrara (1,400 sq ft) registered increases, moving from 2.58% to 2.76% and 3.84% to 4% q-o-q respectively.

Yields in Bandar Sri Damansara (1,300 sq ft) dipped from 2.4% to 2.12%, Lucky Garden (1,760 sq ft) from 2.97% to 2.29% and Puchong Perdana (1,300 sq ft) from 4.94% to 4.59% q-o-q.

Sampled 2-storey terraced houses saw yields in SD7 (1,650 sq ft) increase from 2.2% to 2.4% q-o-q, BU1 (1,650 sq ft) from 2.26% to 2.3%, Bangsar Baru (1,870 sq ft) from 2.26% to 2.4%, USJ 6 (1,200 sq ft) from 2.51% to 2.82%, Bandar Puchong Jaya (1,500 sq ft) from 2.31% to 2.57% and Pusat Bandar Puchong (1,400 sq ft) from 2.49% to 2.96%. TTDI (Athinahapan; 1,760 sq ft) dipped from 2.03% to 1.73%.

In the high-rise category, yields in Villa Flora (1,248 sq ft) rose from 3.43% to 3.75% q-o-q, TTDI-The Residence (1,800 sq ft) from 3.46% to 3.69%, Cascadium (1,125 sq ft) from 4.2% to 4.56%, Tivoli Villa (818 sq ft) from 3.81% to 4.38%, Sri Putramas II (1,295 sq ft) from 3.48% to 4.06%, Marc Residence (840 sq ft) from 4.15% to 4.34% and Stonor Park (2,314 sq ft) from 4.56% to 4.65%.

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on Feb 6, 2017.

For more stories, download TheEdgeproperty.com pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.